Patrick Witt, the newly appointed cryptocurrency czar under President Trump, commits to advancing U.S. crypto policy and stablecoin legislation following Bo Hines’ transition to Tether.

His focus on Senate crypto market structure legislation, the GENIUS stablecoin law, and a U.S. crypto reserve could reshape regulatory landscapes, potentially affecting Bitcoin and stablecoins.

Patrick Witt Prioritizes Stablecoin Legislation and Bipartisan Support

Patrick Witt has been appointed as the US President’s cryptocurrency czar, following the tenure of Bo Hines. Witt, now stepping in as a key figure for the Trump administration, aims to intensify efforts in finalizing US cryptocurrency policy.

The initiatives involve finalizing Senate market structure legislation and implementing the GENIUS stablecoin law. A federal cryptocurrency reserve is also under consideration to enhance national financial strategies and stabilize the digital asset market.

Market reactions and responses from key lawmakers indicate a push for bipartisan support. Witt’s statement, emphasizing continued efforts in policy execution, highlights the administration’s commitment:

Work will not stop and all initiatives are being fully implemented.

GENIUS Law’s Influence on Bitcoin and Crypto Reserve

Did you know? The GENIUS stablecoin law, if passed, could mark a significant shift similar to the first regulatory framework for digital assets introduced in the US, setting precedents for other countries.

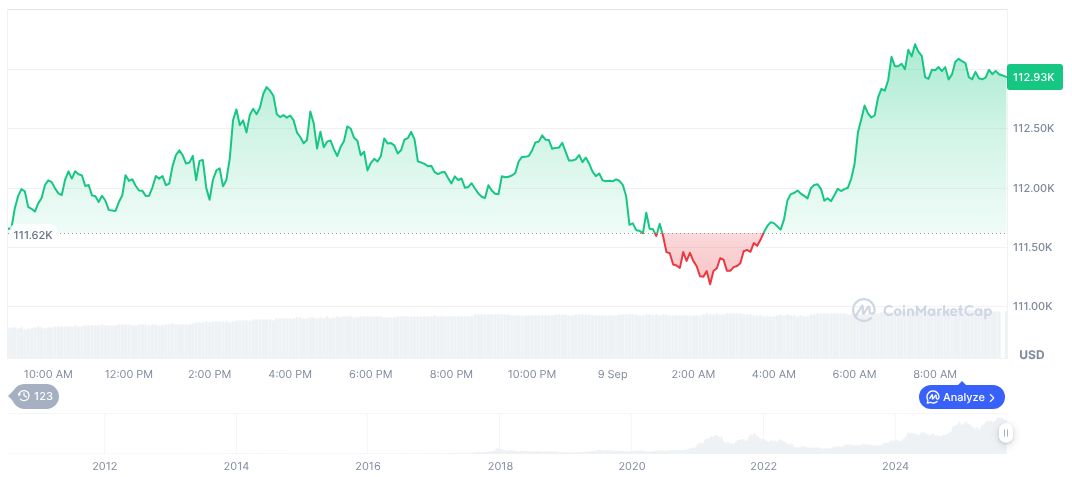

Bitcoin (BTC) is trading at $112,719.75 as per CoinMarketCap data. With a market cap of $2.25 trillion and a 24-hour trading volume of $43.44 billion, BTC shows a price increase of 0.55% in 24-hours. Circulating supply stands at 19,918,400.

Insights from the BTCRepublic research team suggest that the push for clear regulation in the stablecoin sector could stabilize the market. The potential establishment of a federal crypto reserve may influence Bitcoin’s role as a reserve asset.