The altcoin market is fast-growing. It is rare to find a cryptocurrency investor that holds just Bitcoin in their portfolio. Diversification through altcoins has become a popular strategy, especially in the crypto market, where the level of risk from investments is significantly high.

An altcoin is any other cryptocurrency that is not Bitcoin. Altcoin is a blend of “alt,” meaning alternative, and “coin,” meaning cryptocurrency.

Bitcoin was the first cryptocurrency launched in 2009, shortly after the global financial crisis. Among the exciting things about Bitcoin is that it revolutionized the economic and technological landscapes by introducing blockchain technology.

- Understanding Altcoins

- Types Of Altcoins

- Factors To Consider Before You Buy Altcoins

- Where To Purchase Altcoins

- How To Buy Altcoins From Centralized Exchanges

- Pick A Reliable Crypto Exchange

- Create An Exchange Account

- Fund The Account

- Place An Order

- Send Altcoins To A Crypto Wallet

- Tips For Beginners Investing In Altcoins

- In Summary – How To Buy Altcoins

- FAQs

However, while Bitcoin had the first-mover advantage, developers quickly realized some areas for improvement with its model. This later gave birth to alternative cryptocurrencies.

This guide takes seasoned and novice traders alike through the altcoin industry. It is the ultimate guide for beginners looking to buy altcoins in the market.

Understanding Altcoins

Bitcoin set the gold standard for cryptocurrencies. However, developers quickly noticed flaws in the Bitcoin network, which they sought to improve upon by alternative cryptocurrencies created using blockchain technology.

One leading issue developers picked up was that Bitcoin was not fast enough. This negated its use case as a medium of currency, as Satoshi Nakamoto pointed out in the Bitcoin whitepaper.

Other developers also believed blockchain technology could be used for much more than creating digital currencies. This analogy birthed smart contracts that are now used to create multiple applications that rely on blockchain technology.

However, despite altcoins seeking to become better than Bitcoin, the latter remains the king of cryptocurrencies. Bitcoin currency dominates more than 50% of the global cryptocurrency industry, with a market capitalization of over $1 trillion.

Types Of Altcoins

There are more than 10,000 altcoins in the cryptocurrency market. Each of these coins is classified under a specific category. The main categories of altcoins include the following:

Smart Contract Platforms

At the top of our list are smart contract platforms. These altcoins are powered by blockchain networks that can run conditional programs.

Smart contracts are the backbone of every use case of blockchain technology. If you have heard about games created using blockchain, decentralized finance (DeFi) platforms, decentralized exchanges (DEXs), etc., know that they are made on smart contract platforms.

Smart contract platforms have native tokens to pay the fees needed to transact on the blockchain. These native tokens are now known as altcoins.

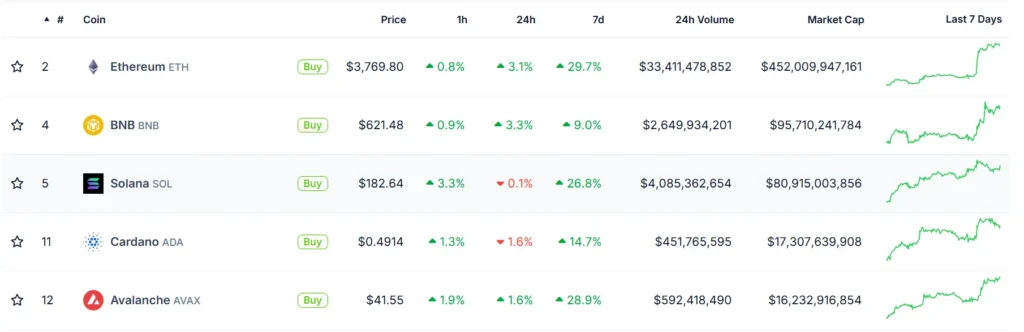

Some of the most common smart contract platforms in the market today include the following: Ethereum, BNB Chain, Solana, Cardano, Avalanche, Polkadot, and Tron. Below are the top five largest smart contract platforms in the market.

Stablecoins

A stablecoin is a digital currency that tracks the value of an underlying asset, such as fiat currency. Stablecoins are critical in the cryptocurrency industry because they are “stable.” Their value does not fluctuate; instead, it remains pegged to the specific asset.

