Tron founder Justin Sun has announced a $1 billion fund that will go towards combating fear, uncertainty, and doubt (FUD) as the cryptocurrency market reeled from intense losses on Monday.

In the last 24 hours alone, the global crypto market cap has dropped by 18% to around $1.8 billion. Most, if not all, cryptos are trading in the red zone today.

The recent downtrend has been attributed to multiple factors including a crash in global stocks and selling activity by the Jump Crypto trading firm. Sun is now looking to fight such market FUD using a $1 billion fund.

Justin Sun Announces $1B Crypto Fund to Fight FUD

Sun, also the founder of the HTX crypto exchange has announced that the $1 billion fund will not only combat FUD but also bolster investments in the crypto industry and improve liquidity.

The industry pundit noted that the cryptocurrency industry had witnessed significant growth over the past year. However, the recent price fluctuation demonstrated a need to fight manipulative tactics that usually inhibit price performance.

The crypto industry is facing a “Black Monday” event that has seen most cryptos tank to multi-month lows. Bitcoin is down 18% in the last 24 hours to trade at $50,022 at the time of writing.

Ether has also dropped by 23% to around $2,215, while BNB is down 21% to around $419. Solana and XRP have also dropped by 22% and 19% respectively in the last 24 hours.

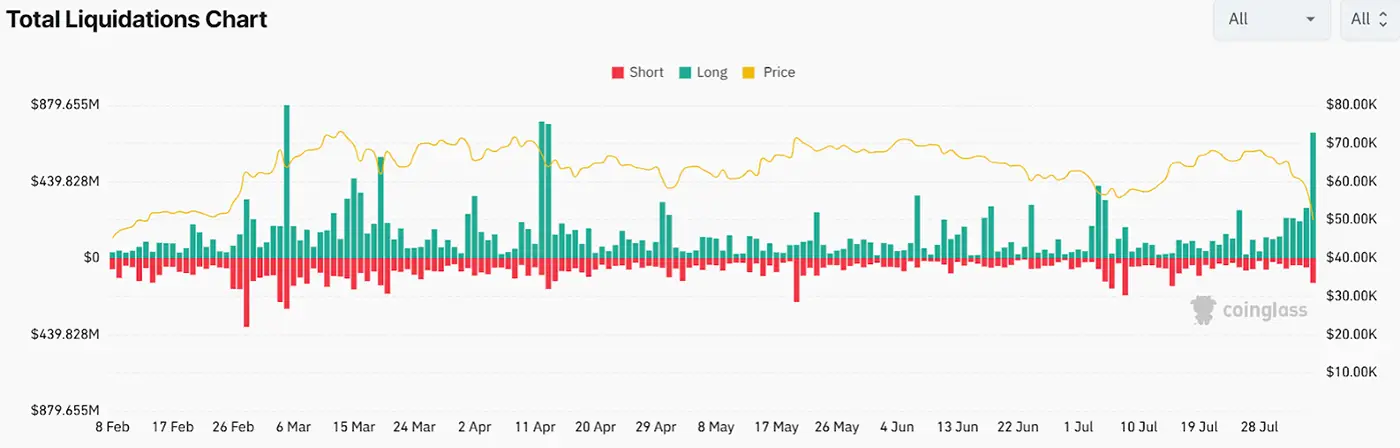

The recent price drop has triggered a bloodbath in the crypto futures market. Data from Coinglass shows that $1.18 billion in both long and short positions has been liquidated from the crypto market in the last 24 hours.

The liquidation chart also shows that traders with leveraged longs are taking the most beating as prices continue dropping lower.

Report Links Market Dip To Jump Crypto

The recent drop in crypto prices has been linked to crypto trading firm Jump Crypto. According to QCP Group, Jump Crypto transferred hundreds of millions of dollars worth of cryptocurrencies to exchanges fuelling fears of a potential selloff.

“The immediate trigger in crypto seems to have been aggressive ETH selling from Jump Trading and Paradigm VC. The move was probably exacerbated by market makers scrambling to cut short gamma as front-end ETH volumes spiked more than 30% to 120%,” the report said.

The selling behavior by Jump Crypto comes amid reports that the US Commodities and Futures Trading Commission (CFTC) was investigating the trading firm. The probe led to the company’s president, Kanav Kariya, stepping down from his position.