If you know about Bitcoin, it is time to learn about the second-largest cryptocurrency, Ether (ETH). Ether is the native token for the Ethereum blockchain.

When it comes to Ethereum, its use cases across the cryptocurrency industry vary. For instance, while Bitcoin has cemented its place as an alternative currency and investment asset, Ethereum is the king of smart contracts.

To answer the question, “What is Ethereum?” we will dive deep into how this blockchain and its native token, ETH, transformed blockchain technology.

This article will go down Ethereum’s memory lane from when it was created. We will also unravel critical details on how this blockchain, which has the most extensive decentralized finance (DeFi) total-value locked (TVL), brought more use cases to blockchain technology.

An Introduction To Ethereum

Ethereum is a decentralized global software platform powered by blockchain technology. The platform is commonly known for supporting “smart contracts.”

Smart contracts are autonomous computer programs that execute various actions under certain conditions. Smart contracts are the quintessence of blockchain technology as they meet the purpose of blockchain, which is to eliminate intermediaries.

As you unravel more about “what is Ethereum?” you will find it popular with investors and blockchain developers. Its native cryptocurrency, Ether (ETH), has a market capitalization of more than $350 billion, ranking it below Bitcoin as the second-largest cryptocurrency.

The Ethereum blockchain is crucial in creating decentralized applications (DApps). DApps are programs such as games, exchanges, marketplaces, etc, created atop blockchain networks.

Ethereum is the next step of the internet. Tech giants like Apple, Microsoft, and Alphabet dominate the Web2 industry. Conversely, Ethereum is powering the next-generation web: “Web3.”

The History Of Ethereum

We cannot talk about Ethereum without mentioning its co-creator, Vitalik Buterin. Buterin is one of the leading industry players in blockchain. He published the Ethereum whitepaper in 2013 to address the shortcomings of Bitcoin.

In the whitepaper, Buterin outlines a new way for blockchain to achieve broader utility: smart contracts.” Smart contracts enable the creation of decentralized applications. DApps already existed in the blockchain industry before the creation of Ethereum. However, Buterin wanted to have a way for these DApps to interact.

Ethereum 1.0 was launched under the efforts of Buterin and other co-creators, including Joe Lubin, Gavin Wood, Anthony Di Loria, Amir Chetrit, Miha Alisie, and Charles Hoskinson. These co-creators held a presale for ETH in 2014, where they raised over $18 million. The funding went towards supporting Ethereum’s developments.

As the Ethereum 1.0 network grew, developers founded The DAO to bring democracy to the network by allowing users to vote on proposals and network changes. The formation of The DAO negated the need for a CEO to oversee Ethereum. For changes to be implemented on the network, they needed the support of most users in the organization.

While The DAO was an excellent concept, everything collapsed in June 2016. A hacker stole $40M worth of funds from The DAO, essentially bankrupting it. Ethereum sought to reverse the theft by voting on a “hard fork” for Ethereum, where they ditched the old network for a new one.

The new protocol created after the hard fork is now known as Ethereum. The older network (Ethereum 1.0) still exists and is called Ethereum Classic.

How Does Ethereum Work?

To answer the question “What is Ethereum?”, we will look into several concepts around Ethereum, which make up the Ethereum ecosystem.

Smart Contracts

The first feature of the Ethereum ecosystem is smart contracts. Smart contracts are self-executing contracts with a code containing the terms of an agreement. Smart contracts will execute autonomously once specific conditions are met. A smart contract does not require a third party to verify or enforce it.

The most famous examples of smart contracts include cryptocurrency trading exchanges, non-fungible tokens (NFTs), lending apps, and other projects created atop blockchain networks.

Decentralized Applications (DApps)

Decentralized applications are the applications created on top of Ethereum. Think of them as the applications you find on your phone, only that they are made using blockchain technology this time.

DApps tap into the smart contract capabilities of Ethereum. These DApps are transparent, secure, and immutable by leveraging blockchain technology. The DApps popular on Ethereum include DeFi, GameFi, etc.

Ethereum Gas Fees

Just like you would pay to use any service on the internet, you will also pay gas fees to use Ethereum. ETH, the native token for the Ethereum blockchain, is not only used as a digital currency or speculative asset like Bitcoin but also to pay fees on Ethereum.

Every action performed on the Ethereum blockchain needed computational effort. The effort to support transactions and activities on the network is known as gas. Users have to pay a fee for this gas. The gas fee is paid using Ether.

Ethereum gas fees have been at the heart of controversy around the blockchain. Sometimes, gas fees on the blockchain can skyrocket to astronomically high levels, causing a strain on those using the network and developing on it.

Recently, Buterin tabled a proposal for multidimensional gas pricing to address this long-term problem. This new plan aims to promote network efficiency and security by lowering operational costs and optimizing transactions.

