With a market cap of more than $1.4 trillion, Bitcoin (BTC) ranks as the most valuable cryptocurrency and by far the most popular. Most new crypto market investors start by buying Bitcoin, listed on most cryptocurrency exchanges.

When you want to buy Bitcoin as a beginner crypto investor, there are notable differences from buying stocks in the traditional market. Moreover, before you consider buying Bitcoin, new investors need to understand that this digital asset can be highly volatile.

The price of BTC can change significantly within a short period. Therefore, one should only buy Bitcoin if one has a high-risk appetite.

- What is Bitcoin?

- Is Bitcoin a Good Buy?

- Portfolio diversification

- A good inflation hedge

- Decentralization

- Technological backing

- Potential for high returns

- How to Buy Bitcoin

- 1. Choosing a Platform to Buy Bitcoin

- 2. Creating an Exchange Account

- 3. Funding Your Exchange Account

- 4. Placing an Order

- 5. Step-by-step Buying Process

- 6. Storing Bitcoin

- Post-Purchase Considerations

- In Summary – How to Buy Bitcoin

- FAQs

If you are ready to buy Bitcoin in 2024, this article is for you. It offers a comprehensive guide into the world of Bitcoin and how you can diversify your portfolio with one of the best-performing assets in 2024.

What is Bitcoin?

Bitcoin is a digital currency that dates back to 2008. To better understand Bitcoin, you should read the whitepaper published by Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

Bitcoin seeks to be a superior form of fiat currency. It runs on its peer-to-peer network to fulfill transactions. Peer-to-peer transactions allow individuals and institutions to trade Bitcoin without using a third party.

Like all cryptocurrencies, Bitcoin runs on distributed ledger technology (DLT) or blockchain. Through blockchain, Bitcoin becomes secure, transparent, and immutable.

Bitcoin is popularly called “digital gold” because of its scarcity. There will only be 21 million coins mined; currently, over 19 million coins are already in supply. New Bitcoins are added to the circulating supply through a process known as “mining.”

By understanding how Bitcoin works, an investor looking to tap this fast-growing world can see why it presents an excellent option to diversify your investment portfolio.

Is Bitcoin a Good Buy?

Buying Bitcoin can be challenging for many because of the myths revolving around Bitcoin over the years. However, the myths unravel as this digital asset enters the mainstream market with endorsement from Wall Street giants such as BlackRock and Fidelity.

If you are looking for a reason to buy Bitcoin in 2024, below are some reasons why it might be a good choice:

Portfolio diversification

By investing in Bitcoin, you can diversify your investment portfolio. While Bitcoin is considered a high-risk asset, it can be a great addition to a portfolio that primarily contains low-risk traditional assets.

Bitcoin does not behave the same as traditional assets like bonds and stocks. For starters, Bitcoin trades 24/7. Moreover, it focuses on the digital asset space, whose popularity has only soared in recent years.

A good inflation hedge

Bitcoin is often touted as a good hedge against inflation. Shortly after the global financial crisis, Nakamoto published the Bitcoin whitepaper in 2008. As such, it was seen by many as an alternative to the traditional financial industry.

Moreover, Bitcoin has a limited supply of only 21 million coins. This feature has seen many compare it to fiat currency, whose supply tends to increase when central banks print more money.

Decentralization

Bitcoin also offers the promise of decentralization. The digital asset lacks a central authority and is also resistant to censorship. The Bitcoin blockchain is open to everyone, and anyone can send BTC peer-to-peer without the authorization of a central authority.

Technological backing

To invest in revolutionary technologies, consider buying Bitcoin. Bitcoin runs on blockchain technology, whose use case expands beyond cryptocurrencies and into areas like supply chain, healthcare, etc.

The Bitcoin blockchain also has a high growth potential. The Lightning Network has increased efficiency and speed and reduced costs for those transacting on the Bitcoin network.

