Since their introduction early this year, US Bitcoin ETFs have recorded the longest stretch of net withdrawals per day. This is a result of a broader flight from assets seen as more risky at a trying time for the world markets.

Internal And External Pressure Taking Its Toll On Traders

Bloomberg data indicates that investors withdrew over one billion dollars from ETFs for the eight consecutive days leading up to September 6. The outflows occur during a difficult time for commodities and stocks due to concerns about economic growth.

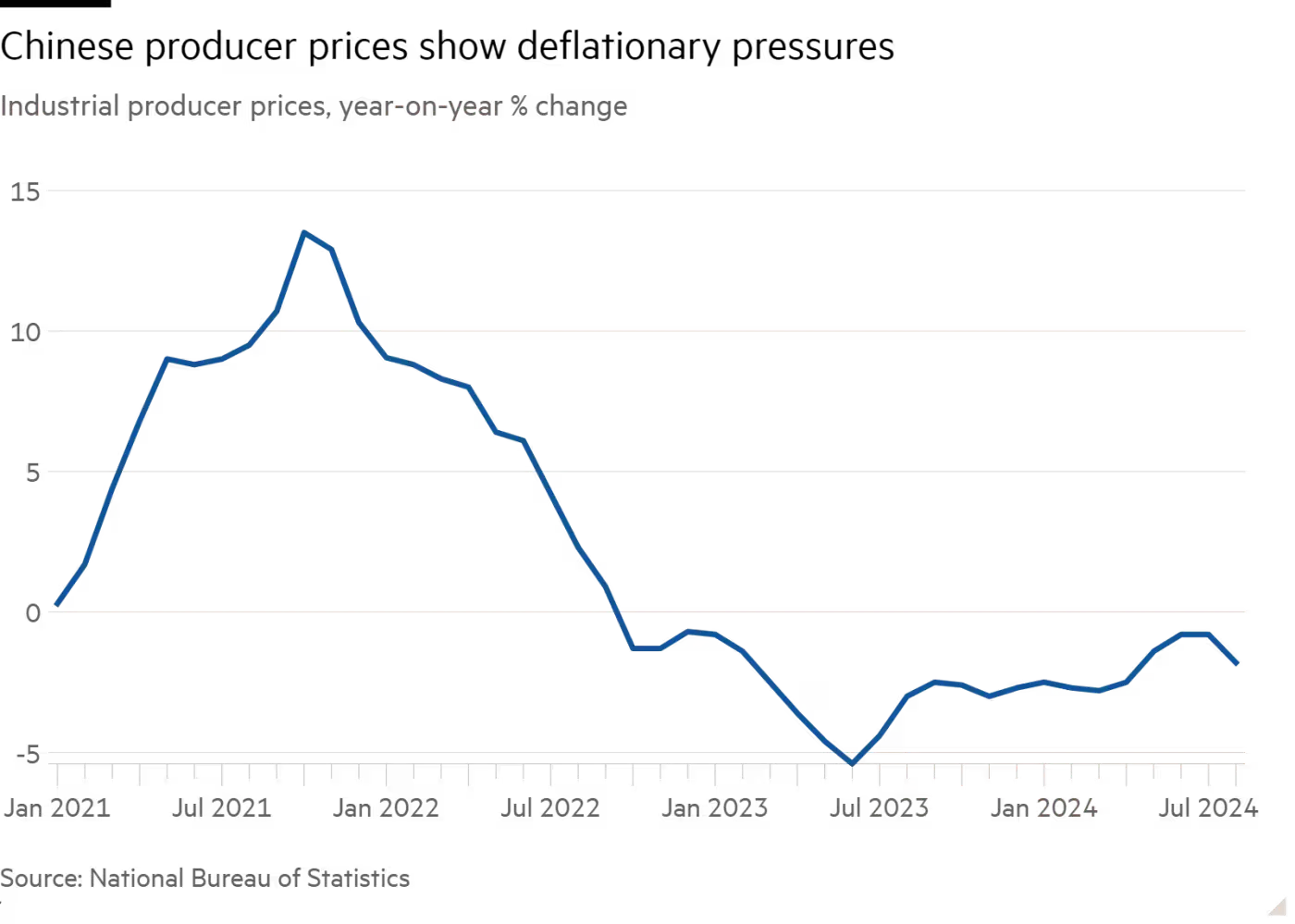

Traders are being negatively impacted by both the deflation in China and the varying US jobs statistics. The market for cryptocurrencies, which has become increasingly correlated with stock market price movements in the short term, is being hurt by the uncertainty.

September has been difficult for Bitcoin, but it is now rebounding from a 7% price dip, rising to USD 54,870 on Monday, a one percent increase from its previous price.

Election-Linked Demand Increase For Options Hedges

Sean McNulty, Arbelos Markets’ trading director, states that the small price gain is partly driven by well-known influencers who’ve embarked on closing out their shorts. He then cites one instance – a post on social media by Arthur Hayes, BitMEX co-founder.

According to McNulty, another contributory factor could be Donald Trump performing better in polls and forecasts. The Republican nominee for US president supports cryptocurrencies.

McNulty stated that there is a higher demand for options in hedges because of the possibility of Tuesday’s debate between Democratic contender Kamala Harris and her Republican opponent triggering volatility.

Unlike Trump, Harris has still not declared her position on cryptocurrencies, although crypto donations are allowed in her campaign.

The US BTC exchange-traded funds made a big splash when they launched in January. In March, the coin’s price increased to nearly USD 74, a record.

An unexpectedly huge demand for ETFs partly caused the increase. After that, the inflows decreased, and the year-to-date gain in Bitcoin has dropped to roughly 30%.

Until the US publishes its data on consumer prices this Wednesday, the token is expected to be traded in its previous range of USD 53,000 to USD 57,000, according to Caroline Mauron, one of Orbit Markets’ co-founders.

Her company provides liquidity for traders of derivatives associated with digital assets. The inflation figures could influence how quickly the US Federal Reserve implements its planned monetary easing program.

Before January 11, SEC restrictions prevented Bitcoin ETFs from trading Bitcoin at its spot or current price. Instead, fund managers had to hold Bitcoin futures contracts or own businesses and other ETFs associated with Bitcoin.

Although spot Bitcoin ETFs now offer greater direct exposure to Bitcoin, various investors are drawn to diverse strategies. These could include futures or additional means of becoming exposed to Bitcoin markets.