The world’s largest asset manager BlackRock (NYSE: BLK) is planning to tokenize exchange-traded funds (ETFs) following the success of its Bitcoin ETF, Bloomberg reported on Sep. 11.

Sources familiar with the matter told the publication that the Wall Street giant is exploring ways to make ETFs available as tokens on a blockchain. The firm is working toward tokenizing ETFs tied to real-world assets (RWAs) like stocks.

In simple words, tokenization refers to the process of using blockchain technology to convert RWAs like stocks, U.S. Treasuries, real estate, etc. into tradable tokens.

Tokenization not only digitizes assets but also makes them fractional and accessible assets available for 24/7 trading.

If BlackRock’s plan goes through, it means its ETFs, which trade only during limited hours on weekdays, will be available for 24/7 trading across the globe.

The firm isn’t new to blockchain-based financial products such as cryptocurrencies and tokens.

In 2024, the New York-based firm launched a spot Bitcoin ETF (IBIT) and a tokenized money market fund (BUIDL). Both are among the most successful digital funds launched by a Wall Street player so far.

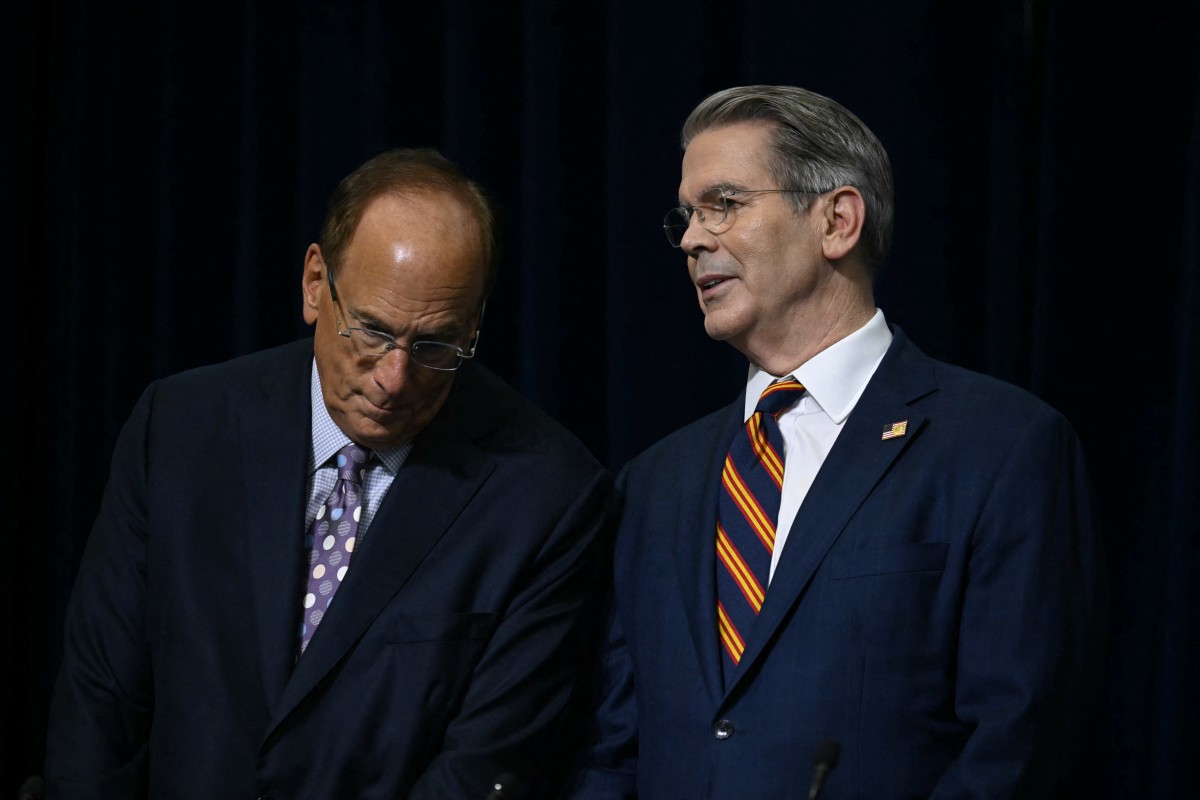

BlackRock CEO Larry Fink also believes that every financial asset can be tokenized.

Crypto-focused exchanges like Kraken and Robinhood (Nasdaq: HOOD) already offer tokenized stocks. But it would mark a revolutionary step for BlackRock which is steeped in the TradFi ethos.

The latest development comes amidst Nasdaq filing a proposal with the Securities and Exchange Commission (SEC) to let tokenized equities and exchange-traded products (ETPs) to be traded on its main market.