Due to their stable value, stablecoins make it easy to transact in the cryptocurrency industry. They also offer a haven for traders who want a break from the volatile crypto market.

The largest stablecoins in the crypto market are Tether (USDT) and USD Coin (USDC). These stablecoins are backed by cash or cash equivalents. Their values are pegged to the US dollar.

You will also find algorithmic stablecoins such as DAI in the market. The DAI stablecoin uses other smart contracts such as ETH, USDC, and other cryptocurrencies as collateral. DAI is one of the oldest stablecoins in the market.

Decentralized Finance (DeFi) Altcoins

The other category of stablecoins is decentralized finance (DeFi) altcoins, which allow holders to lend and borrow cryptocurrencies to generate passive income.

DeFi altcoins have varying use cases, such as staking, governance, and utility tokens. Investing in these tokens allows you to benefit when the price increases and access more opportunities to earn returns.

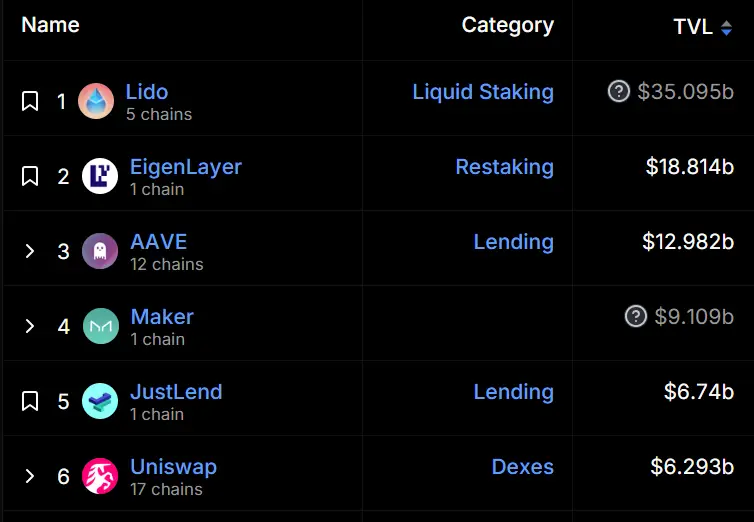

Some of the most popular DeFi altcoins in the crypto market include Lido Staked Ether (stETH), Aave (AAVE), Compound (COMP), and Uniswap (UNI). Below are the top DeFi protocols in the crypto market, according to DeFiLlama.

Meme Coins

The other popular category of altcoins is meme coins. Meme coins have blown up the cryptocurrency market because of high interest from retailers. However, these altcoins are highly speculative, and while they can deliver huge returns, the losses can also be quite significant.

The meme coin hype started with the dog-themed cryptocurrency Dogecoin. Dogecoin is one of the top ten large crypto companies by market cap. Over the years, new meme coins have sprouted, including Shiba Inu, Floki Inu, DogWifHat, and PEPE.

Before investing in meme coins, knowing the enormous risks involved is prudent. Meme coins usually have little use case, apart from older ones such as Dogecoin, which is used as a means of payment by Tesla. Moreover, these coins are usually inflationary and have significantly low values.

Gaming Coins

One of the industries where blockchain technology is fast gaining adoption is gaming. Besides existing games tapping blockchain technology, some games are solely built atop blockchain technology. These games are referred to as Web3 games.

These gaming projects have their native tokens that players use to purchase in-game items. Moreover, unlike traditional games, Web3 games allow players to exchange their in-game earnings for real money and earn passive income.

Some of the most popular gaming altcoins include The Sandbox (SAND), Immutable X (IMX), and Gala Games (GALA).

Factors To Consider Before You Buy Altcoins

One needs to consider multiple factors before investing in altcoins, and it is vital to understand the benefits and risks before pouring your money into these tokens.

Some altcoins lack real utility behind them, making them highly volatile. Such altcoins’ value solely depends on the forces of demand and supply. This is especially true with altcoins such as meme coins, which tend to post quick gains within a short time.

You must also check the regulatory status of an altcoin before investing your money. For instance, last year, the US Securities and Exchange Commission sued two of the largest exchanges in the US, Binance and Coinbase, for selling cryptocurrencies classified as securities without the proper registration.

