The continuous evolution of the cryptocurrency ecosystem is also precipitating changes in the ways people access and transact with their crypto assets. Crypto exchanges are important industry players, helping to bring people together for transactions.

However, due to concerns about the abuse of cryptocurrency operations, governments across the world are coming up with regulations aimed at sanitizing the industry.

One such regulation mandates the implementation of a Know Your Customer (KYC) process for those wishing to use crypto agencies for transactional purposes.

Who are the best no-KYC crypto exchanges? Keep reading because that is exactly what this guide seeks to unravel.

What Is KYC?

Know Your Customer or KYC refers to a regulatory compliance requirement in which financial institutions, including cryptocurrency exchanges, verify the identities of their customers.

The requirement is in place to ensure adherence to laws aimed at preventing fraud, such as money laundering and the financing of terrorism, among others.

In the cryptocurrency space, most centralized exchanges implement KYC procedures before allowing users to deposit significant amounts or withdraw funds. This typically requires individuals to undergo biometric capturing and provide information such as:

- Personal data: such as name, birth date, and residential/office address.

- Proof of address: usually from formal documents that contain the user’s address, such as utility bill receipts or statements of account from a bank.

- Government-issued identification: for example, a national identity card, driver’s license, or passport. These not only help to verify identity but also confirm that the user has attained the age required by law to use a crypto exchange.

- Video or selfie: helps verify the individual’s identity and the authenticity of their KYC documents.

In some exchanges, users may be asked to provide additional information, like the source of their funds or the purpose of engaging in crypto transactions. They may also have to disclose if they’ve transacted with other exchanges or wallets in the past.

Once all the necessary information is gathered, the last three steps of a strong KYC process are as follows:

- Screening for sanctions and watchlists: involves searching to see if the user is on any list of those sanctioned by the government. The aim is to ensure they are not participating in illegitimate activities or not under any sanctions.

- Risk assessment: conducted to evaluate the risk profile of the new client and determine the most appropriate activity level for them on the platform. Higher-risk users may have their account transactions and privileges limited. In the UK, new customers must complete and pass a quiz that confirms their understanding of the risks involved in investing in cryptocurrencies.

- Continuous user account monitoring: essential to track any activities deemed suspicious. Any suspicious activity must be reported to the appropriate regulator by the exchange. Failure to do so may attract fines and litigation.

Why People Choose No-KYC Crypto Exchanges

The purpose of implementing KYC is to promote transparency and comply with regulations. However, opting for crypto exchanges that do not demand KYC checks appeals to many traders for a variety of reasons, such as:

- Protection of privacy: Although KYC promotes compliance with regulations, it can raise privacy issues, especially for people looking to take advantage of the decentralized and anonymous nature of the crypto industry. For such people, the KYC process may feel invasive and lead to concerns about potential data breaches.

These concerns are reasonable because there have been cases of data breaches in major platforms in the past.

As a result, users who are worried about privacy violations are increasingly turning to no-KYC exchanges. Such platforms offer them an opportunity to trade without revealing personal information.

- Speed and convenience: Some users tend to see KYC processes as slow or complex. Non-KYC exchanges remove these delays and complexities, allowing customers to begin trading instantly. This appeals to those prioritizing a speedy and convenient signup.

- Circumventing strict regulations: In areas with stringent crypto government regulations and monitoring, no-KYC exchanges enable people to circumvent them, allowing for their participation in global cryptocurrency markets without the worry of regulatory sanctions or penalties.

- Greater accessibility: No-KYC platforms provide participatory opportunities for people in regions bedevilled by limited financial systems, helping those who lack banking access or face geographic barriers to engage with global markets.

Best No-KYC Crypto Exchanges

There are not many top no-KYC crypto exchanges around these days. Most platforms tagged no-KYC exchanges in several reviews are actually KYC-compliant – some are wallets offering no-KYC registration.

However, this article is not about cryptocurrency wallets; instead, it focuses on cryptocurrency exchanges. So here are the few best no-KYC exchanges around:

Margex

Margex is a Seychelles-based decentralized peer to peer crypto exchange created in 2019 by former traders. It features a highly intuitive and user-friendly interface designed with both new and experienced traders in mind.

