Spot Ethereum exchange-traded funds (ETFs) saw outflows of $107 million on the first day of trading after much hype around the products.

These ETFs went live on July 23 after the US Securities and Exchange Commission (SEC) approved S-1 registration statements. The launch came nearly seven months after spot Bitcoin ETFs debuted in the US.

With these products being the first spot altcoin ETFs in the US, the launch has been met with much enthusiasm from the market, believing they will help bring the crypto market mainstream.

Spot Ethereum ETFs Post $107M Inflows On First Day

The first day of trading for spot Ether ETFs was a notable success after these products amassed $112 million in trading volumes within the first 15 minutes.

After around 90 minutes, these ETFs posted total volumes of $361 million. According to Bloomberg ETF strategic Eric Balchunas, the performance of the ETF within the first few hours saw it outperform normal ETF launches.

The total figures from the first day of trading saw these spot Ether ETFs generate $1.08 billion in cumulative trading volumes. The volumes were around 23% of the $4.5 billion generated by spot Bitcoin ETFs on the first day.

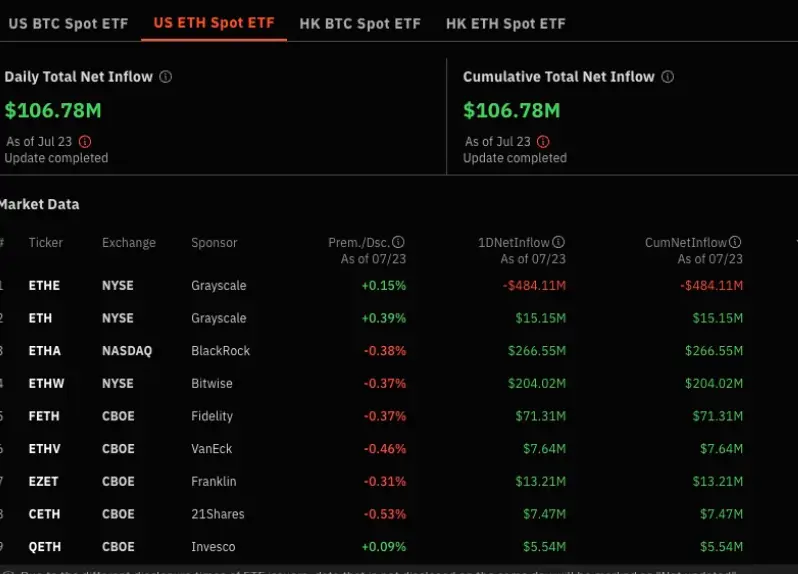

The total inflows at the end of the day came to $106.6 million. On the first day, giant asset manager BlackRock led the pack with its iShares ETF, amassing $266.5 million in volumes. The Bitwise Ethereum ETF also posted $204 million in net inflows during the first day.

The third-largest Ethereum ETF in inflows was the Fidelity Ethereum Fund, with $71.3 million in net inflows. The Franklin Templeton Ethereum fund amassed $13.2 million in inflows, while the 21Shares’ Core Ethereum ETF posted $7.4 million.

Grayscale Outflows Topple $484M

Most Ether ETF volumes recorded on the first day came from outflows from the Grayscale Ethereum Trust (ETHE). The Grayscale Ethereum Trust saw outflows of $484.9 million on the first trading day.

This ETF product launched with $10 billion in net assets. The digital asset manager converted its Ethereum Trust into an ETF. The trust allowed institutional investors to access Ethereum indirectly, presenting a better option than buying Ethereum.

Unlike ETF products, where shares can be redeemed at any time, investors in the Grayscale Ethereum Trust were subject toi a six-month lock-up period. These investors will now have a chance to access their funds with the Ether ETFs.

Therefore, investors with funds locked up in the trust are now withdrawing their assets, which explains the high outflows.

A similar scenario was seen in January this year when spot Bitcoin ETFs launched. Grayscale converted its Bitcoin Trust into an ETF, and it recorded more than $17.5 billion in outflows.

A smaller Grayscale ETF version dubbed a mini trust saw net inflows of $15.2 million.