Such charges can affect the value of altcoins. It can also affect their liquidity if they get delisted from leading cryptocurrency exchanges. Therefore, as a trader, it is recommended that you check on the regulatory status of an altcoin before buying.

Liquidity is crucial because it can affect your ability to buy and sell an altcoin. If an altcoin is illiquid, you might be unable to make large trades or sell when the price drops.

You should also be aware of any developments around the altcoin. If there is growing adoption, that could be an ideal time to buy altcoins. However, any adverse developments might affect the value of the altcoin.

Where To Purchase Altcoins

If you want to buy altcoins in 2024, the first thing that you need to do is to look for where to buy these tokens. You can buy altcoins from peer-to-peer platforms, as well as decentralized exchanges and centralized exchanges.

Peer-to-Peer Platforms

Peer-to-peer (P2P) platforms allow you to buy altcoins from other cryptocurrency investors. P2P models operate under the framework of decentralization. They allow you to trade altcoins with other people without using a platform.

While P2P platforms might help you lock in better prices and forego any charges you have been charged on a trading platform, they come with a high level of risk.

Before transacting with a user on a P2P platform, it is recommended that you check what other users have to say. You can check any reviews that might be linked to the users.

Decentralized Exchanges

When looking for where to buy atcoins, you can also consider decentralized exchanges (DEXs). These are exchanges created atop a blockchain. Like P2P platforms, DEXs allow users to transact without relying on a third party.

Unlike centralized exchanges that require a central authority to execute trades, trades on a DEX are executed by a smart contract. With a DEX, you can trade altcoins through your wallet without moving funds from the wallet to the DEX.

Centralized Exchanges

The best place to buy altcoins as a beginner is a centralized exchange. Centralized exchanges operate like stock brokerage platforms. You can deposit funds on these platforms and later place an order to purchase the tokens you want.

Centralized exchanges have frameworks that require users to verify their identities to improve security. Moreover, these platforms also come under scrutiny from regulators, mandating that they comply with the set regulatory frameworks.

How To Buy Altcoins From Centralized Exchanges

In this guide, we will go through buying altcoins from centralized exchanges.

Pick A Reliable Crypto Exchange

The first step towards doing so is getting a reliable cryptocurrency exchange to work with. When choosing a cryptocurrency exchange, you need to consider the following factors:

User experience

The first thing to consider as a beginner looking to buy altcoins from an exchange is the user experience. You should go with an exchange with user-friendly features that simplify trading on the platform.

It is also advisable to pick the exchange with an active customer support team. This team will guide you if you have questions about using the platform.

Fees

Fees are also another crucial factor to consider. You should evaluate the fees charged on an exchange to execute trades. Doing so will help you better determine whether it is ideal to make frequent small or large trades.

You should also consider the deposit and withdrawal fees charged by an exchange. If an exchange charges exorbitant fees, it might eat a significant chunk of your profits.

Supported cryptocurrencies

You should also look at the cryptocurrencies supported on an exchange to help you make a solid decision. Not all altcoins are supported on leading exchanges. Therefore, if you have a particular altcoin you want to buy, search on the exchange’s website to determine whether it is available.

Liquidity

The other key factor to consider is the liquidity. The best exchange is the one that has high trading volumes. These volumes show that many users use the exchange and point towards high liquidity, making it easy to execute large trades instantly.

Reputation

You should also consider the reputation of a cryptocurrency exchange in the cryptocurrency industry. You can do so by checking the reviews from past users of that exchange.

It is also best that you pick an exchange that does not have a negative reputation for hacking attacks or scams. A reputable exchange should also not have a history of lost customer funds.

Create An Exchange Account

After picking the cryptocurrency exchange that you intend to use, the next step is to open an account with a cryptocurrency exchange. Opening such an account differs from one exchange to the other. However, in all instances, you will need an email address.

You can use an email address and a robust password to set up your account. However, due to the changing regulatory framework and the growing concern that cryptocurrencies are being used for illegal activities, exchanges will need you to verify your identity.

You must submit Know Your Customer (KYC) documents to verify your identity. The process entails submitting a government-issued document with your full name and image. You must then conduct a real-time image check to determine whether you own the submitted documents.

When opening an account, it is always prudent to create a strong password. That password will ensure that there is no unauthorized access to your account. It is also best to set up two-factor authentication, which always requires authorization during sign-ins.

