Over 600 Bitcoin ATMs were shut down all over the world in just two months. The US recorded the most shutdowns.

About 600 Bitcoin ATMs Went Offline Globally In Q3 2024

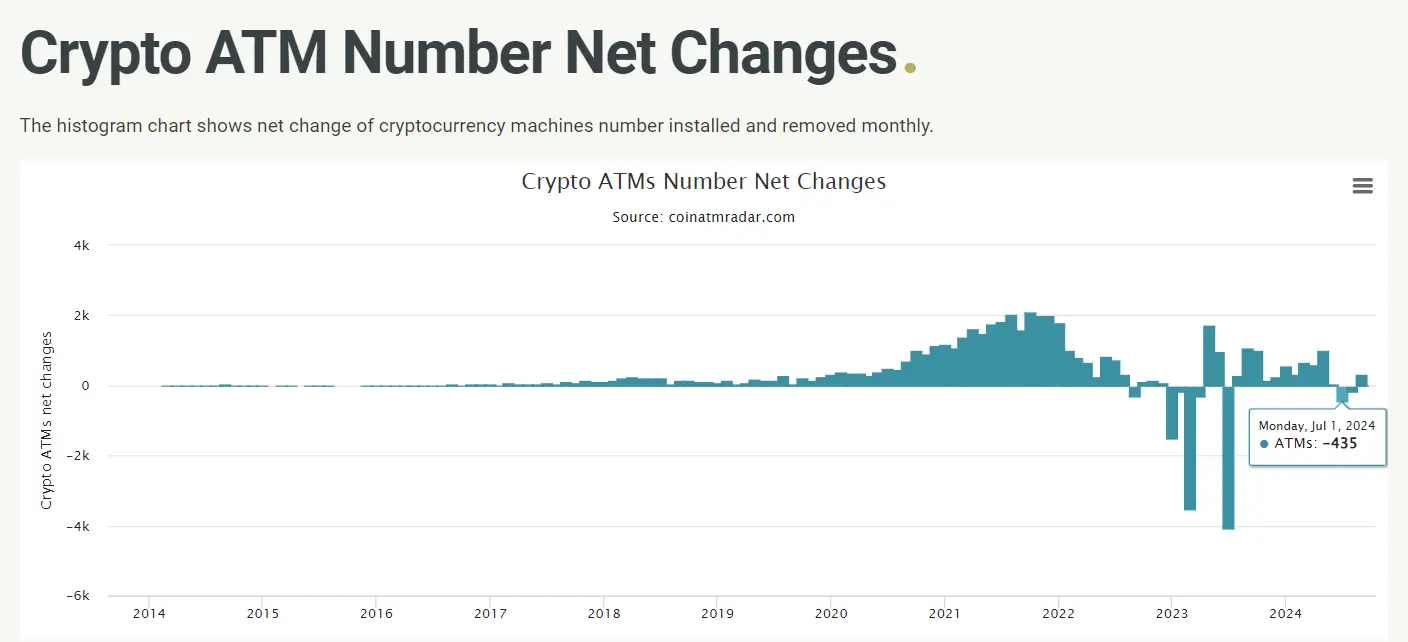

According to data from Coin ATM Radar, over 600 Bitcoin automated teller machines (ATMs) either went offline or were shut down worldwide in the first two months of 2024 third quarter (Q3).

Bitcoin ATMs are similar to regular cash ATMs but only allow the purchase of crypto assets using credit/debit cards.

As of September 5, 2024, there are over 38,500 active crypto ATMs globally, as suggested by the data from Coin ATM Radar.

The data shows that globally, 435 Bitcoin ATMs went offline in July, while 182 Bitcoin ATMs went offline in August.

The US saw the largest number of Bitcoin ATMs shutdowns, totaling 411. The US alone shut down 258 Bitcoin ATMs during Q3 2024.

The reason why the US has the highest number of shutdowns is due to the activities of law enforcement authorities.

The US Federal Trade Commission (FTC) announced that scams and extortion relating to Bitcoin ATMs increased tenfold since 2020. The scammers took advantage of the rapid and anonymous nature of crypto transactions.

To curb the scams of Bitcoin ATMs, the US authorities have taken the step of shutting down the BTC ATMs within the country.

The global Bitcoin ATM network revealed that both the US and Canada together hold about 91% of the global Bitcoin ATMs.

Aside from the US, Germany and Singapore are also opposed to Bitcoin ATMs.

Recently, Germany began a crackdown on cryptocurrency ATMs, while the Singaporean government does not permit them at all.

Singapore’s ban on crypto ATMs is a part of the Monetary Authority of Singapore’s broad effort to regulate crypto promotions to the public.

While the US is clamping down on crypto ATMs, California is taking a different and optimistic stance. On August 7, a committee was set up in Chico, California, to address how crypto ATMs can be regulated in the region.

Another county in California, the County of Butte, is proposing a way to regulate crypto ATMs like banks.

Increase In Crypto ATM Scams

Data from the FTC shows that the total losses from crypto ATM scams and extortion were over $110M in 2023, and the most vulnerable people are those between the ages of 60 and above.

The most common crypto scam involves the scammer persuading their victim with fake promises to transfer funds via crypto ATMs.

Out of the over 38,500 crypto ATMs worldwide, about 28,691, which amounts to 74% of the total crypto ATMs worldwide, are controlled by the top 10 operators.

One of the operators, Bitcoin Depot, which has about 8512 crypto ATMs (~22% of the total crypto ATMs), stated that it constantly warns its users against potential scams on its kiosks and via screen prompts.