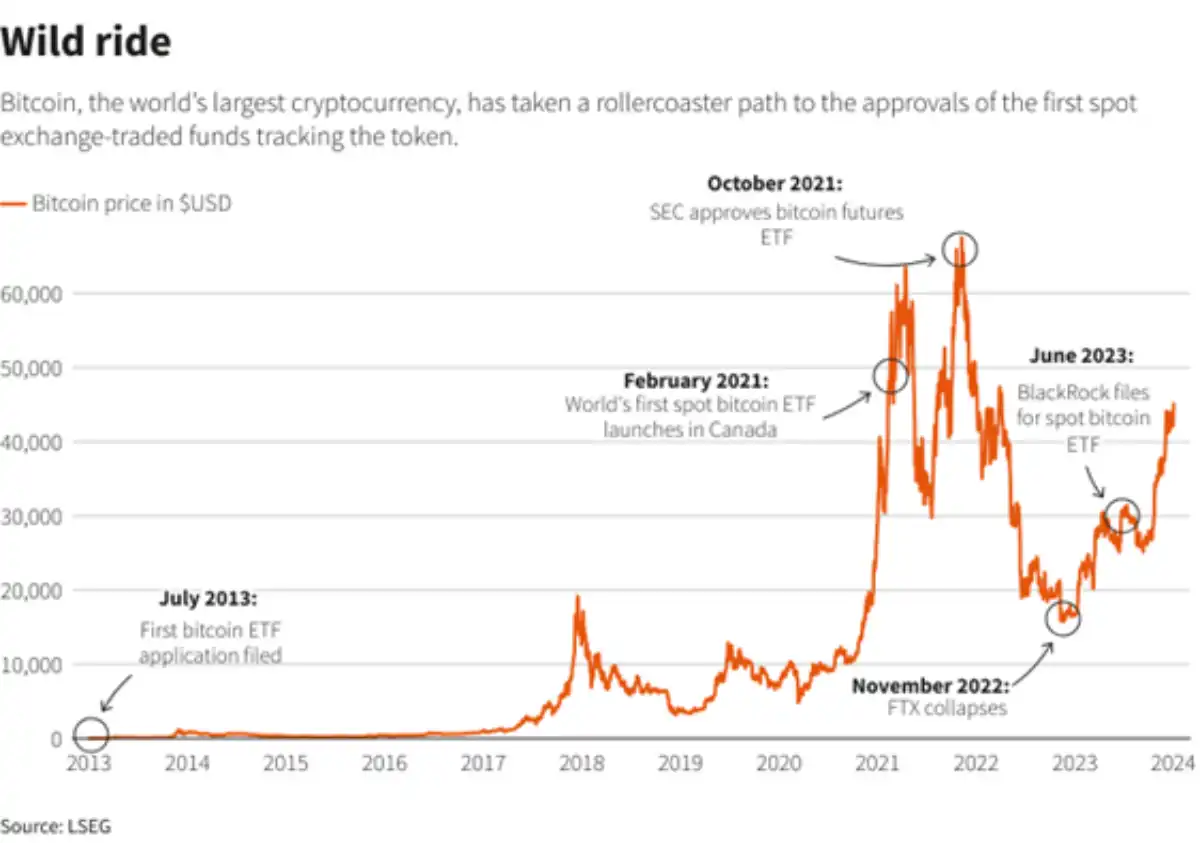

On Wednesday, January 10, 2024, the United States Securities and Exchange Commission (SEC) approved the first 11 Bitcoin spot exchange-traded funds (ETFs) in the U.S. that track the price of Bitcoin. Although Bitcoin futures ETFs have been trading on the Cboe Exchange since 2021.

This was a major victory for the cryptocurrency industry, which has been yearning for almost a decade for the launch of such a product.

The Bitcoin ETF approval in the U.S. triggered a significant transformation, especially among investors who saw the approval as a more accessible and regulated means of tapping into Bitcoin’s price moves.

BTCRepublic walks you through what you need to know about the Bitcoin ETF approval and what it means for investors and Bitcoin itself.

Quick Fact

- Event: The U.S. SEC approved the first 11 Bitcoin spot exchange-traded fund (ETFs) that track the price of Bitcoin.

- Date: Wednesday, January 10, 2024

- Impact: The approval gave crypto investors increased ways to gain exposure to Bitcoin, which they can now hold through existing financial instruments.

- Reaction: Expected major inflows of capital into the market, as a result of portfolio diversification.

Unlocking the Potential of Spot Bitcoin ETF Investments

The U.S. SEC gave the green light to the first batch of spot bitcoin ETFs to come out of the country on January 10, 2024.