Potential for high returns

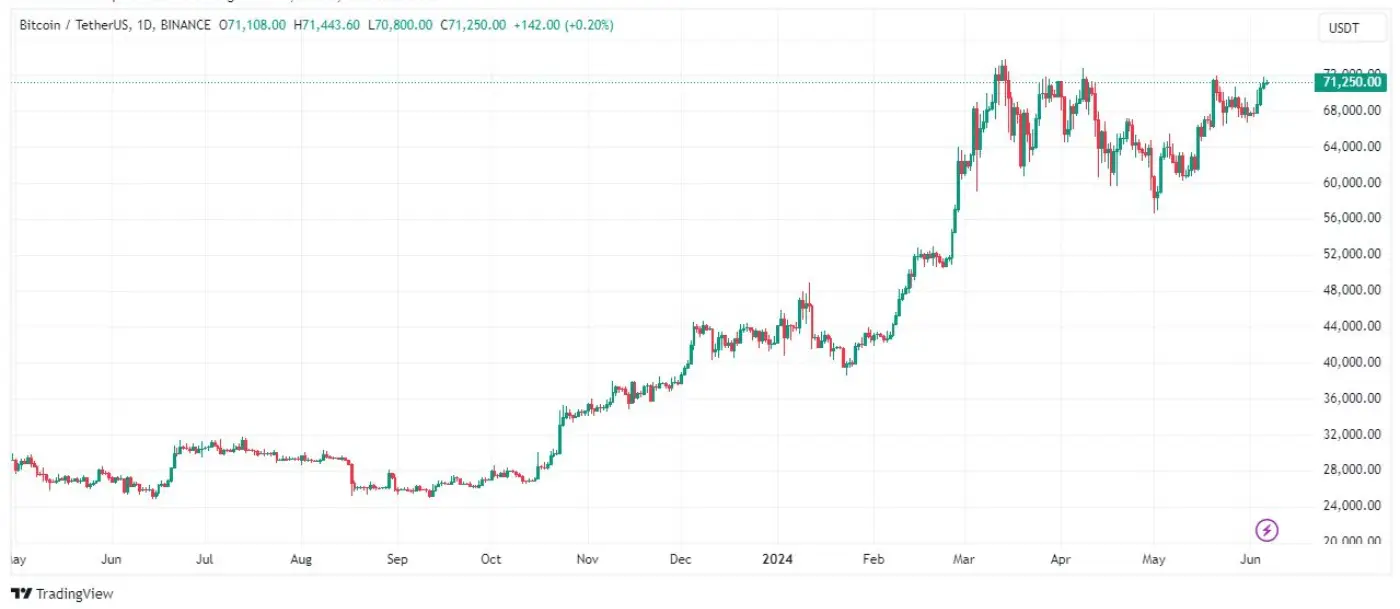

Despite Bitcoin being a high-risk asset, it also has the potential to deliver high returns. Over the years, the price of Bitcoin has grown significantly. The chart below shows that Bitcoin’s price has appreciated by over 175% in the last year.

While Bitcoin can potentially deliver huge returns, the losses can also be as significant. BTC can post double-digit percentage drops in a matter of hours.

How to Buy Bitcoin

Now that we understand that Bitcoin can be a good buy for financial investors let us review the process of buying Bitcoin from a cryptocurrency exchange.

1. Choosing a Platform to Buy Bitcoin

Many cryptocurrency exchanges exist in the market, and as a novice trader, you might need help with the choices. You must consider several factors before picking a cryptocurrency exchange to work with to ensure it best suits your needs. These factors include the following:

User Interface

The user interface is the first thing to consider when choosing a cryptocurrency exchange, especially when you are a beginner. The best cryptocurrency exchange should be easy to use and navigate, making buying and selling Bitcoin easy.

Security

It is also essential to consider the security of a cryptocurrency exchange before using it. Over the years, multiple hacks have happened in the crypto space, including the infamous Mt.Gox hack, where all the Bitcoin belonging to users was stolen.

It is recommended that you assess the reputation of a cryptocurrency exchange. If it has had a history of hacking attacks, it is best to refrain from creating an account and opt for an exchange with a good track record of upholding security.

Supported payment methods

You should also consider whether a cryptocurrency exchange has implemented the payment method you plan on using. You can buy Bitcoin on some exchanges with a debit or credit card. However, on others, the same might not be possible.

Regulations

The regulatory framework around cryptocurrencies and exchanges differs from one jurisdiction to the other. Before you buy Bitcoin from a cryptocurrency exchange, it is recommended that you check whether that exchange is supported in your jurisdiction. You can do so by checking the list of any banned crypto trading platforms on your country’s regulator’s website.

2. Creating an Exchange Account

Once you select an exchange, you are closer to buying Bitcoin. This guide will illustrate buying Bitcoin from one of the largest cryptocurrency exchanges, Binance.

You should note that cryptocurrency exchanges have different interfaces, but in most cases, the process of opening an account is usually the same. Below are the steps to follow to open a cryptocurrency exchange on Binance.

Sign Up with your Email Address or Phone Number

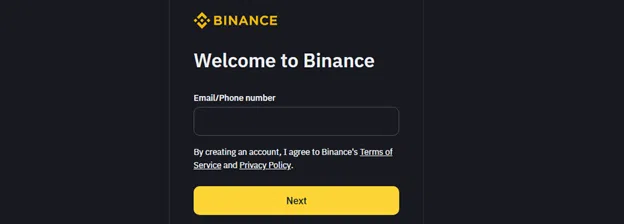

Creating an exchange account is the first step to opening a cryptocurrency exchange platform. To do so, go to the exchange’s official website. Some exchanges, such as Binance, have a mobile application that you can also use to create an account.