The proposal also comes as Ethereum faces increased competition from other networks like Solana, Cardano, and Avalanche, attracting developers due to low fees and high network speed.

Ethereum Virtual Machine

The Ethereum Virtual Machine is the engine that powers the Ethereum ecosystem. It is designed to boost interoperability on the Ethereum network. As other blockchain networks realize the potential of the EVM, they have introduced EVM-compatible layers and mechanisms into their systems.

By promoting interoperability with other blockchains, smart contracts native to Ethereum can run on different chains without significant changes. This engine promotes seamless developments in the blockchain industry. It also encourages collaborations and expansion in the DApp industry.

The Ethereum Merge

Ethereum runs on a proof-of-stake (PoS) consensus. However, this did not happen when the blockchain went live in 2015. Ethereum previously relied on a consensus known as proof-of-work (PoW), which Bitcoin currently uses.

On September 15, 2022, the “Ethereum Merge” went live. The Merge shifted Ethereum from a proof-of-work model to a proof-of-stake. The transition culminated in a significant drop in Ethereum’s energy consumption by more than 99%.

The PoS consensus model addresses the challenges prevalent with PoW consensus algorithms. Blockchains running on PoS algorithms consume less energy and are also more efficient.

Ethereum 2.0 In The Making

The Ethereum Merge was just the start of a long list of upgrades set to unveil Ethereum 2.0. Ethereum 2.0, or Eth2 or Serenity, is a series of upgrades to the Ethereum network to improve scalability.

ETH 2.0 has always been a long-term goal for Ethereum developers. The rollout was set to happen in three main phases. Each phase contains unique features to improve Ethereum’s speed, cost-effectiveness, and efficiency.

Phase 0 happened in December 2020 after the launch of Beacon Chain. A Beacon Chain is a chain that runs parallel to the mainnet under the PoS consensus. The Beacon Chain merged with the Ethereum Mainnet in 2022 in “The Merge” process.

Phase 1/1.5 introduced shard chains and supported the transition of the Ethereum mainnet from PoW to PoS. This phase marked the official switch from PoW.

The last phase, phase 2, is currently underway. It will roll out Ethereum 2.0 while supporting fully formed shards. Shard chains will work with smart contracts to integrate DApps and other technologies seamlessly.

One of the latest upgrades in Phase 2 was the Dencun upgrade. This upgrade reduced the fee on the network and improved its competitive edge against other PoS networks. The Dencun upgrade also improved the experience of developers and security through several Ethereum Improvement Proposals (EIPs).

How Ethereum Transformed Blockchain

Ethereum introduced a broader utility for blockchain technology. Over the years, countless applications have been created on Ethereum. These applications have unveiled the next phase of the internet known as Web3.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) marks the next transformation in finance. DeFi applications are created atop blockchain technology. These applications seek to deliver financial services to people without the need for central authorities.

DeFi businesses provide P2P lending and borrowing services, decentralized exchanges, etc. The DeFi industry has seen the rise of some of the most popular projects like PancakeSwap, Aave, Uniswap, Compound Finance, etc.

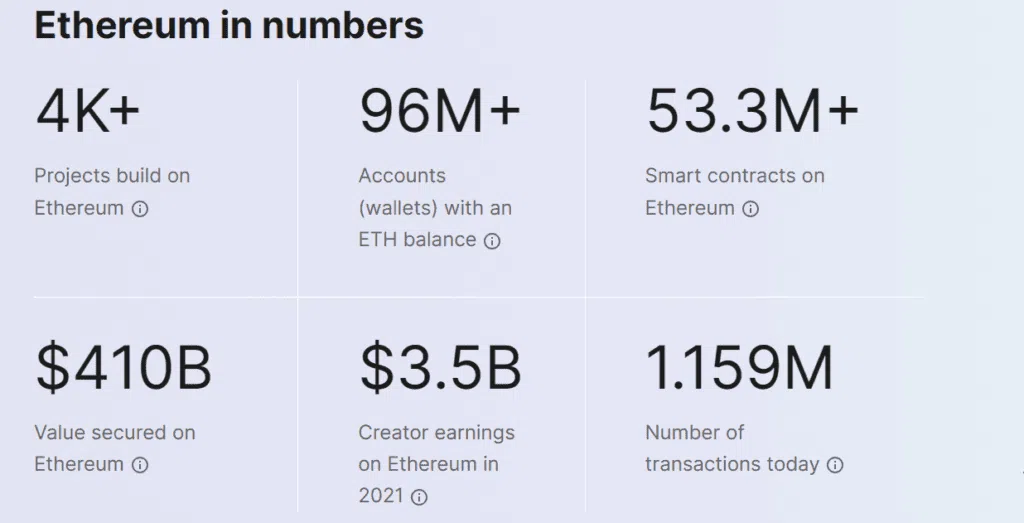

Data from DeFiLlama shows that Ethereum is the largest blockchain by DeFi activity, with a total value locked (TVL) of over $52 billion.

