Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, has lined up Nasdaq as a strategic investor as it prepares to go public in New York this week, Reuters reported on Sept. 9, citing people briefed on the matter.

According to the report, the share sale could raise up to $317 million, with Nasdaq expected to buy about $50 million of stock in a private placement at the time of the offering.

Gemini plans to trade under the ticker symbol “GEMI.”

The arrangement is more than financial and Nasdaq’s stake will be paired with a partnership giving its institutional clients access to Gemini’s custody and staking products. In return, Gemini customers will be able to use Nasdaq’s Calypso platform to track and manage collateral.

Neither Nasdaq nor Gemini commented on the details. Reuters noted that the exchange’s plans could still shift depending on market conditions.

Riding a Rebound in Listings

The offering comes as U.S. equity markets show renewed demand for new deals, with tech and crypto-related companies drawing strong investor interest. A successful debut would make Gemini the third publicly traded exchange after Coinbase and Bullish.

Gemini currently holds about $21 billion in client assets and has processed more than $285 billion in trading volume. Its business spans retail and institutional services, an over-the-counter desk, a credit card and trading in major tokens including Bitcoin, Ethereum and stablecoins.

Financially, the company reported a net loss of $282.5 million on $68.6 million in revenue for the first half of 2025, widening from a $41.4 million loss a year earlier.

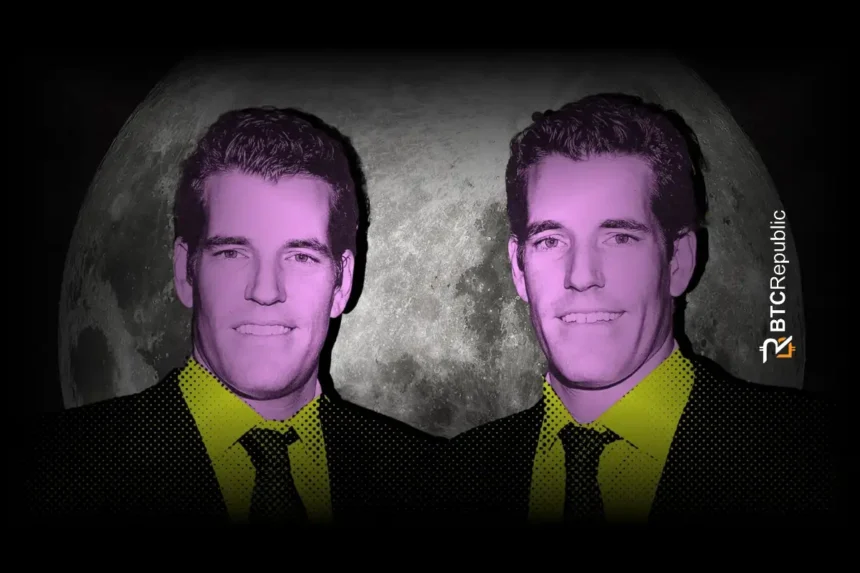

The Winklevoss twins, who first rose to prominence through their legal battle with Facebook, invested heavily in Bitcoin in the early 2010s and became known as the “Bitcoin twins.” Their bid to take Gemini public is testament to how deeply digital assets are now tied to Wall Street.

A Sign of Renewed IPO Momentum

This IPO comes as part of a wider rebound in U.S. equity capital markets, where firms like Figma and Firefly Aerospace have recently delivered strong first-day performances. The crypto sector, too, has been active, with companies like Circle and Bullish seeing institutional demand for their IPOs.

Should it proceed as planned, Gemini will become the third crypto exchange to go public, joining Coinbase, which is now part of the S&P 500, and Bullish.

Expanding Footprint in Europe

Beyond the U.S. market, Gemini is also making significant strides in European expansion. The company recently introduced a range of offerings to serve over 400 million investors across the EU and EEA.

New services include:

- Staking for Ether and Solana, offering yields up to 6 percent APR, daily reward accrual, and no minimum deposit.

- Gemini Perpetuals, a regulated derivatives product allowing up to 100x leverage and no expiration dates, operating under MiFID II guidelines.

Both offerings are compliant with European regulations, such as MiCA for staking via Gemini’s Malta-based entity.

Gemini’s European CEO, Mark Jennings, emphasized, “With MiCA, the region can set the global benchmark for clear, consistent crypto rules.” He added that Europe remains a strategic priority for the company’s global roadmap.

Tokenization Push from Nasdaq

This investment also aligns with Nasdaq’s recent push into tokenized securities. The exchange has filed with the SEC to update its rules to allow tokenized stock trading on its platforms. Nasdaq has criticized “siloed” overseas platforms offering tokenized U.S. equities and argued that such innovations belong on regulated exchanges.

Gemini had already ventured into this space earlier, launching tokenized shares in Europe, including stocks like MicroStrategy (MSTR).