The approved ETFs included BlackRock, Invesco, Fidelity, Grayscale, and Ark Invest. The approval paved the way for these funds to begin trading and marked a massive step for Bitcoin (BTC). Also, it unlocked potential for investors.

For instance, investors now have more ways to gain exposure to Bitcoin apart from just holding it directly. Investors can now hold Bitcoin via existing financial instruments trading on regulated stock exchanges.

To better understand what BTC ETF approval meant for investors, it is key to know what the BTC ETF is.

What is a Bitcoin ETF?

In simple terms, an exchange-traded fund (ETF) is an investment fund that tracks the performance of an underlying asset or a specific group of assets, such as commodities, bonds, or stocks.

In the case of a Bitcoin ETF, this investment fund tracks the price of Bitcoin. Its value rises when Bitcoin increases in price, or falls when the price decreases.

A Bitcoin ETF enables investors to get exposure to the value of Bitcoin without directly owning it. Similar to individual stocks, it is traded on traditional stock exchanges.

So, what does a BTC ETF Mean for Investors?

Foremost, the approval of a spot Bitcoin ETF in the U.S. exposes investors to the legitimacy of Bitcoin. That means Bitcoin is no longer considered scammy, infamous, or shady, and it could be added to mainstream portfolios.

The approval significantly changed Bitcoin’s perception among the mainstream public, increasing its credibility and genuineness as an ‘asset class’.

After all, the U.S. SEC wouldn’t approve anything detrimental to investors. Now, a wide audience of people and institutions – even those with little experience in crypto trading – can buy/sell BTC.

More so, BTC ETFs make it much easier for investors to own Bitcoin. Retirement planners can now include it in employer-sponsored 401(k) plans. Big institutional fund managers can now add it to their investment funds.

Investors no longer need to rely on a vulnerable piece of hardware for storage – a Bitcoin wallet. Also, retail investors need not worry about the difference between “cold” and “hot” wallets to store their Bitcoins.

All they need to do is just buy a BTC ETF from one of the many regulated asset managers that are set to go live with their own ETFs.

According to Kevin de Patoul, co-founder and CEO of Keyrock, during a CNBC interview,

This ETF has two main impacts: increased distribution in the US (a moderate impact, as there have been ETFs outside of the US for years) and increased credibility of crypto as an ‘asset class’ (a very high impact).

Timo Lehes, co-founder of Swarm Markets, also mentioned that,

The approval of a Bitcoin ETF has huge implications for US investors because they can now hold crypto in their brokerage account, which they couldn’t do before.

Lehes added that,

This gives the green light for portfolio diversification into the asset, and we expect major inflows of capital into the market, as a result.

Vijay Ayyar, vice president of international markets for CoinDCX, stated that,

[The Bitcoin ETF approval] mark a key moment in the maturity of the crypto asset class.

He added that,

Mass retail now has an easy, safe way to gain exposure to the asset class through their brokerage account.

Future Outlook

The BTC ETF’s approval is expected to accelerate market adoption and foster the development of regulated crypto-related products offered by trusted and reputable firms.

Also, since the approval extends far beyond national borders, it signals a move toward global recognition and adoption of BTC.

Lastly, the underlying asset, Bitcoin, is highly volatile and speculative. Hence, investors should be cautious and wary about the risks and market manipulation associated with Bitcoin.

As seen already, the approval triggered a domino effect, which led to increased investor interest and capital inflow into Bitcoin. This drove a price surge for the crypto and revolutionized the crypto market in general.

Frequently Asked Questions (FAQs)

What exactly is a Bitcoin Exchange-traded Fund (ETF)?

A Bitcoin ETF is a financial product that tracks the performance of Bitcoin. It enables investors to gain exposure to Bitcoin without directly buying, holding, or managing the crypto itself. It offers the familiarity of trading Bitcoin but within regulated markets.

How does a Spot Bitcoin ETF work?

A Bitcoin ETF works by holding Bitcoin as its underlying asset. The value of the fund mirrors the price of Bitcoin. That is, its value rises when Bitcoin increases in price, or falls when the price decreases.

Why is a Bitcoin ETF appealing to first-time investors?

A Bitcoin ETF eliminates the complexities, intimidations, and risks associated with investing in Bitcoin directly, especially for beginners. Also, it eliminated the technicalities and needs for managing crypto wallets, keeping private keys, and navigating crypto exchanges. Finally, Bitcoin ETFs are transparent and regulated. What a peace of mind to cautious investors.

Are there risks involved in investing in Bitcoin ETFs?

Yes, there is a level of risk involved in investing in Bitcoin ETFs, just like any other investment. BTC ETF tracks the price of Bitcoin. Hence, its value rises when Bitcoin increases in price, or falls when the price decreases. Since Bitcoin is very volatile, its price fluctuations can affect the value of the ETF.