Polymarket, the popular crypto prediction market, has integrated Chainlink’s oracle network to bring fast, reliable price data to its markets. The goal is to make market results settle quickly and automatically.

This means traders can know winners and receive payouts without long waits. This comes as the blockchain prediction company prepares to launch in Unites States with $10B valuation after approvals and new investment.

Why Faster Settlements Matter

Faster and automated settlement reduces confusion and the chance of human error. For everyday users, it means clearer prices, quicker withdrawals, and less waiting after markets end. That means market that track Bitcoin and other crypto pairs can close and pay winners quickly, instead of waiting for slow, manual checks.

This upgrade aims to cut delays and make results more reliable for traders. The team says the integration runs on Polygon and will support many crypto pairs, making short, 15-minute markets possible.

Strategic Timing and Market Position

The partnership comes as Polymarket prepares to return to the US market after a three-year absence. The company recently spent $112 million to acquire QCEX, a regulated exchange that gives it the legal foundation to serve American customers again.

Polymarket had to leave the US market in 2022 after the Commodity Futures Trading Commission fined the company $1.4 million for operating without proper registration. The regulatory issues forced the platform to block American users while continuing to operate internationally.

The timing of the Chainlink partnership appears strategic. As Polymarket seeks to rebuild trust with regulators and users, the automated resolution system provides concrete evidence of the platform’s commitment to fairness and transparency.

Chainlink brings significant credibility to the partnership. The oracle network secures over $93 billion in total value and processes trillions of dollars in blockchain transactions. Major financial institutions including JPMorgan, Mastercard, and UBS already rely on Chainlink’s technology.

Looking Forward

The partnership positions both companies at the center of two growing trends: the tokenization of real-world assets and the institutional adoption of blockchain technology. Chainlink has recently secured partnerships with major financial institutions and government agencies, while Polymarket has attracted billions of dollars in betting volume.

As prediction markets mature, automated resolution systems could become the industry standard. The success of this partnership may influence how other betting platforms handle outcome determination, potentially leading to more reliable and trustworthy prediction markets across the industry.

The integration represents more than just a technical upgrade—it’s a step toward making prediction markets a legitimate source of real-time information about future events, backed by cryptographic proof rather than human opinion.

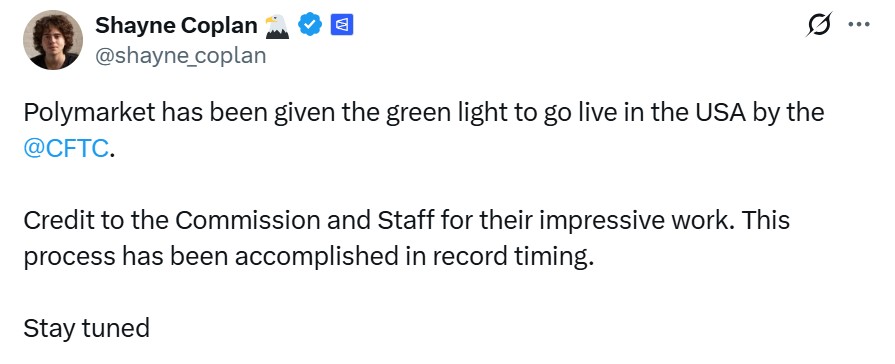

Polymarket Eyes a $10 Billion Blockbuster Valuation as the U.S. Launch Nears

The firm is preparing a U.S. launch backed by regulatory progress and new funding talks that sources say could push the company’s valuation toward $10 billion. The push follows steps to secure a regulated on-ramp in the U.S. including acquiring a CFTC-licensed exchange that would allow the company to offer prediction markets to American users within a compliant framework.

Donald Trump Jr. joined Polymarket’s advisory board as part of that move. Polymarket’s founder, Shayne Coplan, says the firm plans a big U.S. launch that could lift the company’s valuation toward $10 billion.

Competition Heats Up with Kalshi

Prediction markets are drawing more money and attention. Kalshi, a regulated rival, raised major funding and has grown fast after court wins that clarified which political contracts are allowed. The rise of these platforms shows investors want new ways to trade on events and prices. At the same time, regulators and states are watching closely.

Kalshi’s regulatory path and Polymarket’s oracle upgrade create two competing business models: regulated derivatives venues vs. crypto-native markets, each with different advantages and constraints.

What This Means for the U.S. Crypto Market

The Polymarket News of U.S. launch could push prediction markets into the mainstream. That could increase attention on crypto tools that link to real-world outcomes, and it may draw more institutional interest. But tighter rules and oversight are likely to follow, shaping how fast it grows.

The platform’s improved data integrity and faster settlements, coupled with political and financial backing, could boost institutional interest. Polymarket’s Chainlink deal makes its market outcomes faster and cleaner.

The investment and advisory ties give the company political and financial momentum as it eyes a U.S. comeback. Whether that comeback succeeds will depend on how regulators respond and how the company balances innovation with rules and consumer protection