The British Columbia Securities Commission (BCSC) has pointed out a fraud committed by the crypto exchange ezBtc.

According to the Commission, the Canadian crypto exchange and its founder diverted millions of customers’ funds for personal use. Their actions led to heavy losses for the investors.

A panel has already been set to investigate the founder of the exchange, David Smillie, for misappropriating about 13 million Canadian dollars from customers’ funds.

David was accused of using the money for gambling. The BCSC also discovered that ezBtc used the money invested in cryptocurrency “for their purpose”.

ezBtc Misappropriated 935.46 Bitcoin

Before it was completely dissolved in 2022, ezBtc claimed it stored customers’ crypto investments in cold storage. In September 2019, the platform went offline permanently before shutting down in 2022.

The company operated from 2016 to 2019, gaining 2,300 Bitcoins during that period. However, it was discovered that the company misappropriated 159 Ether and 935.46 Bitcoin for personal use and gambling.

The Commission stated that the funds were transferred to David’s exchange accounts from the eZBtc account. The Commission added that the accused diverted the 935.46 Bitcoin to FotuneJack and ClouBet accounts.

The transfers were done sometimes directly to David’s exchange accounts while at other times they were done indirectly to his accounts or gambling sites.

According to the panel, the deceit from David and his company led to a significant loss as customers were unable to withdraw their funds.

The court ruling states that the accused will face sanctions from September 24, and the fine will range from bans on market participation to monetary sanctions.

ezBtc and David’s representatives were not present during the hearing, but a lawyer represented the funder.

The Canadian Crypto Space Is Still Facing Some Issues

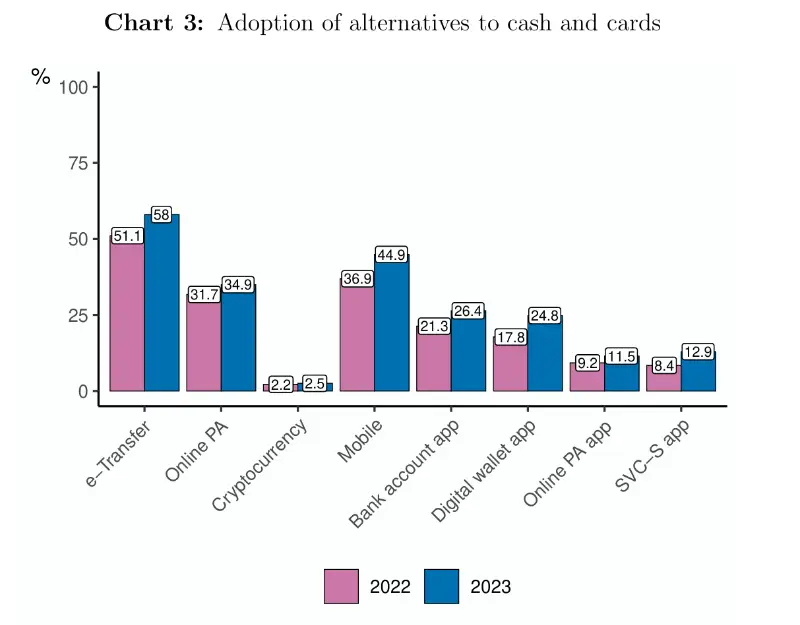

The ezBtc issue could once again impact the adoption of cryptocurrency in Canada. For the past two years, crypto adoption in Canada has stalled.

A recent report revealed that only 3% of the Canadian population is using Bitcoin or other types of crypto assets for daily payments. They are more interested in the conventional payment methods – cash and card payments.

Many of them are more familiar with e-transact, a payment option that utilizes phone numbers or email addresses when transferring money.

There has been a general reluctance to use crypto assets for payments in Canada, as many prefer cash transactions. This has slowed the adoption of cryptocurrency payments in Canada.