In recent weeks, crypto prices, notably those of Bitcoin and Ethereum have soared to unprecedented levels. For instance, both BTC reached record-breaking highs of USD99,645 and USD4,878, respectively, this November.

BTCRepublic has covered the latest Bitcoin price surge earlier.

Curve Finance Riding The Price Surge Wave

This price surge has been nothing but good news to those operating in the decentralized finance (DeFi) space. One such operator, Curve Finance, has particularly been reaping handsomely from this latest crypto price phenomenon.

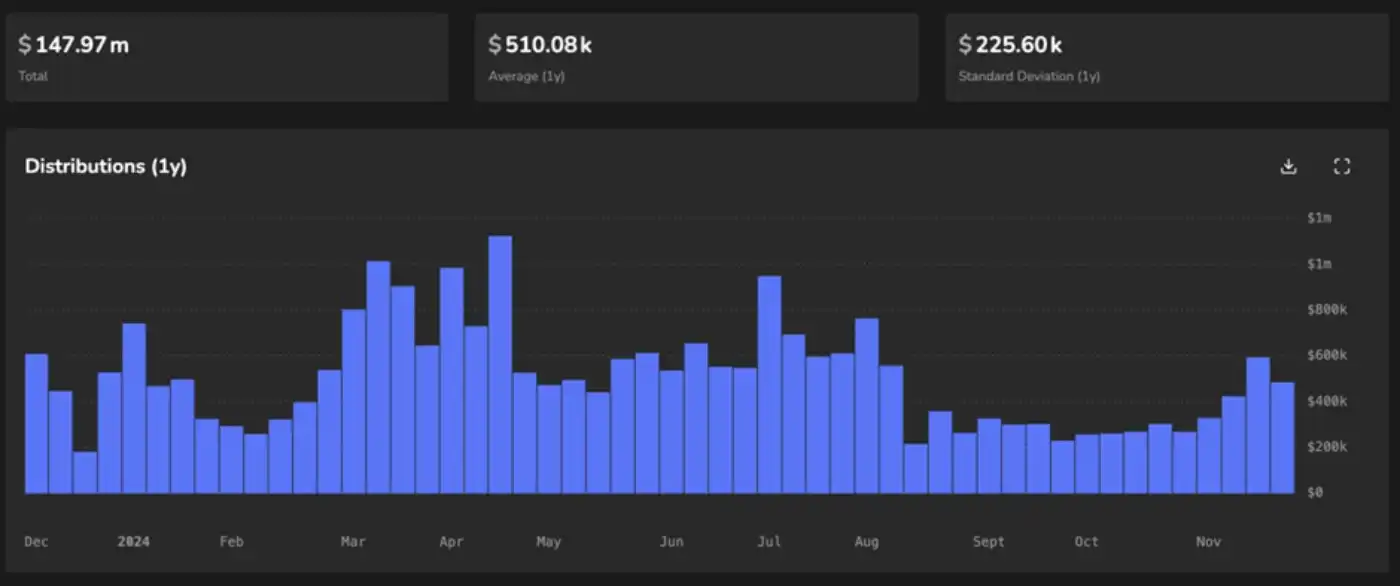

Within the last one month, the company, which focuses on trading stablecoins, has seen its weekly earnings nearly double.

In addition, its veCRV token attracted inflows amounting to USD484,000 as of the end of November, up from the USD268,000 recorded around the same time in October.

Furthermore, CurveDAO shareholders have received roughly USD36 million as their annualized revenue for the current period.

