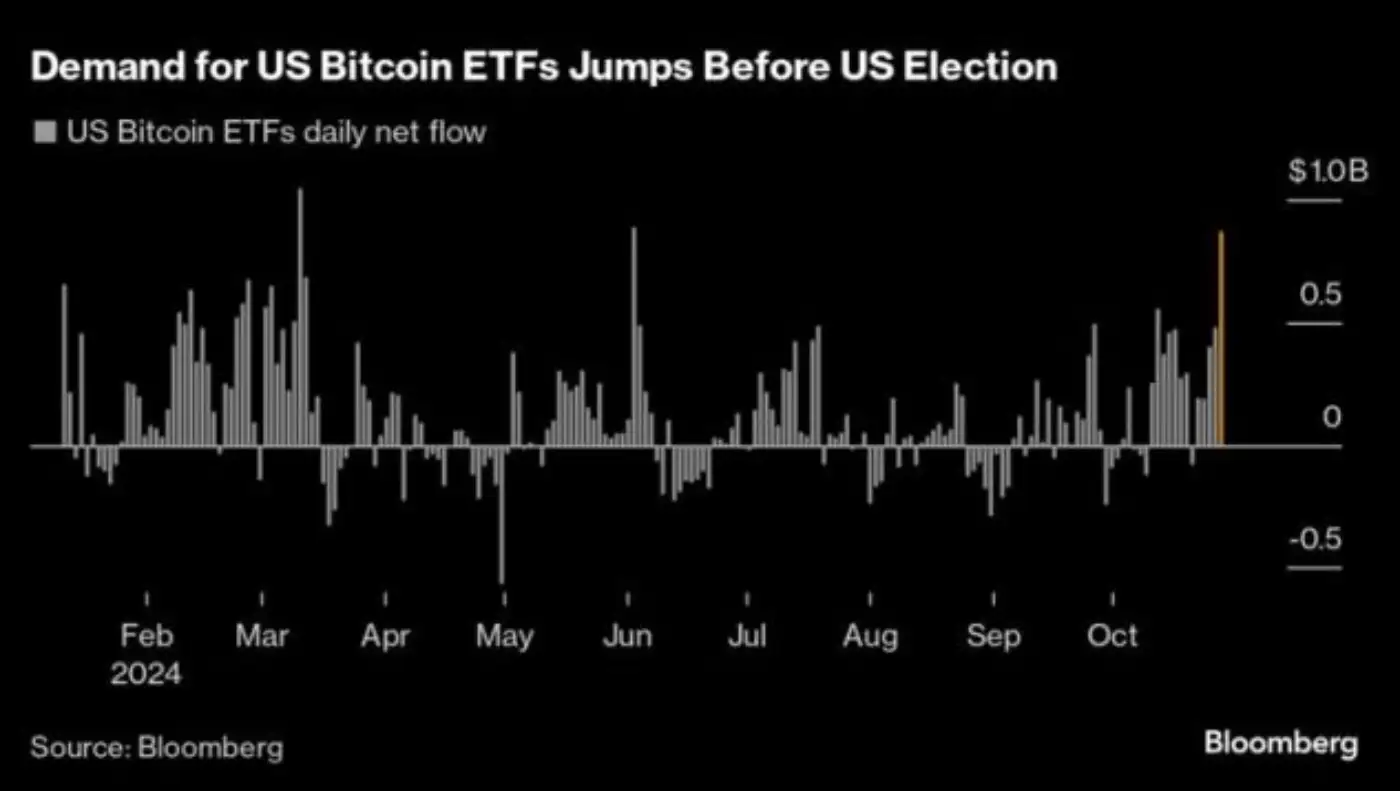

The US spot Bitcoin exchange-traded funds (ETFs) saw an inflow of about $870M on Tuesday, October 29, from the group of 12 funds issuers. This is the ETFs’ third-highest daily haul.

Tuesday’s inflow lifted year-to-date inflows for the 12 issuers to over $23B. This significant increase in inflows coincides with Bitcoin’s surge toward a record high amidst speculation about the potential outcome of the November 5 US election.

US Spot Bitcoin ETFs Hit Record Net Inflows Of $870 Million On Tuesday

On Wednesday, October 29, 2024, Bloomberg data showed that the US spot Bitcoin ETFs hit record net inflows of $870M on Tuesday, October 28. The inflows marked the highest single-day surge since June and the third-highest daily inflow since the US spot Bitcoin ETFs went live in January.

The data further revealed that the total subscriptions in the 12 ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, have exceeded $23B altogether.

BlackRock’s IBIT led the train with $629M inflows, followed by Fidelity, Bitwise, Grayscale, and VanEck with significant contributions.

Fidelity’s FBTC recorded an inflow of $133M, Bitwise’s BITB recorded $52M, Grayscale’s mini Bitcoin trust (BTC) recorded $29M, VanEck’s HODL recorded $16M, and Ark’s ARKB recorded $12M.

Only Grayscale’s Bitcoin Trust (GBTC) recorded net outflows at $17M.

Total trading volumes rose beyond $4.75B, which is the highest since March, with BlackRock’s IBIT accounting for $3.3B alone, according to SoSoValue.

High inflows into an ETF are a measure of investor confidence or interest in the underlying asset. While inflows may not directly cause the ETF’s underlying assets to increase in value, the buying pressure can lead to a price jump in the near term due to supply and demand dynamics and increased sentiment among traders.

Bitcoin Teases Record High Near $74,000

The increase in ETF demand came as Bitcoin surged toward a record high amidst speculation about the potential outcome of the November 5 US election.

Yesterday, the price of the world’s largest cryptocurrency, Bitcoin (BTC), soared 3%, extending seven-day gains to 7.7%. Currently, Bitcoin is teasing close to its all-time high (ATH) of $74K, trading at $72,196.12 at press time, according to Tradingview data.

The last time Bitcoin was close to its all-time peak record was in March, when it reached $73,798, having seen an increase of 73% this year.

Impact Of The US Elections

Is the increase in Bitcoin’s price fueled by pre-election market volatility expectations?

Some analysts, including Geoff Kendrick of Standard Chartered Bank, have predicted that the price of Bitcoin could rise to about $73K on US Election Day, November 5, 2024, if Donald Trump wins the election.

Geoff added that there is a potential that Bitcoin could hit $125K by the end of the year, provided Republicans sweep Congress. In contrast, he stated that Bitcoin may hit $75K record levels by the end of 2024 if VP Kamala Harris wins the presidential election.

Bitcoin may be flirting with these high prices amid speculation and uncertainty due to the forthcoming US elections.