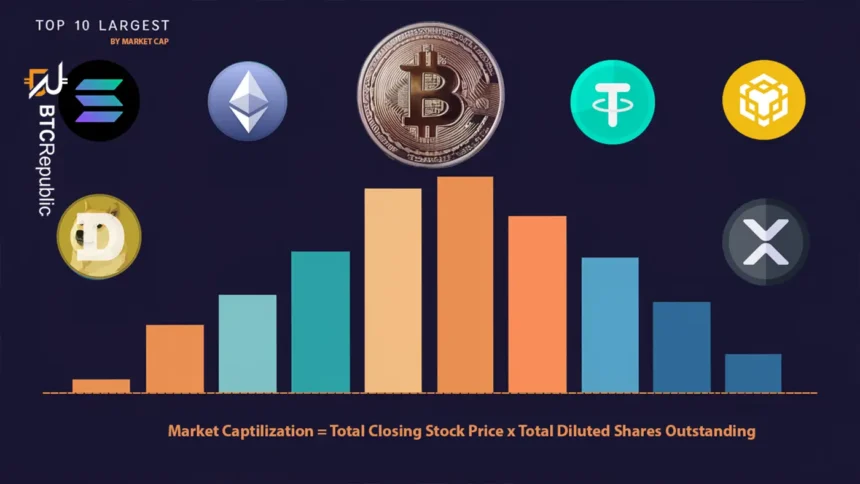

The global cryptocurrency market has a total market capitalization of more than $2.5 trillion, with the top ten-largest cryptocurrencies making up the largest share.

When you are a beginner just getting started with cryptocurrency investments, the top ten largest cryptocurrencies by market capitalization are the best to go for. These coins usually have solid fundamentals and near-zero chances of rug pulls.

The market capitalization of a crypto asset is calculated by multiplying its current price by the circulating supply. This metric can help show an asset’s dominance in the cryptocurrency industry.

This article will examine the top ten largest cryptocurrencies by market capitalization and their potential to rally higher.

Bitcoin (BTC)

The largest cryptocurrency in the market by market capitalization is Bitcoin. Data from Coingecko shows that Bitcoin has a market capitalization of over $1.2 trillion, meaning it dominates an over 50% share of the crypto market.

Bitcoin’s massive market cap comes as it has a first mover advantage. BTC launched in 2008, making it the first cryptocurrency. Its presence in the market for more than 15 years has seen its popularity soar. The rising demand has increased prices, which has, in turn, led to the giant market cap.

Bitcoin’s growth continues to be seen, given that it hit an all-time high of above $73,000 in March 2024. Its adoption has also extended beyond the retail industry into traditional financial institutions on Wall Street, which are now exploring ways of getting exposure to this asset.

Spot Bitcoin exchange-traded funds (ETFs) have helped boost the legitimacy of Bitcoin across the global financial industry. These products allow investors to get exposure to BTC while reducing the volatility of Bitcoin’s price.

The launch of spot Bitcoin ETFs opened the floodgates for more support from some of the top people in the US financial industry, including the CEO of BlackRock, Larry Fink.

BlackRock is the largest asset manager globally, with over $10 trillion in assets under management. This firm is among those that offer spot Bitcoin ETFs.

Fink recently touted Bitcoin as a legitimate financial instrument. He noted that this asset served the same purpose as gold, as people could use it to hedge against risks such as economic headwinds.

Former US President Donald Trump is also expected to speak during the Bitcoin 2024 conference later this month, where he is expected to dump up support for the coin and the crypto industry in general.

Ethereum (ETH)

The second-largest cryptocurrency by market cap after Bitcoin is Ethereum (ETH). Ether is a cryptocurrency launched shortly after Bitcoin, popularly known as the largest altcoin. Altcoins are any other cryptocurrencies other than Bitcoin.

Ethereum has a market cap of over $415 billion, dominating over 16% of the total $2.5 trillion cryptocurrency market capitalization. ETH’s price action over the years has also been phenomenal amid a buzzing community and high investor interest.

Ethereum has distinct differences from Bitcoin. For starters, the Ethereum blockchain has more use cases than Bitcoin. Ethereum is a hub for decentralized applications (DApps), including decentralized finance (DeFi), gaming applications, and non-fungible tokens (NFTs).

The Ethereum development community is also among the most active in the blockchain industry. This community is constantly looking for ways to evolve and increase the scalability and efficiency of the Ethereum blockchain.

Ethereum switched from a proof-of-work (PoW) consensus to a proof-of-stake (PoS) consensus mechanism in September 2022. This switch saw the Ethereum blockchain become more energy-friendly as the PoS model depended on validators to verify transactions and not on computational power as PoS models.

