Tech giant Microsoft is about to jump on the Bitcoin bandwagon with its new proposal. Recently, Microsoft proposed adopting Bitcoin (BTC) as a corporate treasury asset.

However, Microsoft’s board of directors kicked against the move, saying that the firm’s treasury already assesses an array of assets, including Bitcoin (BTC).

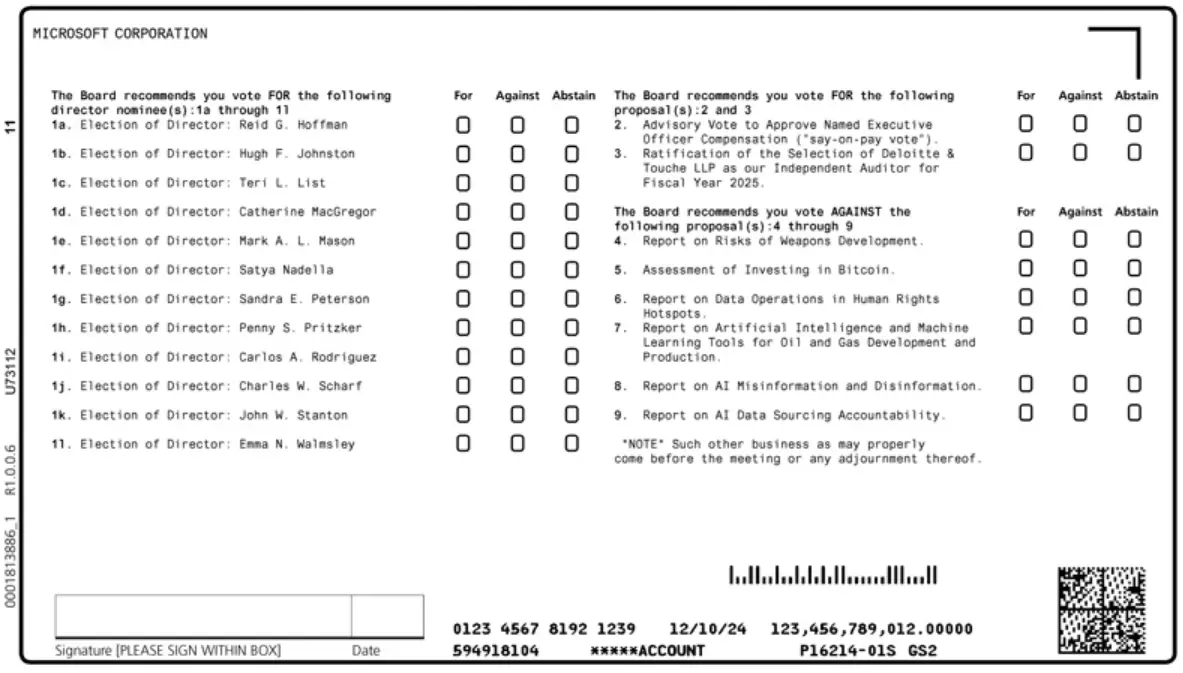

In response, the firm has called on its shareholders to vote on the proposal to assess Bitcoin as a diversification investment by December 10.

Microsoft Shareholder To Propose On Whether Firm Should Look Into Bitcoin Investment

Come Tuesday, December 10, 2024, Microsoft’s shareholders will vote on whether or not to invest in Bitcoin.

According to a filing with the US Securities and Exchange Commission (SEC) on Thursday, October 24, 2024, Microsoft has outlined critical issues that will be discussed at the firm’s next shareholder meeting. One of them is the proposal to assess Bitcoin (BTC) as a potential corporate investment in the firm’s balance sheet.

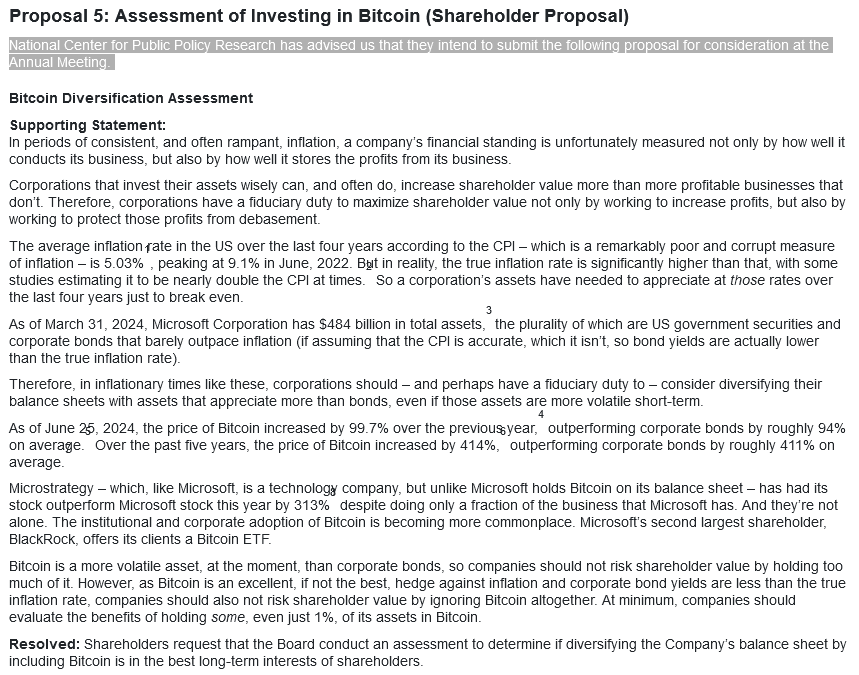

The proposal, “Assessment of Investing in Bitcoin,” which was pushed by the National Center for Public Policy Research, an independent conservative think tank, calls for a detailed evaluation of Bitcoin’s potential role within the tech firm’s treasury operations.

The proposal suggests that Microsoft should consider Bitcoin as a corporate treasury asset to hedge against inflation and other macroeconomic influences.

However, the firm’s board of directors is against this move. The board claimed that Microsoft’s treasury already assesses a variety of assets, including crypto assets like Bitcoin.

The board further stressed Bitcoin’s volatility and the importance of stability in corporate treasury operations. The board claimed that Bitcoin is highly volatile, making it less suitable for ensuring liquidity and operational funding.

Due to Bitcoin’s notorious volatility, Tesla lost over $100M in 2022. Although the car firm still holds a large number of Bitcoins in its assets. Recently, Tesla moved about $765M of its crypto assets into private wallets, which triggered the fear of a big sell-off.

In opposition, the National Center for Public Policy Research has notified all of Microsoft’s shareholders of the intended proposal and urged them to vote on whether or not to assess Bitcoin as a diversification investment at the company’s annual meeting on December 10.

Nevertheless, the board has recommended voting against this proposal because it already “evaluates a wide range of investable assets,” including BTC.

Is An Investment in Bitcoin Possible For Microsoft?

Only after the voting will everyone be certain whether Microsoft will eventually invest in Bitcoin or assess Bitcoin as a corporate treasury asset or not.

However, Microsoft accepted Bitcoin payments at its online Xbox store between 2014 and 2018. Also, Microsoft is more invested in artificial intelligence (AI) tech than blockchain tech.

Shortly after the filing, Microsoft’s (MSFT) share, which was trading relatively flat on October 24, increased by about 0.03% to $424.7, according to Google Finance.