Currently, Margex serves over 500,000 users and offers traders the chance to trade up to 100x leverage across 153 countries.

All you need to start transacting at Margex is a registration process that doesn’t take more than thirty seconds. The process requires just three things – your name, password, and checking a box that indicates that you live in a country supported by Margex. That’s it—no KYC! After the very brief registration, make a deposit and start trading.

You can quickly buy Bitcoin or other cryptocurrencies on Margex using USD, GBP, EUR, or your local currency. The platform supports various popular methods of payment, including Mastercard, Visa, bank transfers, and Apple Pay.

Its crypto converter makes it easy to swap one coin for another directly within your Margex Wallet with few mouse clicks and no extra fees.

Intending stakers will have to deposit a coin that is eligible for staking and then activate the staking feature on their wallet’s page. Staking USDC or USDT can earn you up to 5%. No limits are placed on withdrawing or trading a client’s staked balance, nor are there predefined limits on how many coins you can stake.

The exchange has a strong security framework featuring multiple layers of protection, all subject to regular audits by both internal and external security experts.

Security measures at Margex include real-time monitoring and alerts for asset movements, two-factor authentication, and SSL encryption. Additionally, all assets are kept in multi-signature offline cold storage, and an access control system minimizes the risk of internal fraud.

Margex also safeguards against price manipulation through its MP Shield, ensuring fair yields on staking pools.

They offer an affiliate program with a fixed commission rate of 40% and daily crypto payments. Their support team is available globally and can assist in multiple languages. You can access Margex on desktop, Android, and iOS devices.