Fund The Account

The third step is to fund the cryptocurrency exchange account. There are two main ways to go about this: fund with cryptocurrency or with fiat currency.

To fund your account with cryptocurrency, you need to have already owned crypto assets in the past. You then have to transfer the cryptocurrencies to the exchange platform and later exchange them with the altcoin you intend to buy.

If you are a beginner in the industry, consider buying altcoins with fiat currency. You can do so by linking your debit card or credit card to your exchange account. The amount you want to spend to buy altcoins will then be charged to your card. Some exchanges also allow you to buy bitcoins with PayPal.

Despite the method of funding you choose, you should fund your account with an amount you are willing to lose, bearing in mind the volatile nature of altcoins.

Place An Order

The fourth step is to place an order to buy tokens. When placing an order to buy altcoins, consider two main orders you can create: market and limit orders.

A market order is fulfilled at the prevailing price of a crypto asset. With this type of order, the exchange will fulfill it instantly at the ongoing price of the altcoin that you want to buy.

However, if you want to maximize your chances of making profits, consider creating a limit order. This type will see your order being fulfilled at a lower price. For instance, if you suspect the price of the altcoin you want to buy will drop, you can place a limit order at a lower price. The exchange will fulfill that order when the price falls to the predetermined price.

Send Altcoins To A Crypto Wallet

Once you have the altcoins you want on your exchange account, the next step is sending the coins to a crypto wallet. Doing so will safeguard your assets and ensure they are safe from any unprecedented events that might happen on the exchange, such as bankruptcy or hacks.

You can store your crypto assets in a hot or cold wallet. A hot wallet allows you to store your crypto assets online. It is the best type of wallet if you are a frequent trader, as it is easy to send your tokens back to the exchange whenever you want to sell.

However, hot wallets are susceptible to hacking attacks. Therefore, if you want to store your crypto assets for the long term, it is best that you do so in a cold wallet. Cold wallets will store your assets offline so they are safe from attackers.

Tips For Beginners Investing In Altcoins

If you are a beginner looking for the best altcoins to buy now, keep a few tips in mind. The first is that you need to diversify your investment portfolio. You must hold a basket of different altcoins to minimize losses if one token drops by huge margins.

It is also good to manage risk by setting a stop-loss order. This type of order allows you to minimize losses if ETH drops below a certain level.

Altcoins perform depending on the ongoing market trends and developments. You must be aware of the ongoing market trends, as they will help you predict how an altcoin might perform in price.

You must also have a basket of tools and resources to track your portfolio and the market. Some tools that you can track the price movement are CoinGecko and CoinMarketCap. It is also best that you keep in touch with what other investors are saying by being active on crypto Twitter.

In Summary – How To Buy Altcoins

Altcoins, largely known as alternative cryptocurrencies, are the ideal investment option for crypto investors looking to diversify their investment portfolio. With more than 10,000 altcoins in the cryptocurrency market, it might be challenging for a novice trader to navigate the industry.

If you are looking to buy altcoins, the best way to do so is by first getting a cryptocurrency exchange that is reliable and secure. Afterward, you can fund that exchange and place an order to buy the altcoins that you want.

Before buying altcoins, it is vital to note that these tokens can be highly volatile. Moreover, most altcoins also need more use cases to sustain their value. Therefore, you should always keep track of your investment to manage risk.

FAQs

-

What are altcoins?

Altcoins or alternative cryptocurrencies refer to all other cryptocurrencies apart from Bitcoin. They are a good way of diversifying your crypto investment portfolio to manage risk.

-

What are the best altcoins to buy?

The best altcoins to buy are the ones with utility. Such altcoins are less volatile and lower the chances of falling victim to scams and rug pulls.

-

How much money do I need to start investing in altcoins?

You can start investing in altcoins with as low as $10. The lowest amount you need to trade altcoins depends on the minimum deposit allowed on the exchange.

-

Are altcoins risky?

Altcoins are a high-risk investment because of the volatile price movement. When investing in altcoins, ensure you do so with money you are willing to lose.

-

Is investing in altcoins illegal?

Investing in altcoins is not illegal. However, you should check the local regulatory framework to understand whether some altcoins may be banned in your jurisdiction.