The network is also constantly undergoing upgrades to improve and reduce transaction fees. These efforts go towards realizing Ethereum 2.0.

The Ethereum community is also eagerly awaiting the launch of spot ETH ETFs. BlackRock and Fidelity are among the ETF issuers awaiting the final approval of these products. The US Securities and Exchange Commission (SEC) approved the 19b-4 forms for these ETFs, with the final green light expected in July.

Tether (USDT)

The third-largest cryptocurrency by market capitalization is the USDT stablecoin. This stablecoin has a market capitalization of more than $113 billion.

USDT is a stablecoin whose price is pegged to $1.It is needed to enable trades across the cryptocurrency market as most buy and sell orders on exchange platforms are settled in stablecoins such as USDT.

Tether, the issuer of the USDT stablecoin, pegs this coin’s value to $1 by using reserves such as US Treasury bills. Tether is among the biggest investors of US Treasuries to ensure that the value of 1 USDT remains at 1 USD.

Unlike other cryptocurrencies unique to their respective blockchains, USDT is supported across many blockchains to enable the easy settlement of transactions.

BNB (BNB)

The fourth-largest cryptocurrency in the market is BNB. This token is associated with the largest cryptocurrency exchange by trading volumes, Binance.

When the Binance exchange was launched in 2017, the exchange floated BNB tokens through an initial coin offering (ICO). The coin has since grown to become the third-largest cryptocurrency by market capitalization.

Data from Coingecko shows that BNB has a market cap of more than $87 billion, with its maximum supply at 200 million coins.

Given that the BNB coin has the backing of the exchange giant Binance, it has solid fundamentals supporting its price action.

During the ICO, BNB was trading at less than a cent. Seven years later, the coin gas rallied to more than $500. BNB has rallied by more than 130% in the past year alone.

The BNB token also secured a significant win recently after a US court ruled that BNB secondary sales do not constitute securities.

This ruling was in response to a lawsuit filed by the SEC against the Binane exchange, claiming that BNB is a security.

Solana (SOL)

The other large crypto by market capitalization is Solana. Solana has a market capitalization of more than $73 million, and despite being in the market for under five years, it has amassed a vast community of supporters and investors that have seen its value skyrocket significantly.

Among the triggers of Solana’s popularity is its habit of outperforming the broader cryptocurrency market. For instance, SOL has rallied over 400% in the past year.

The Solana blockchain is often seen as a major rival to Ethereum. Over the years, Ethereum has grappled with issues such as high gas fees and slow speeds. These issues have led the calls for a more scalable blockchain.

Solana, which offers fast speeds with relatively low gas fees, has emerged as a major contender to Ethereum. Developers are now leveraging the Solana blockchain to create DApps. Solana-based meme coins have also been on a pedestal this year.

The efficiency of the Solana blockchain has also caused the network to attract the attention of traditional financial companies. For instance, payments giant PayPal announced that it would release its PYUSD stablecoin on Solana.

As Ethereum ETFs gain traction, Solana is also getting the attention of Wall Street. The crypto market has been riled up with speculation that asset management firm BlackRock could pursue a spot SOL ETF.

USD Coin (USDC)

USD Coin (USDC) ranks as the sixth-largest cryptocurrency by market capitalization and the second-largest stablecoin after USDT. The stablecoin has a market capitalization of around $33 billion, nearly four times lower than that of USDT.

USDC is issued by a US-based company known as Circle. Its value is also pegged to $1. Unlike the other cryptocurrencies in the market, stablecoins such as USDC are not volatile, making them ideal for measuring the performance of other assets.

The USDC stablecoin is in the form of an ERC-20 token, and it is widely used across blockchain applications. However, this stablecoin is available not only on Ethereum but also on platforms such as Avalanche, Solana, TRON, Hedera, Stellar, and Algorand.

Since this token maintains the same value as the US dollar, it enables instant global payments, buys goods and services, and supports lending and borrowing on decentralized finance platforms.

Lido Staked Ether (STETH)

The other cryptocurrency that one should consider investing in among the top ten largest cryptos is Lido Staked Ether. STETH tends to have a similar price action to Ethereum, but there are also distinct differences.

STETH is a token representing the ETH that one has staked on the Lido staking platform. These tokens are minted when one deposits ETH to the staking contract. They are also burned when the staked tokens are redeemed.

When Ethereum switched to a PoS consensus in 2020, it replaced miners with validators. Validators confirm transactions on the Ethereum blockchain and play a vital role in securing the network.

The price of STETH is pegged 1:1 to the Ether tokens staked on the Lido staking platform. The value of STETH is often the same as the price of Ether. However, its market is lower than Ether’s at $33 billion.