Pros

- User-friendly interface

- Up to 100x leverage

- Live (human) chat support

- Two-factor authentication

- Multiple payment methods

- Offline cold storage

Cons

- Fewer cryptos available compared to some other exchanges

- Not available for US traders

Bisq

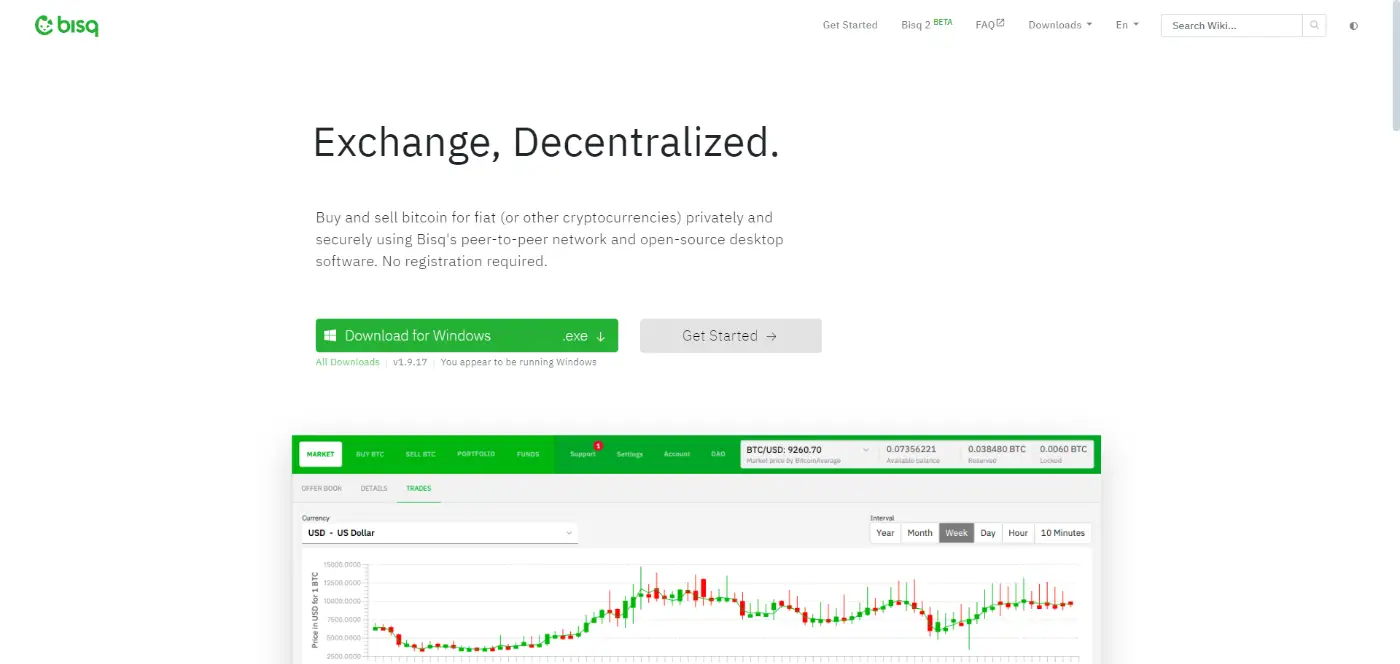

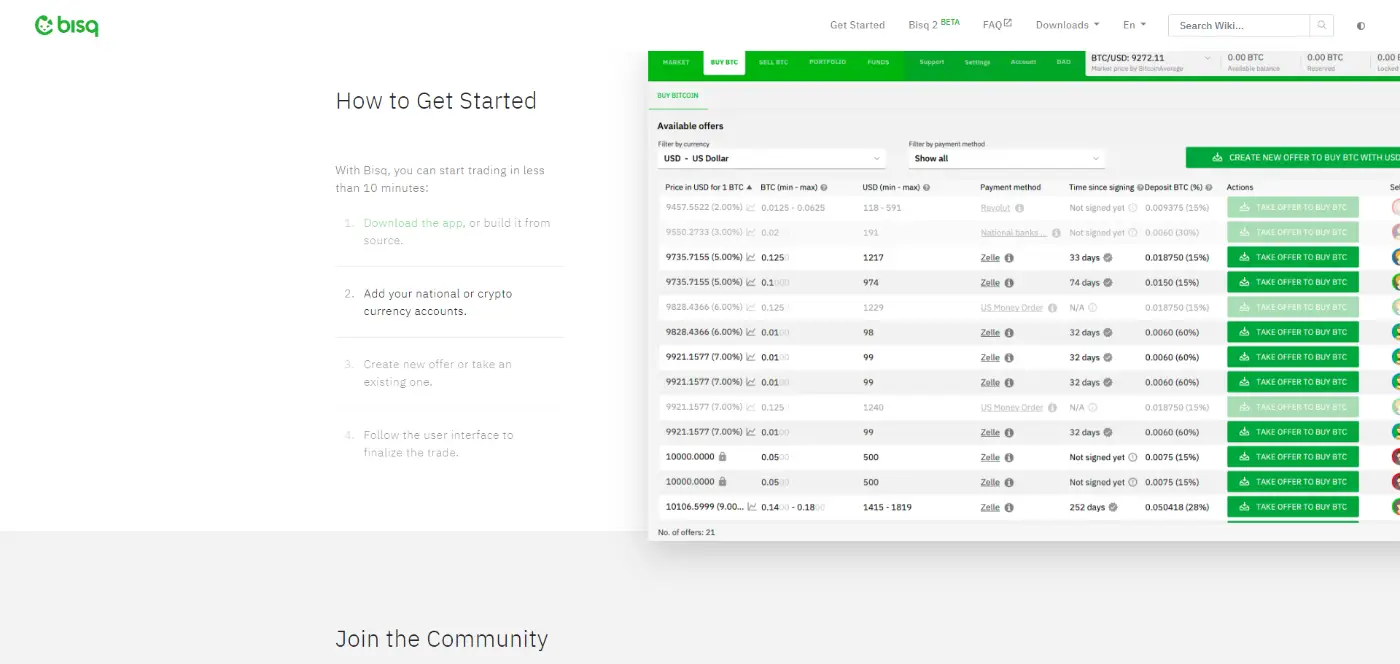

Bisq is a decentralized peer-to-peer network and open-source desktop software that now offers two versions: Bisq 1 and Bisq 2.

