President Donald J. Trump signed the GENIUS Act into law on July 18, 2025, emphasizing its role in positioning the United States as a global leader in digital assets.

The GENIUS Act, hailed as historic, is anticipated to drive stablecoin issuance and attract institutional investment, reshaping digital currency landscapes.

US Crypto Leadership Enhanced by GENIUS Act

President Trump signed the GENIUS Act on July 18, aiming to position the United States as a global crypto leader. This legislation creates the first federal framework for stablecoins, focusing on 100% reserve backing and strict consumer protection measures.

The legislation, called the GENIUS Act, is the first major law governing digital currency, and establishes a regulatory framework for the $250 billion stablecoin market.

Stablecoins are viewed as a relatively safe type of cryptocurrency since their value is pegged to other assets, like the dollar. The bill passed the House on Thursday with the support of 206 Republicans and 102 Democrats.

The fate of the GENIUS Act was in question earlier this week when a dozen conservatives stymied a procedural vote. A compromise was ultimately reached, and the holdouts allowed the legislation to proceed.

The president on Friday suggested that he spoke to the holdouts individually on the phone to persuade them, after House Speaker Mike Johnson told him there were a dozen Republicans opposing the bill.

Stablecoin regulation will now be required under federal law, mandating transparent reserve disclosures and enhanced consumer safeguards. These measures aim to bolster confidence in the U.S. digital asset market, potentially increasing institutional participation and stablecoin adoption.

The GENIUS Act will make America the undisputed leader in digital assets, bringing massive investment and innovation to our country.

Despite the significance, notable figures from the crypto community have yet to publicly respond.

What is the GENIUS Act?

The GENIUS Act (which stands for Guiding and Establishing National Innovation for U.S. Stablecoins) establishes guardrails and consumer protections for stablecoins. The bill also creates a legal category for stablecoins and establishes clear boundaries for which digital currencies could be referred to as stablecoins.

With the GENIUS Act signed into law, banks, nonbanks and credit unions can dive into the market by issuing their own stablecoins.

Along with being less volatile than other virtual currencies, stablecoins can facilitate faster, lower-cost financial transactions, supporters of the technology say.

Before the Senate vote on the Genius Act in June, Sen. Bill Hagerty of Tennessee, the bill’s sponsor, said stablecoins could allow businesses and consumers to settle payments “nearly instantaneously,” rather than taking weeks.

Market Stability and Expert Insights on GENIUS Act’s Impact

Did you know? The GENIUS Act parallels European initiatives like MiCA, setting a precedent for centralized stablecoin regulation—an unprecedented move in U.S. history.

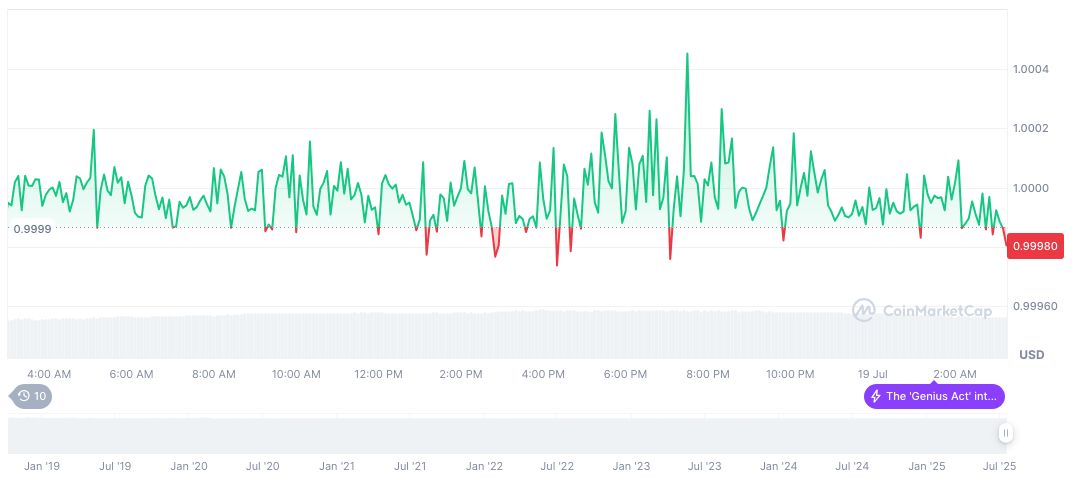

USDC remains stable, currently priced at $1.00, with a market cap of $64.79 billion and a 24-hour trading volume of $22.54 billion. The coin shows minor price changes over 90 days, as reported by CoinMarketCap on July 19.

Insights from industry experts suggest that the GENIUS Act may increase legitimate stablecoin supply, enhancing liquidity in U.S. markets. Historical parallels suggest improved regulatory clarity often leads to broader institutional involvement and adoption.