Binance typically requires that you provide an email address to create an account on the platform, as shown below.

You should ensure that you use a valid email address. You can also create a Binance account using your Google or Apple ID.

After signing up, an email will be sent to your email address, asking you to verify the account creation. Enter the code provided to proceed with the signup process.

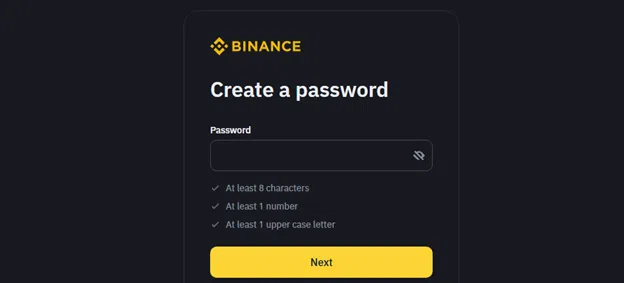

Create a Strong Password

You then have to create a strong password that will keep your digital assets safe and prevent the likelihood of being accessed by an unauthorized individual.

When creating a password to secure your account, you must ensure it is strong and not something another person can easily guess.

If someone referred you to Binance, you will get a prompt to enter the referral ID so they can be eligible for a reward. You will get this prompt after setting a password for your account.

Verify Your Account

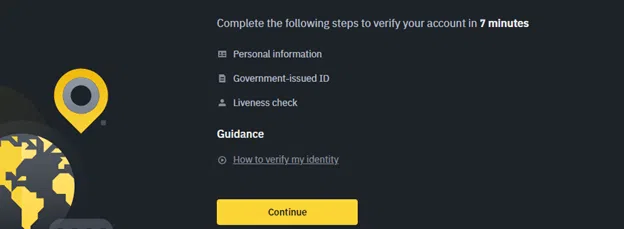

After creating your account, you then have to verify your identity. Cryptocurrency exchanges are required to comply with anti-money laundering (AML) and counter-terrorism financing (CFT) laws. By verifying your identity, these exchanges will determine whether you are a high-risk client.

Binance will check when you provide your personally identifiable information to see whether you are on any sanctions or terrorism watch list. The process helps to keep all customers on the platform safe.

To verify your information on Binance, you must submit your full name and address and upload a government-issued document such as a national ID.

When providing your information, ensure that it matches what is entailed in your national ID card or passport. You will also have to do a liveness check that involves taking a real-time image of yourself to verify that you are the same person whose image appears in the submitted document.

The Binance verification process is swift, but in some cases, it might take several hours for all the submitted details to be verified and confirmed.

3. Funding Your Exchange Account

After verifying your account, it is time to fund it and start trading Bitcoin. Binance offers several ways to fund your account, including the following:

Depositing Crypto

If you already own other crypto assets in a hardware or software wallet, you can transfer them to Binance and trade those assets for Bitcoin.

Depositing crypto to exchange requires you to get the Bitcoin deposit address for your Binance account, which you will use to receive money from your wallet.

If you are a beginner trader with zero experience with wallet addresses, you should be careful when depositing crypto with this method, as the wrong wallet address will lead to a loss of funds.

P2P Trading

This is the easiest way for you to buy Bitcoin from Binance. Binance operates a peer-to-peer marketplace where users transact crypto amongst themselves.

To buy crypto via P2P, find the P2P section on the Binance website or app. Customize your P2P platform to show your local currency and traders in your country. You also have to set a payment method that you will use to transact with your peers.

When buying crypto using P2P trading, you are advised to only transact with verified users. You should also check for bad reviews about a trader to avoid losing funds.

Bank Deposit

You can also make a bank deposit to Binance. To do so, you must deposit fiat to your Binance account, which you will use later to buy Bitcoin. Not all banks support transactions with Binance. Therefore, you should first check with your bank.

4. Placing an Order

Once you have funds in your account, go to the Binance “search” icon at the top of the website or mobile app and search for Bitcoin or BTC. You will have to choose a trading pair, which, in our case, we will select as the BTC/USDT trading pair. USDT is a stablecoin whose value is pegged to $1.

Once you are on the Bitcoin trading page on Binance, you will be greeted with a video that will educate you on the spots to follow to make spot trades on Binance. You will also get to see the spot price of Bitcoin and a chart showing you its performance in the past hours, days, or months.

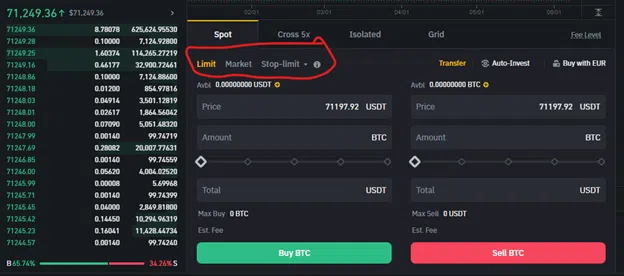

The Binance order page gives you three types of orders to choose from, as shown below:

A buy limit order is fulfilled when Bitcoin drops to or below a specified price. For instance, if you place a buy limit order at $71,100 when Bitcoin trades at $71,200, the order will only execute when the BTC price drops to $71,100 or lower.

