Today, Friday, November 15, 2024, marks the expiration of another Bitcoin and Ethereum options contracts with a very large notional value.

About 38,500 Bitcoin and 189,000 Ethereum options contracts will expire today, and this could have a bigger impact on the cryptocurrency market.

But the question is, “Will the crypto market bounce back afterwards?”

$3.4B Bitcoin And Ethereum Options Contracts Expires Today. Will The Cryptocurrency Markets Be Affected?

Another big Bitcoin options expiry event is due today. Crypto enthusiasts are much concerned about its potential impact on the cryptocurrency market considering that the market has been surging recently.

About 38,500 Bitcoin (BTC) options contracts, with a notional value of about $3.4B, will soon expire.

Although the Bitcoin options contracts expiring today have a very large notional value, the value is similar in magnitude to last week’s, where the crypto market maintained its buoyancy and uprising.

However, some crypto analysts are very concerned and have cautioned that a correction should be expected following the largest rally for about eight months.

The put/call ratio for the expiring Bitcoin options contracts is 0.84, indicating slightly more calls or long contracts sold than puts (short) expiries.

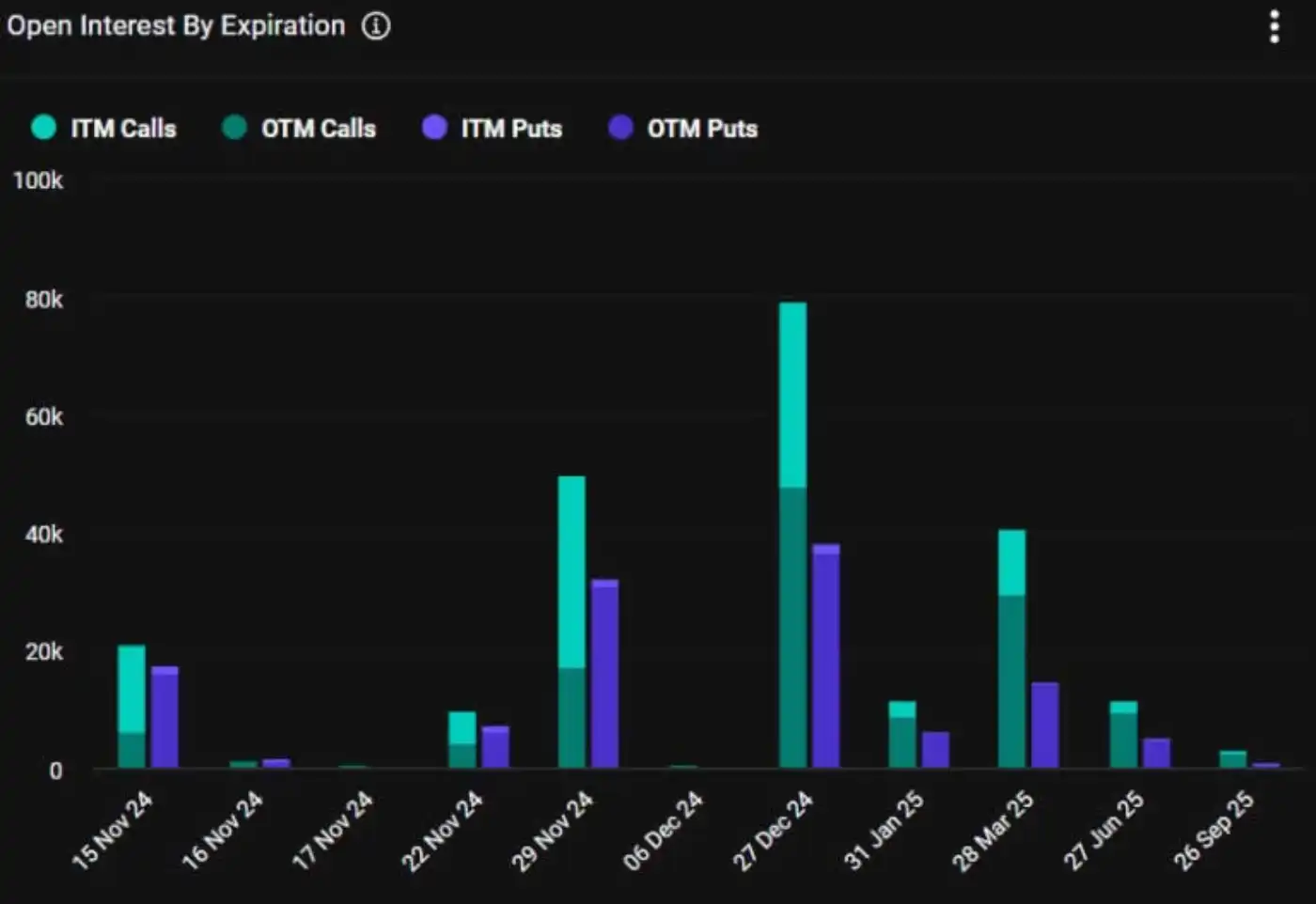

However, there is still a lot of open interest (OI) at the $80K, $90K, and $100K strike prices, which are all within the realms of possibility following this week’s pump.

For context, open interest (OI) is the number (value) of open options contracts that are yet to expire.

Earlier this week, Greeks Live, a popular cryptocurrency derivatives provider, mentioned in an X post that crypto market sentiment has not reached the peak FOMO.

He stated that

Options investors are still tentative to build positions, and 90,000 and 100,000 piled up a large number of options positions.

He added that if BTC breaks through $100K it is

Very likely to cause FOMO in the options market, which will trigger a surge in IV (implied volatility).

On the other hand, about 189,000 Ethereum (ETH) options contracts will expire today, in addition to the expiring Bitcoin options.

The Ethereum (ETH) option contracts have a notional value of $582M and a put/call ratio of 0.92. Altogether, the combined notional value of today’s expiring Bitcoin and Ethereum options is about $4B.

Block Scholes, an institutional-grade research and analytics platform, mentioned in its weekly cryptocurrency derivatives recap that,

Both Bitcoin and Ethereum now benefit from a powerful combination of spot price gains and robust bullish derivatives activity, signaling strong demand to participate in further upside potential.

Brief Crypto Markets Analysis

Although the crypto market has been doing well for some days now partly due to Trump’s election victory, towards the end of the week, the market slightly retreated, shedding about 3.3% of its total capitalization. Nevertheless, the total market cap is still above $3T.

Bitcoin, the largest crypto by market cap, dropped by 2% to close to $87K before slightly recovering marginally in the early hour of Friday. At press time, Bitcoin is trading at about $87,600, according to data from Tradingview.

Ethereum faced harder corrections, dipping by over 4% and currently trading at slightly over $3K.