Bisq 1 is a robust platform for Bitcoin users looking for a peer-to-peer mechanism to buy and sell crypto while not compromising their privacy, being subjected to KYC verification, or relinquishing control of their Bitcoin.

Launched in April 2016 on the mainnet, Bisq supports various cryptocurrencies for transactions, including ETH, L-BTC, LTC, ZEC, and XMR.

To ensure security, Bisq uses three main mechanisms:

- A 2-of-2 multi-sig address that helps secure all Bitcoin transactions on the protocol.

- Each party to a trade must pay a security deposit to be refunded after the trade is concluded.

- Trading disputes are resolved through a three-tier system involving encrypted end-to-end trader chat encryption, mediation, and arbitration.

For those trading fiat money for Bitcoin, there is usually a risk of chargebacks since fiat transactions are often reversible. Consequently, Bisq allows only payment methods that minimize chargeback risks, which is why options like credit cards and PayPal are excluded.

Another way Bisq has used to check the chargeback risk is via a signing mechanism that enforces a 0.01 BTC buy limit until a buyer’s integrity (rather than their identity) is established.

Despite ongoing improvements to the Bisq interface and protocol as a whole, it was initially designed to support only one trade protocol. With the growth of Bitcoin and Bisq’s user base, there arose a clear need to expand Bisq’s scope, for example, integrating Lightning Network transactions and providing mobile access.

Bisq 2 marks a significant step towards achieving such objectives.

After almost three years of development, the first beta of Bisq 2 was finally launched in March 2024. It was built from scratch to enhance user accessibility and accommodate multiple trading protocols.

Like Bisq 1, it is a decentralized Bitcoin platform through which users can trade Bitcoin for other cryptocurrencies and fiat currencies.

It also prioritizes user privacy, as exemplified by the lack of account verification or KYC requirements. Bisq 2 currently operates on the Tor network and plans to support I2P in the future.

Unlike Bisq 1, which requires a security deposit, trade, and miner fees before buying and selling Bitcoin, Bisq 2 will initially allow users to trade Bitcoin without these costs. In August 2024, it was announced that Bisq 2 had successfully integrated the Lightning Network in its version 2.1.0 update.

This paves the way for speedier and more affordable transactions, thanks to the off-chain capabilities of the Lightning Network.

With the Lightning integration, Bisq 2 is set to become a stronger decentralized exchange market competitor capable of attracting users who value fast and cost-effective transactions.

Apart from adding support for the Lightning Network, the 2.1.0 update features many user-friendly improvements, including a QR code scanner for easier address and invoice entry, reducing the likelihood of errors. There are also enhancements in chat functionalities, boosting communication during trades.

Lastly, Bisq 2.1.0 comes with upgraded activity indicators, which offer a better understanding of user interactions, providing traders with the information clarity needed for strategic decision-making. Bisq has a mobile notifications app that is compatible with iOS and Android devices.

Pros

- Integration with the Lightning Network

- Dispute mediation and arbitration mechanism

- Minimizes chargeback risks

- Supportive user community

Cons

- No dedicated customer service team

- Does not accept credit cards

- No website for trading

OpenPeer

Like Bisq, OpenPeer is also a decentralized open-source, peer-to-peer protocol that allows users to trade fiat money and cryptocurrencies directly with one another, avoiding interference from intermediaries like escrow services.

One of its goals is to create a secure and trustworthy trading environment that enhances the peer-to-peer user experience compared to centralized exchanges. This is why it utilizes decentralized identity and proof of humanity solutions that ensure the preservation of user privacy while also guaranteeing user legitimacy.

It operates on various EVM-compatible blockchains, including Ethereum, Polygon, and BNB Chain. Trades are managed through smart contracts that hold the funds until the transaction is finalized.

While OpenPeer does not require users to complete KYC checks, it highly recommends that they do so with at least one of its partners to increase their chances of having their orders accepted by other traders.