Lido presents an Ether holder with a chance to earn staking rewards. Instead of holding ETH tokens in your wallet and waiting for a price appreciation, you can choose to stake ETH tokens and receive returns.

XRP (XRP)

The eighth-largest cryptocurrency by market cap is XRP. XRP is the native token for the Ripple ecosystem, which is one of the oldest in the cryptocurrency industry.

Ripple’s history in the blockchain industry dates back to 2012. The blockchain is behind the RippleNet blockchain infrastructure that supports seamless and fast cross-border payments.

Ripple’s functions mirror those of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system. The platform leverages blockchain technology to enable payment settlements, currency exchanges, and remittances.

The XRP token plays a crucial role in the Ripple ecosystem as it is a bridge currency for financial institutions intending to release offerings within the Ripple network.

XRP has a market capitalization of $32 billion. The performance of this token has been inhibited over the years because of a lawsuit filed against the company by the SEC in 2020.

In its lawsuit, the SEC claimed that XRP was a security and that the token violated the US securities laws. The lawsuit is still dragging on, with many industry pundits anticipating it could end this year.

XRP has already secured a few wins in this lawsuit. Last year, US Judge Analisa Torres ruled that XRP secondary sales are non-securities.

The harsh stance of the SEC towards crypto has also led to Ripple donating to pro-crypto candidates in the US. If XRP wins the lawsuit, it could mark a major turnaround for the token, and a rally toward a fresh all-time high could be on the horizon.

Toncoin (TON)

One of the top performers in the cryptocurrency market this year has been Toncoin, the native token for The Open Network (TON). TON is affiliated with the Telegram messaging platform, but the two operate as different entities because of regulatory scrutiny.

TON is a blockchain platform created to be more scalable than the other networks today. This network can process millions of transactions per second because of the robust multi-blockchain architecture that uses sharding to boost efficiency.

TON has been a top performer over the past year, with the token gaining by over 400%. Its market capitalization currently stands at more than $18 billion.

Toncoin operates as the native token for the TON network by allowing network users and developers to settle transactions. The network has posted significant growth in the past year, and while this growth has been good for the price action, it has also attracted malicious actors seeking to dupe legitimate investors.

The network’s total value locked (TVL) growth, as seen in DeFiLlama, shows increased network usage. The TON blockchain’s TVL stood at around $30 million in March this year and has since expanded to more than $748 million.

Dogecoin (DOGE)

The tenth-largest cryptocurrency by market capitalization is Dogecoin, the largest and the oldest meme coin. DOGE has a market cap of over $17 billion, and its growth over the years has been iconic.

Dogecoin started as a joke in 2013. It was a coin created to make fun of Bitcoin using internet memes. However, its growth has since accelerated, becoming a significant player in the cryptocurrency sector.

Dogecoin birthed the meme coin industry, which now has a total market capitalization of around $50 billion. Meme coins have become notorious for volatile price actions, given that their prices can change drastically within a short period, and sometimes, they can cause significant losses to investors.

In the past year, DOGE has gained by more than 70%. Its price action stems from increasing interest from the retail front and top financial institutions.

One of the prominent supporters of Dogecoin is Elon Musk. The Tesla CEO even adopted DOGE as a means of payment at Tesla, giving the meme coin a use case in the real world.

In Summary

The cryptocurrency market has more than 10,000 coins, with a majority of these being highly volatile. New investors are always looking for coins with solid fundamentals and have already secured a reputation in the cryptocurrency industry.

Some of the best coins for a beginner cryptocurrency investor are the top-ten largest cryptos by market capitalization. These coins dominate the cryptocurrency market, with their total market cap being more than half of the global market cap.

The top ten largest cryptocurrencies by market cap that an investor can purchase include Bitcoin, Ether, BNB, Solana, XRP, Lido Staked Ether, Toncoin, and Dogecoin. The list of the top-ten cryptos also includes stablecoins such as USDT and USDC.

FAQs

-

What are the top ten largest cryptocurrencies by market capitalization?

The top ten largest cryptocurrencies by market capitalization are Bitcoin, Ether, USDT, BNB, Solana, Lido Staked Etrher, XRP, Toncoin, and Dogecoin.

-

Are the top-ten largest cryptocurrencies risky?

Yes. Investing in the top ten largest cryptocurrencies is risky. Cryptocurrencies are high-risk investments because of the volatile price action that can cause unprecedented price swings.

-

How can I buy and store cryptocurrencies?

One can buy cryptocurrencies from an exchange platform. These coins can also later be stored on a digital asset wallet for improved security or to allow transfers.

-

How do I choose the cryptocurrencies to invest in?

One can choose which cryptocurrencies to invest in by considering factors like past price action, underlying fundamentals, and popularity across the market.