SOL was trading at $132 at 02:32 a.m. EST after a 2.71% dip in the last 24 hours. The token’s trading volumes have increased by around 3%, according to CoinMarketCap data.

Solana has posted a double-digit price decline in the past week amid a bearish momentum across the cryptocurrency market. The bearish sentiment comes despite significant growth in the Solana network activity.

Is Solana Price Primed for a Reversal?

SOL has been among the worst-hit tokens during the recent market turmoil.

With top cryptos such as Bitcoin and Ethereum trading sideways, Solana has failed to show resilience. It has recorded one of the biggest drops among the top ten largest cryptos by market cap.

However, the sell-side pressure is waning. A look at the movement of the Relative Strength Index (RSI) line shows buyers are attempting to take control by entering at low prices.

The buying support remains low, with the RSI at 39. SOL is leaning towards the oversold levels, and the low price could attract investors looking to acquire the token at low prices.

$132 is the entry point for most traders, making the case for a short-term gain from current levels.

Nevertheless, the bears appear unrelenting, with SOL facing a critical resistance zone at $140.

This price level has been rejected several times, with the current buying support insufficient to sustain an uptrend. This has seen SOL dropping to $132 after each attempted breakout.

We could see an influx of buyers of SOL drops to collect liquidity at $127. This uncollected liquidity zone could trigger a reaction due to buy orders.

If SOL drops to this favorable entry price, a trend reversal to the upside could be ignited.

According to market analyst “Moki Trading” on X, SOL’s chart indicates an upward surge.

SOL has formed a symmetrical triangle on the daily chart. This chart pattern shows that SOL is ready for a breakout, potentially on the upper side after consolidation.

Solana Network Activity Soars

The increased network activity further proves the bullish case for Solana.

Data from DeFiLlama shows that Solana captured $1.36 billion of DEX volumes on June 19. The network is becoming a notable competitor against Ethereum, whose DEX volumes stood at $1.52 billion.

Solana’s growth comes as the network becomes a hub for retail activity driven by the recent hype around Solana-based meme coins. According to a Pantera Capital report, meme coins have influenced Solana’s market share.

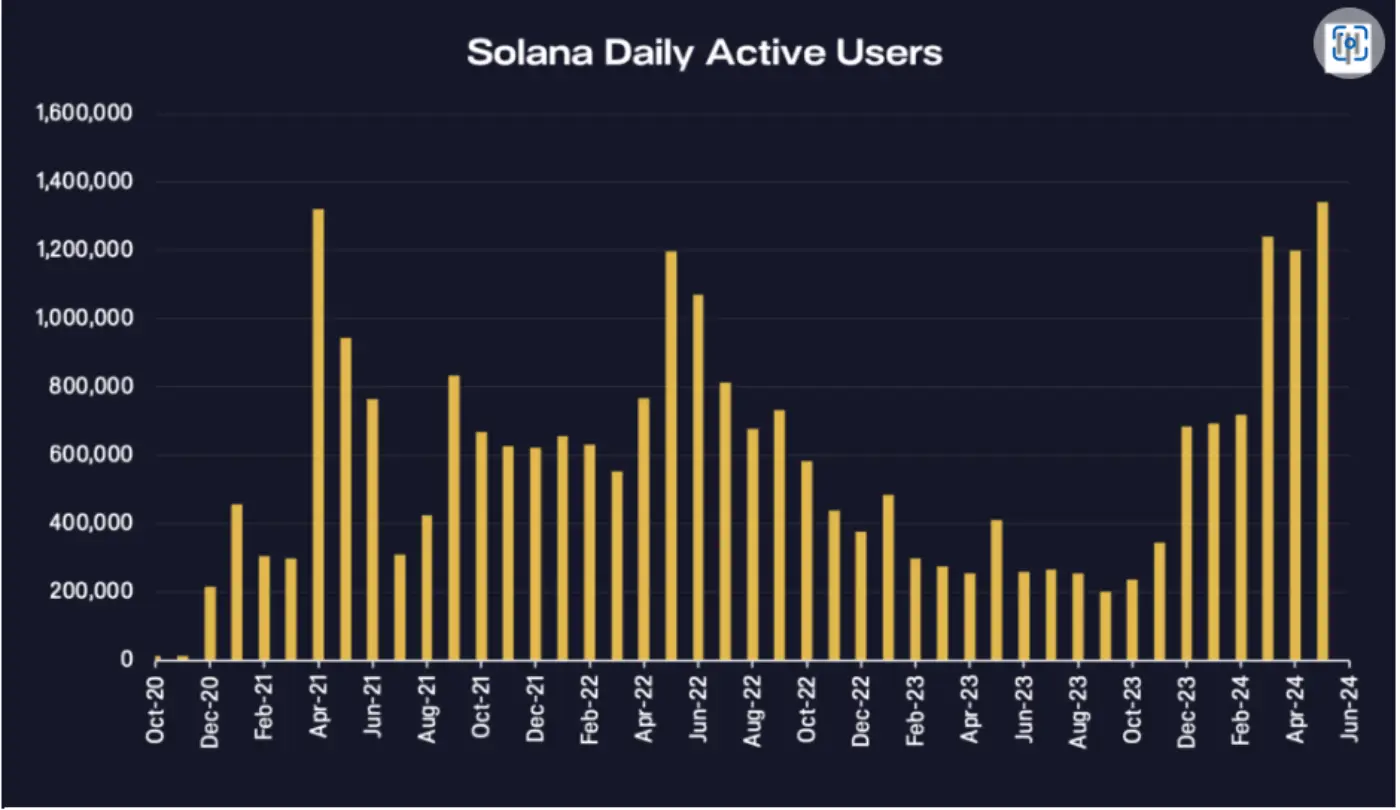

This chart shows that the number of daily active users on Solana hit a record low in October 2023. However, in barely eight months, activity on the network has soared to all-time highs.

Besides meme coins, non-fungible tokens (NFTs) created on Solana also witnessed an uptick in activity. Solana Floor said the network surpassed $13M in NFT trading volumes in seven days.

Growth in network activity positively influences SOL’s price as users purchase the token to settle trading fees.

3iQ Files for a Solana Fund in Canada

After investment manager 3iQ filed for The Solana Fund (QSOL), Solana bulls are also set to dominate the market.

According to the firm, if this product gets approval, it will become North America’s first Solana exchange-traded fund (ETF). This fund could mark a major turnaround for Solana’s institutional adoption.

The fifth-largest cryptocurrency has been struggling to compete against Ether after the latter gained regulatory approval with spot Ether ETFs in the US.