Non-fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are tokenized versions of physical and digital assets on the blockchain. NFTs have garnered much popularity globally. Celebrities like Snoop Dogg, Madonna, and Justin Bieber have purchased NFTs.

Former US President Donald Trump has also rolled out several NFTs. Recently, he held a dinner event for those holding Trump NFT cards.

The rising popularity of NFTs shows that they carry the potential to emerge as one of the main components of the blockchain ecosystem. NFTs have multiple use cases, including speculative trading, video games, digital identity, certificates, art, licensing, and more.

Gaming & Metaverse

The gaming and metaverse worlds have become vital to the Ethereum network. Some of the most popular games created on Ethereum include The Sandbox. Square Enix, a leading video game publisher behind Final Fantasy, also made a game known as Symbiogenesis with Ethereum NFTs.

In the gaming world, Ethereum can be used to tokenize items such as land, avatars, wearables, and other gaming items. It also gives gamers more control over their in-game assets.

Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) are community-led organizations that operate without a central authority. Instead, these entities are governed by code. They leverage smart contracts to collect information and votes to decide on any changes.

The first DAO was the Ethereum DAO, which suffered a hack in 2016. This DAO influenced the creation of similar organizations that stressed the need for decentralization.

Ethereum vs. Bitcoin

Ethereum has its differences from Bitcoin. The latter is the largest cryptocurrency, with a market capitalization of over $1 trillion and an over 50% market dominance. On the other hand, Ethereum’s $350 billion market cap gives it a 14% market dominance.

While the Bitcoin blockchain is starting to find use cases in the NFT industry through Bitcoin Ordinals, Ethereum has managed to tap into more utility. Smart contracts make people more convinced that Ethereum has real-world value.

Recently, the CEO of JPMorgan, Jamie Dimon, said Bitcoin is a fraud and a Ponzi scheme. However, he noted that there was potential in smart contracts. This endorsement proves that Ethereum has a higher chance of integration into traditional finance.

Another key difference is the difference in regulator opinions on Bitcoin. Gary Gensler, the US Securities and Exchange Commission chair, appears to have classified Bitcoin as a commodity. The SEC has also approved multiple spot Bitcoin exchange-traded funds.

The same cannot be said for Ethereum. Gensler recently avoided a question seeking clarification on whether Ethereum is a commodity or a security. The SEC is also spotlighted over the pending decision on spot Ethereum ETFs.

Despite the clear differences between Bitcoin and Ethereum, there are clear similarities. For starters, Ether is just as volatile as Bitcoin. The price tends to change depending on the market sentiments and developments around Ethereum.

The chart above shows Ether’s price movement over the past year. The data indicates that Ethereum’s price tends to fluctuate regularly.

Challenges And The Future

The Ethereum blockchain faces a significant challenge of scalability. However, the ongoing upgrades leading toward the realization of Ethereum 2.0 seek to increase the network throughput and lower transaction fees to attract more users and developers.

Ethereum is also facing increased competition from networks created with scalability in mind. Solana, its main competitor, has witnessed a notable rise in DApp activity due to its significantly low fees. Other competitors include Avalanche, Cardano, and Polkadot.

The lack of regulatory clarity around Ether might also hinder its mainstream adoption. Ethereum has yet to gain its status as a commodity or security. Furthermore, the failure of the SEC to launch spot Ether ETFs is also irking the community.

Despite these challenges, the Ethereum ecosystem continues to grow. The growing popularity of layer-two networks created atop Ethereum, such as Arbitrum, Optimism, and Base, is transforming the blockchain industry.

In Summary

Ethereum is a leading blockchain dominating the decentralized applications industry. The Ethereum ecosystem comprises decentralized finance projects, NFTs, Web3 games, and DAOs. These applications are bestowing more utility on Ether.

The Ethereum blockchain has undergone network upgrades over the years, seeking to improve its efficiency and scalability. As the developers inch closer to Ethereum 2.0, the blockchain aims to become more competitive and scalable.

FAQs

How can I buy Ethereum?

You can buy Ethereum on a cryptocurrency exchange. Exchanges are like brokerage platforms you use to buy and sell digital currency. On these exchanges, you can exchange fiat currency for Ethereum.

What are the risks of Ethereum?

The main risk with Ethereum is the price volatility. The price of Ethereum tends to fluctuate significantly, leading to significant losses to investors. The need for regulatory clarity around Ethereum is also a risk factor.

How does Ethereum work?

Ethereum is an open-source and decentralized network that powers decentralized applications. The native token for Ethereum is Ether (ETH), which is used to pay gas fees on the network.

Is Ethereum better than Bitcoin?

Ethereum has broader utility than Bitcoin. Ethereum is dominating the decentralized applications (DApps) industry. On the other hand, Bitcoin is increasingly being used as a digital currency.