Fidelity Investments, a major global asset manager, recently revealed that more than 77,000 customers’ personal information was accessed in a data breach.

The breach happened between August 17 and 19, 2024, when hackers used two newly created accounts to gain access to an internal document database.

Though no customer funds or account log-ins were compromised, exposed data included Social Security numbers and driver’s license details, raising serious risks for identity theft.

- Key Takeaways

- Facts & Original Research

- What Happened in Timeline & Details

- What Data Was Exposed

- Fidelity Data Breach Exposes Info of 77,000 Customers

- Fidelity Reports Data Breach to Maine Attorney General

- Fidelity Reports Data Breach to New Hampshire AG

- Fidelity’s Response & User Impact

- Fidelity Offers 24-Month Free Credit Monitoring to Affected Customers

- Expert Reactions & Cybersecurity Insights

- How Customers Can Protect Themselves

- Conclusion

- Frequently Asked Questions (FAQs)

In this article, you’ll learn what happened, why it matters for you and other investors, and how to protect your info globally, not just in the U.S.

Key Takeaways

| Main Point | Summary |

| 77,000+ customers affected | Personal data, not funds, was accessed through internal account misuse at Fidelity Investments. |

| Funds remain safe | Fidelity confirmed no account balances or trading access were breached. |

| Identity data at risk | Exposed Social Security numbers and ID documents raise long-term identity theft concerns. |

| Fidelity acted quickly | The company disabled accounts, notified regulators, and offered free credit protection. |

| Experts warn of insider threats | Security professionals highlight weak internal controls as a common vulnerability in finance. |

| Users should stay alert | Enable two-factor authentication, watch for phishing, and monitor credit reports regularly. |

| Cybersecurity is now a trust factor | Investors are choosing firms that prove transparency and response readiness after breaches. |

Facts & Original Research

Key Cybersecurity Statistics from the Financial Sector

The Fidelity breach is part of a wider industry pattern showing how personal data, not just money, has become the prime target for cybercriminals.

| Year | Financial Industry Breaches | Records Exposed | Average Cost per Breach | Common Attack Type |

| 2022 | 236 | 48 million | $5.97 million | Phishing / Credential Theft |

| 2023 | 301 | 61 million | $6.85 million | Insider Misuse |

| 2024 | 342 | 79 million | $7.4 million | Internal Access Exploits |

| 2025 (Q1–Q3) | 210+ (projected 400+) | 52 million+ | $8.2 million | AI-driven Social Engineering |

What Happened in Timeline & Details

Between August 17 and 19, 2024, attackers gained unauthorised access to a Fidelity Investments database through two new employee accounts. These accounts were created within Fidelity’s internal system and later used to copy files containing customer records.

Security analysts confirmed that the breach was not caused by ransomware but by credential misuse, a common issue in corporate networks. The exposed data was part of Fidelity’s document management system, which stores verification records, identification scans, and account setup documents.

Fidelity discovered the breach during a routine security audit. Once detected, the company shut down the compromised accounts and notified regulators and affected customers. Investigators now believe the attackers were financially motivated, seeking personal data for resale on dark web marketplaces.

What Data Was Exposed

Investigators found that the stolen records included names, addresses, Social Security numbers, and driver’s license details linked to more than 77,000 Fidelity customers. No trading accounts or financial balances were accessed, but the exposed information can still be used for identity theft or phishing scams.

Fidelity said that affected clients will get free credit monitoring and fraud protection services. They also reported the breach to state regulators and the U.S. Securities and Exchange Commission (SEC).

Cybersecurity experts warn that breaches involving personal identifiers are long-term threats, even if no passwords were stolen. The data can circulate on dark web marketplaces for months, putting customers at ongoing risk.

Fidelity Data Breach Exposes Info of 77,000 Customers

One of the largest asset managers in the world, Fidelity Investments, has confirmed that the personal information, including Social Security Numbers (SSN) and driver’s licenses, of 77,000 of its customers was compromised during an August data breach.

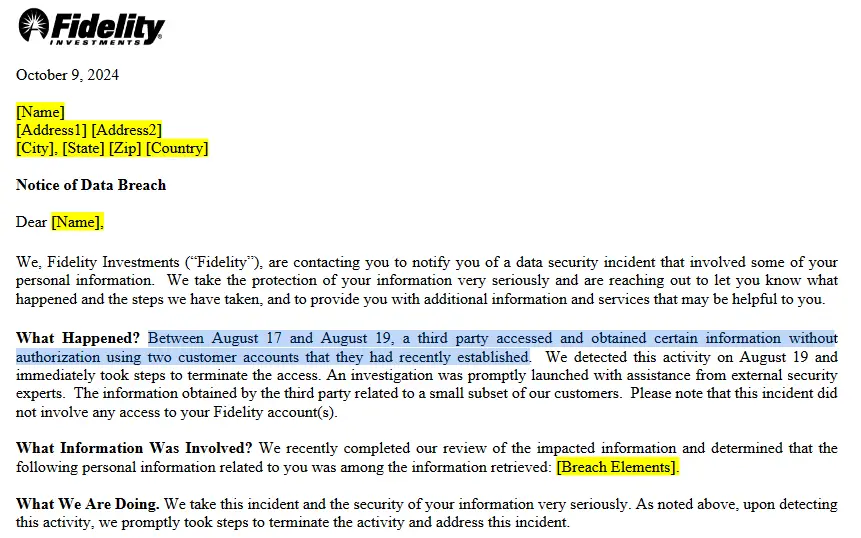

Fidelity Investments reported that the data breach took place between August 17 and August 19 when an unnamed third-party agent accessed customers’ information on its systems “using two customer accounts that they had recently established.”