A market order is when you buy Bitcoin instantly at the best available market price. This type of order is fulfilled instantly at the prevailing price of BTC.

Lastly, the buy stop-limit order is used to buy Bitcoin at a specified price or better. However, it will only be fulfilled after BTC’s market price hits a specified stop price.

5. Step-by-step Buying Process

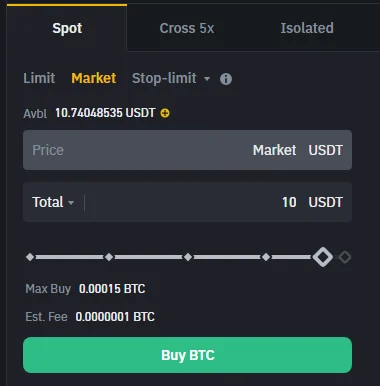

Below is the step-by-step process of buying Bitcoin on Binance using a market order and USDT stablecoin. Enter the amount of USDT you want to spend. You can buy Bitcoin on Binance for as low as $10, as seen below:

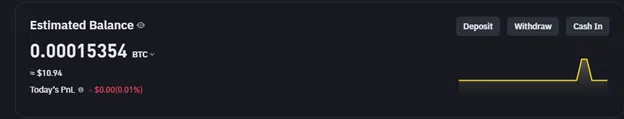

A market order will be fulfilled instantly. Therefore, as soon as you press the “Buy BTC” button, head over to the user dashboard, and the amount of Bitcoin you have bought will be reflected on your account, as shown below.

6. Storing Bitcoin

You can choose to store Bitcoin on your crypto exchange account. However, given the rampant cases of hacks on exchanges and bankruptcies such as the infamous FTX exchange, it is best to store Bitcoin in an external wallet and not on an exchange.

You can choose between a software or hardware wallet when storing Bitcoin in a wallet. Software wallets will store your coins online, while a hardware wallet will store your BTC offline.

Awareness of the growing risk of hacking attacks and the loss of Bitcoin is vital. Therefore, you should always have your passwords stored safely and securely. One should also follow best internet practices, such as robust anti-malware programs.

Post-Purchase Considerations

After you buy Bitcoin on Binance, you need to consider the following factors to become a proactive trader. With these considerations in mind, you will lower the price volatility risk.

Monitor Your Investment

You should constantly monitor your crypto investment by tracking price changes. The price of Bitcoin rarely stays at one level for long. Therefore, if you are a frequent trader, failing to track the price changes can cause unprecedented losses or lead to missing out on profits.

Understand the Regulatory Framework

The crypto regulatory framework is changing globally, and keeping up with these changes is vital to ensuring compliance. You should also keep up with the tax laws in your country to understand how much you might be required to pay on gains made on your investment.

Continuous Education

One should also be willing to learn and explore the industry constantly. One can learn about this space by researching and looking for educative articles. Some of the platforms that one can use to learn more include X (Twitter), educative websites, and video platforms.

In Summary – How to Buy Bitcoin

Bitcoin is the largest digital asset globally. It ranks among the top-performing assets globally in the last few years. If one wants to buy Bitcoin, one can do so easily using a cryptocurrency exchange, a platform where one can buy and sell Bitcoin.

The process of buying Bitcoin is relatively straightforward. After creating an exchange account, one can deposit fiat or crypto to the exchange and later buy Bitcoin. Afterward, one can store the assets in a cryptocurrency wallet.

After making your purchase decision, monitor your crypto investment regularly for price changes. One should also seek to understand the crypto regulatory framework in their jurisdiction and be willing to learn about the sector continuously.

FAQs

-

What is Bitcoin?

Bitcoin is the largest and the oldest cryptocurrency. It has a market cap of over $1.4 trillion, ranking it among the top-performing financial assets.

-

Where can I buy Bitcoin?

One can buy Bitcoin on a cryptocurrency exchange. A crypto exchange is like a brokerage account where you can trade BTC.

-

How do I fund my account on a cryptocurrency exchange?

One can fund their crypto exchange account using an existing crypto wallet, bank account, credit card, or debit card. Some exchanges also support P2P trading.

-

What are the risks involved in buying Bitcoin?

Bitcoin is a highly volatile asset. The price of this digital asset can change drastically, causing significant losses.

-

Can I buy a fraction of a Bitcoin?

Yes. Buying a fraction of a Bitcoin, known as a satoshi, is possible. With as little as $10, you can become a Bitcoin owner.