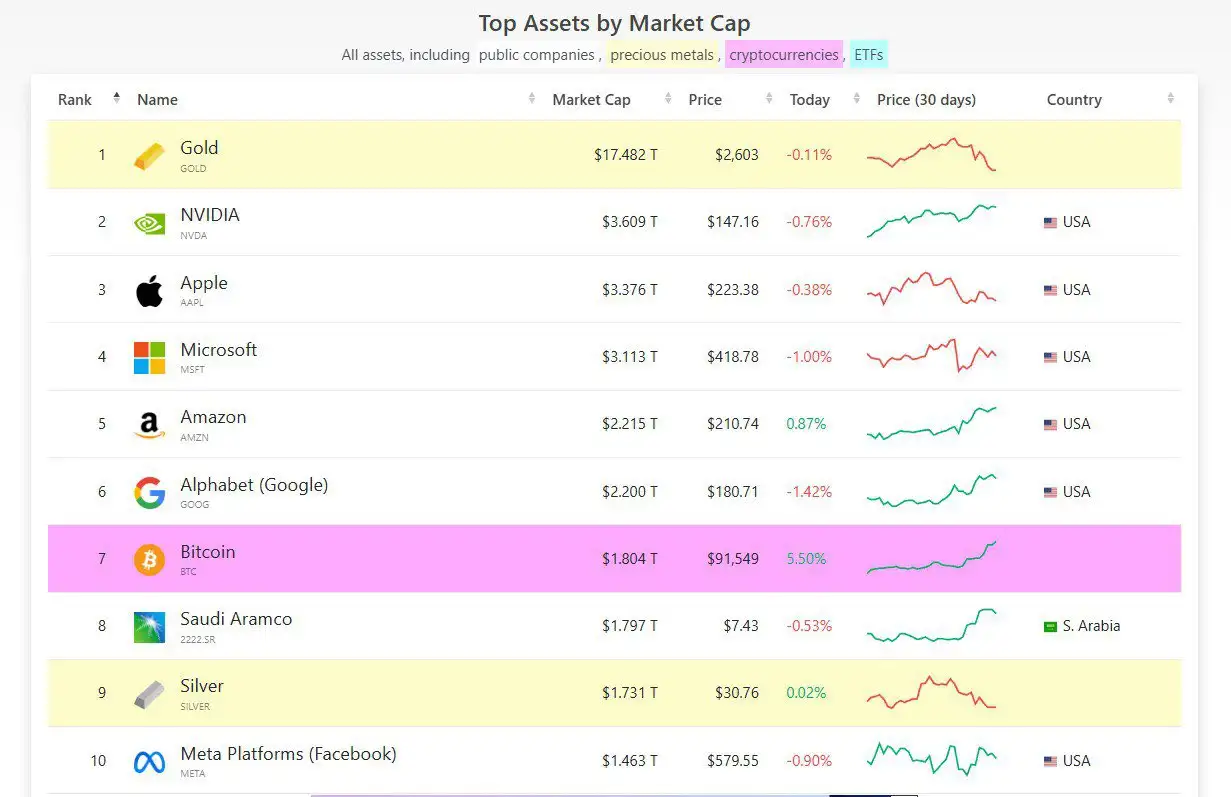

Bitcoin (BTC), the leading crypto asset by market capitalization, has surpassed Saudi Aramco by market cap to become the world’s 7th largest asset officially.

Currently, Bitcoin has a market cap of $1.81T, while Saudi Aramco, the current sixth largest firm in the world has a market cap of $1.79T.

This is coming shortly after Bitcoin’s price hits $93k, according to data from Tradingview.

Bitcoin (BTC) Surpassed Saudi Aramco To Become The World’s 7th Largest Asset

According to a recent X post by WatcherGuru, Bitcoin has overtaken Saudi Aramco, the popular oil giant, to become the 7th largest asset in the world by market cap.

Bitcoin now has a market capitalization of $1.81T, which is slightly higher than that of Saudi Aramco at a $1.79T valuation.

Currently, the largest cryptocurrency trails only behind Gold and popular tech giants like Nvidia, Apple, Microsoft, Amazon, and Alphabet in terms of market cap.

According to Tradingview, Bitcoin has surged over 23% to $91,348 since last week, possibly triggered by Donald Trump’s election victory and optimism surrounding a more crypto-friendly US government.

With this impressive growth, there are expectations that Bitcoin could continue to surge in market cap to surpass more firms.

Bitcoin’s Continuous Winnings

Earlier this week, it was reported that Bitcoin overtook Silver, with a market cap of $1.726T, which highlighted its rise in the global asset rankings.

Aside from Silver, Bitcoin also surpassed major firms like Meta Platforms ($1.472T), Tesla ($1.123T), and even Warren Berkshire Hathaway ($1.007T) by market caps.

2024 has been a big year for Bitcoin. The token became the first to experience crypto-based exchange-traded funds (ETFs) in the US. Since then, Bitcoin has enjoyed an increasing institutional investment interest.

The 2024 US presidential election was another game changer for Bitcoin, especially with the involvement of Trump, who would soon be the first pro-Bitcoin US president.

All of these have positively driven the price of Bitcoin to new highs as the crypto witnessed a new all-time high of $93,477 on Wednesday, November 13.

Prediction Come True

Prior to the US election, there were several predictions that Bitcoin would positively react to the election turnout.

A notable prediction was that of Geoff Kendrick, an analyst at the Standard Chartered Bank. He predicted that the price of Bitcoin could rise to about $73K on US election day if Donald Trump wins the election.

Although Bitcoin traded just below $69K on November 5, the crypto has since risen far above $73K and is currently soaring close to $100k amid exuberance around Trump’s victory.

If everything goes as predicted, Trump’s recent victory and the prospects of a pro-cryptocurrency government might be the beginning for Bitcoin bulls.