The crypto market witnessed a remarkable event as the price of Ethereum (ETH), the second-largest cryptocurrency by market capitalization, soared by 15% in just seven days despite the whale selloff.

At the time of writing, Ethereum is trading at $2,645.48, which represents a price increase of about 2.85% in the last 24 hours and an increase of about 15.36% in the past seven days.

Currently, Ethereum has a 24-hour trading volume of $17,540,984,773.

The Price of Ethereum (ETH) Soared 15% Amid Whale Selloff

Recent data revealed a massive selloff from Ethereum whales over the past weeks.

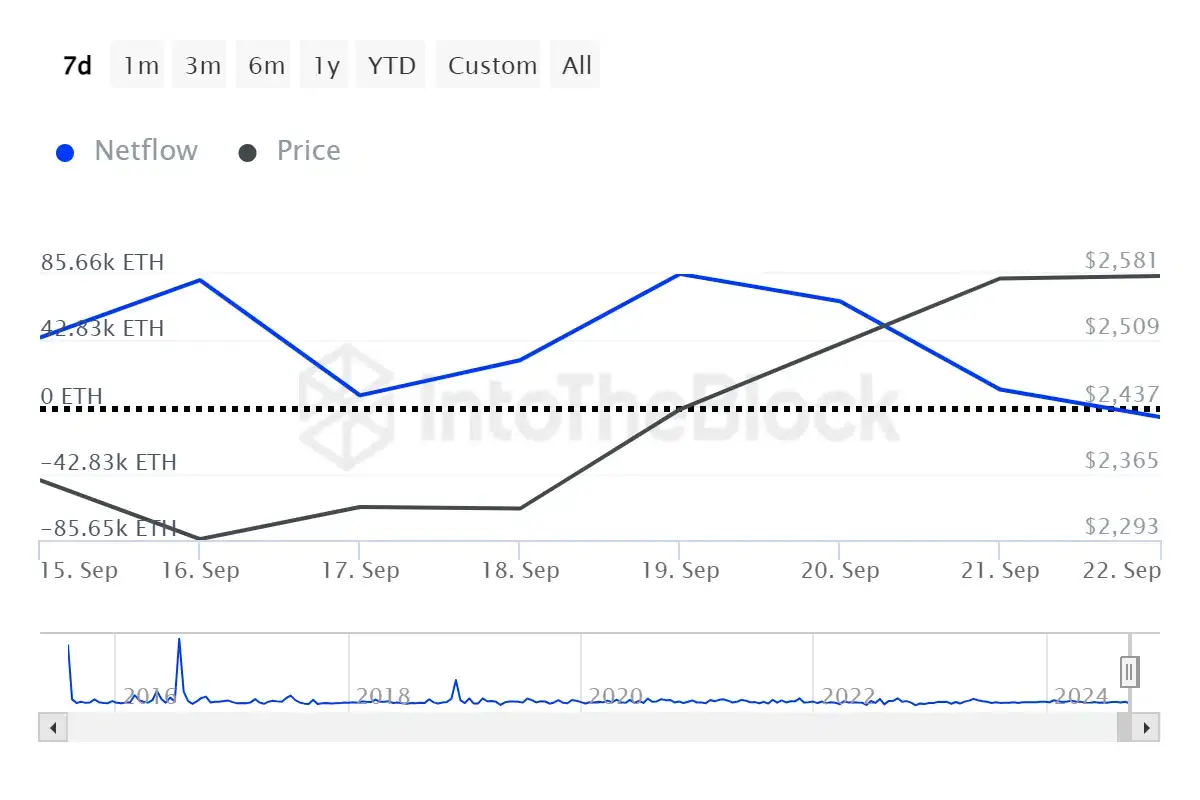

According to IntoTheBlock, net flows for large Ethereum holders (whales) dropped from 85,650 ETH in inflows on September 19 to 6,420 ETH in outflows on September 23, with Ethereum Foundation and Vitalik Buterin being some of the major aggressive sellers.

The IntoTheBlock chart reveals that there was a strong selloff from Ethereum whales as the price of the cryptocurrency moved from $2,300 to $2,400 on September 19. Even as the selloff continued, the price of Ethereum continued its bullish movement.

Usually, an aggressive selloff like what was observed with Ethereum should trigger a significant drop in price.

However, the opposite was reported instead. With such an observation, it could be deduced that the recent bullish movement in the price of Ethereum was a result of the activities of retail traders and not large holders (ETH whales).

Also, data from IntoTheBlock revealed that Ethereum experienced an exchange net inflow of 150,690 Ethereum tokens on September 19.

Although, the inflows have cooled down. The cryptocurrency also witnessed a net inflow of about $480M into centralized exchanges (CExs) over the past seven days.

The whale-to-exchange net inflow ratio shows that retail Ethereum traders have been more active over the weekend, pushing the price of Ethereum upwards.

Despite this aggressive selloff from the ETH whales, the price of Ethereum has remained bullish, as seen in the chart above. Ethereum’s price soared about 2.85% in the past 24 hours and about 15.4% in the past seven days.

Ethereum is currently trading at $2,645.48. Earlier today, the price of the token touched a high of about $2,684, which is the first time in September.

Ethereum currently has a market capitalization of $319B, with a daily trading volume slightly above $17B.

US Federal Reserve’s 50 Basis-point Rate Cut Responsible For Ethereum’s Bullish Momentum

According to market analysts, the recent US Federal Reserve’s 50 basis-point rate cut is one of the factors that triggered Ethereum’s bullish momentum.

However, for Ethereum to sustain this upward trend and hit the $2,800 benchmark, it needs to see a stronger accumulation.

The US Fed’s rate cut has a market-wide effect as the largest cryptocurrency by market cap, Bitcoin, was also affected.

According to our previous report, the price of Bitcoin rose to about $64,800 early Monday morning before dropping to about $63,800 just 2 hours later.