Growth Also Aided By The Launch Of A New Coin In November

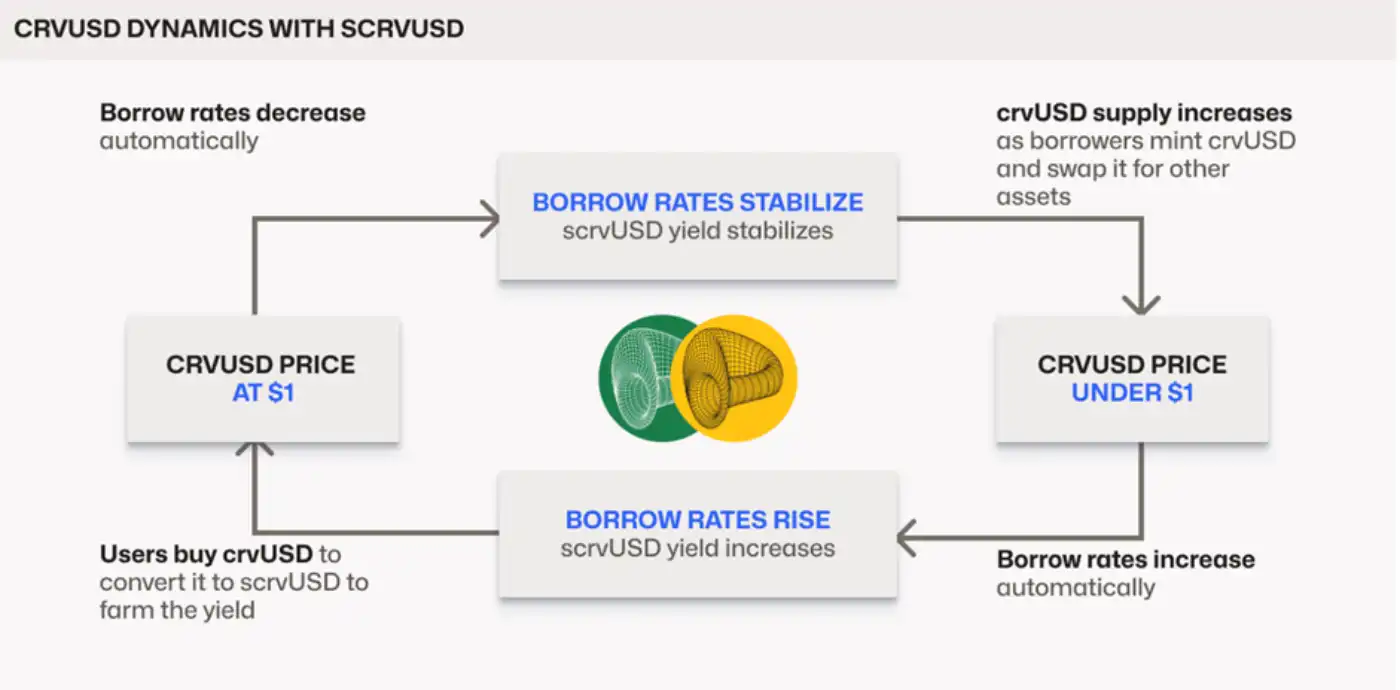

Apart from the favorable crypto-price rise scenario, other factors have also aided this uptick in Curve Finance’s fortunes. These include a higher leveraged financing demand and the launch of “Savings-crvUSD,” or “scrvUSD,” a decentralized yield-bearing stablecoin, on November 13, 2024.

Since it was introduced, scrvUSD has brought in almost $14.5 million from those searching for income opportunities that are low-risk and secure.

ScrvUSD differs from conventional yield farming in that it ensures liquidity and safety by preventing the re-hypothecation of depositor funds.

The implication of this is that funds can be redeemed by their depositors whenever they choose to. This has boosted the reputation of scrvUSD in terms of being a reliable DeFi passive income option.

A Curve Finance spokesperson declared that “this growth aligns with the broader optimism in the market following the recent U.S. elections.

The anticipation of pro-crypto policies under Donald Trump’s administration has strengthened market confidence, driving crypto prices as well as the demand for products like crvUSD.”

These recent gains are further strengthened by current efforts by CurveDAO to improve scrvUSD parameters further through the ecosystem’s governance mechanism.

The platform hopes that constant improvements will positively impact demand for crvUSD and eventually make it the industry’s top stablecoin while also positioning Curve Finance as a DeFi leader.