OpenPeer offers low fees by utilizing decentralized relayers to cover what users would have been charged as gas fees. Hence, the exchange can be accessed by users whose wallets only have stablecoins since they won’t need native tokens such as ETH, BNB, and MATIC.

There are no fees for crypto buyers, and sellers are charged only a 0.3% fee. Additionally, OpenPeer does not have any minimum transaction size or fee, making it easier for users interested in trading smaller amounts.

It’s available in 21 countries, including African states Nigeria, South Africa, Kenya, Cameroon and Ghana.

Pros

- Smart contract feature

- Low transaction fees

- No gas fees

- Wide range of payment methods

Cons

- No dedicated customer support team

- Available in much fewer countries compared to some other exchanges

- No info about mobile device support

Challenges Associated With No-KYC Crypto Exchanges

While the appeal of decentralized and private cryptocurrency transactions is strong, it’s essential to consider the associated risks.

No-KYC crypto exchanges provide anonymity, sign-up speed, and convenience, but there are significant dangers that users need to recognize before trading. Below are some of them.

Absence of Regulatory Control And Protection For Consumers

A major risk of no-KYC exchanges is the absence of regulatory oversight and safeguards for consumers. These platforms work outside legal systems, meaning users don’t benefit from the protections found in KYC-compliant exchanges.

In cases of platform failure, hack, or fraud, for example, consumer protection may become a challenge.

At such times, it may be nearly impossible to recover lost crypto assets, especially since there’s no authority to demand accountability from the unregulated exchange.

Higher Fraud Possibility

Exchanges without KYC measures are more vulnerable to scams and other fraudulent practices. Due to the absence of identity checks, bad actors can use fake accounts to access no-KYC exchanges and indulge in illicit activities such as money laundering and phishing.

In a nutshell, the lack of KYC verification can raise the likelihood of dealing with dishonest people or fraudsters on crypto platforms.

Non-Compliance Risks

Cryptocurrency regulations are constantly evolving. For example, KYC checks are now mandatory in the US, UK, and some other countries.

Since laws can quickly change, traders who don’t stay tuned to current regulatory trends in and around their locations may attract unnecessary attention from regulatory organizations aiming to enforce compliance.

Conclusion

Even with the increasing spate of regulations, there are still some no-KYC crypto exchanges that are helping people transact anonymously without worrying about their personal data being compromised.

Though the no-KYC process comes with a number of benefits, it also has some challenges.

The onus is on you, the user, to determine whether you prefer these benefits to the potential costs.

FAQs

Why do some individuals sign up with no-KYC exchanges?

People may choose no-KYC exchanges because of their preference for privacy and anonymous transactions. No-KYC platforms typically do not ask for identities to be verified, enabling transactions without concerns about breach of personal data. Additionally, no-KYC exchanges allow for quicker registration and access, especially for those in countries with strict financial laws.

How does KYC impact decentralization and anonymity?

Ideally, decentralized services should keep users anonymous and ensure that personal information is kept private. However, because of the tendency for abuse, governments are trying to bring cryptocurrency transactions under their regulatory authority. So, despite the implications for decentralization and anonymity, many crypto exchanges have reluctantly started to implement strict KYC policies to avoid being penalized by regulators.

Do crypto wallets require KYC to own?

Whether you need KYC for a crypto wallet depends on the wallet type you choose. Custodial wallets usually require KYC verification because they are managed by crypto exchanges or financial institutions that must follow KYC regulations. In contrast, non-custodial wallets usually do not require KYC, as they allow users to have full control over their private keys and digital assets. However, there are non-custodial wallet services that might still ask for KYC verification if they decide to adopt regulatory measures voluntarily.

Are governments enforcing KYC regulations?

Yes, in some jurisdictions. Take the US for example. Recently, several exchanges that previously did not require KYC processes (such as KuCoin, OKX, and Bitget) have either started implementing them or stopped offering services in the US due to strict regulations affecting cryptocurrency exchanges. With new crypto regulations on the horizon in the US, it is expected that both decentralized and centralized exchanges will adopt even more KYC procedures, such as complying with the Form 1099-DA requirement in the next few years.