Soon after, Fidelity sent a letter to the affected customers, saying,

“We detected this activity on August 19 and immediately took steps to terminate the access.” The finance company added that the incident did not involve any access to customers’ funds.

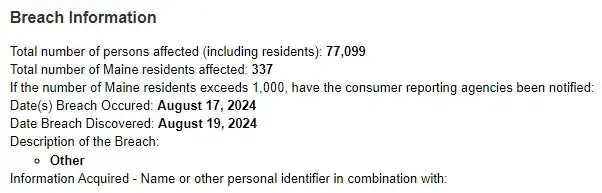

Fidelity Reports Data Breach to Maine Attorney General

On Wednesday, October 9, the American financial services firm filed a data breach report to the Maine Attorney General’s office almost two months after the incident.

In the report, Fidelity stated that 77,099 out of its total 51.5M+ customers were affected by the data breach. Fidelity revealed that it is currently working together with “external security experts” to resolve the matter.

Fidelity Reports Data Breach to New Hampshire AG

Fidelity reported the data breach in another filing to New Hampshire’s attorney general. In the notice, Fidelity mentioned that the third-party agent,

Accessed and stole certain personal data of Fidelity customers and other individuals by submitting fraudulent requests to an internal database that contains images of documents belonging to Fidelity customers.

In another separate filing with the Massachusetts attorney general, Fidelity Investments mentioned that the breached data included customers’ Social Security numbers (SSNs) and driver’s licenses.

However, in all the filings, the asset manager did not explain how the two customer accounts were created or compromised to allow access to the personal data of the other affected customers. Also, at the time of writing this post, there is no information about the data breach on Fidelity’s website.

Fidelity’s Response & User Impact

After confirming the breach, Fidelity Investments quickly locked the compromised accounts and started a full internal review. The company also brought in third-party cybersecurity firms to trace how the attackers got access and to close any weak points in its system.

Fidelity stated that no trading activity or customer funds were affected, and clients can continue using their accounts safely. However, the firm urged users to stay alert for phishing emails or suspicious calls, since stolen personal data can be used for social engineering scams.

Affected customers will receive credit-monitoring support and identity-theft insurance at no cost. Fidelity also promised to upgrade its internal access protocols, adding multi-layer verification for all employee accounts to prevent a similar breach in the future.

Fidelity Offers 24-Month Free Credit Monitoring to Affected Customers

According to the report, Fidelity Investments is offering its affected customers a free 24-month credit monitoring and identity restoration service.

The firm stated that this service will better equip the affected customers to help the firm detect,

Any unusual activity that may affect [their] personal financial situation.

According to the report, this is the fourth time Fidelity has experienced a data breach this year. The first data breach took place on March 4, the second on March 18, and the third on July 19.

On March 27, Fidelity Investments filed an S-1 form for a spot Ethereum exchange-traded fund (ETF), with the inclusion of staking.

Last month, Indodax, a popular Indonesian crypto platform, suffered a data breach, losing about $22M in assets across multiple networks.

Expert Reactions & Cybersecurity Insights

Cybersecurity experts say the Fidelity breach highlights how even trusted financial institutions face growing threats from insider misuse and weak identity controls.

Jake Hollman, a data security researcher at CyberSafe Global, noted that, “The real risk isn’t just stolen credentials; it’s how easily internal tools can be abused once a single point of entry is compromised.”

Industry analysts add that finance firms are now top targets because of the valuable personal identifiers they store, often more useful than direct financial data. Recent reports show a 42% rise in finance-sector breaches in 2024 alone. Security experts suggest stronger multi-factor authentication, access segmentation, and real-time threat detection as key solutions to prevent similar incidents.

How Customers Can Protect Themselves

Fidelity customers, and anyone using online financial services, should take a few key steps right now to protect personal data.

- Change passwords and enable two-factor authentication on every financial account, even if Fidelity says trading access wasn’t breached.

- Monitor bank and credit reports for any unusual activity or new accounts you didn’t open.

- Ignore calls, texts, or emails claiming to be from Fidelity that ask for login details — these are likely phishing attempts.

- Use a credit freeze if you suspect your Social Security number has been exposed.

- Keep security alerts active in both Fidelity and bank dashboards to catch login attempts quickly.

Conclusion

The Fidelity data breach shows that even leading financial firms remain targets for cybercriminals. While no trading accounts were affected, the exposure of personal identifiers, such as Social Security numbers and license details, can still lead to lasting identity risks.

Fidelity has taken quick action by alerting users, offering credit monitoring, and reinforcing internal systems. Still, the event is a clear reminder that every investor should stay alert, protect private data, and verify every message or request.

Staying informed is your best defence. Follow BTCRepublic for ongoing updates on financial security, crypto safety, and digital risk awareness.

Frequently Asked Questions (FAQs)

What caused the Fidelity data breach?

Hackers gained access through two newly created internal employee accounts. These were later used to copy files from Fidelity’s document system between August 17–19, 2024.

Was my Fidelity account or money affected?

Fidelity confirmed that no funds or trading accounts were touched. Only personal identifiers such as names, addresses, and ID details were exposed.

What should I do if I receive a breach notice from Fidelity?

Activate the free credit monitoring and fraud protection provided. Change your passwords, turn on two-factor authentication, and monitor your credit reports regularly.

Will Fidelity face penalties for this incident?

Regulators, including the SEC and state privacy boards, are reviewing the case. Fidelity has pledged full cooperation and stronger internal security policies.

How can investors protect themselves from future breaches worldwide?

Use strong passwords, avoid clicking unknown links, and verify any contact claiming to represent financial institutions. Security awareness is now essential for every investor, no matter the country.