Many people wonder if Bitcoin is truly safe to use. After all, it’s digital money that lives on the internet, and that can sound risky at first. The truth is, Bitcoin’s safety depends more on how you use it than the technology itself.

In this guide, BTCRepublic breaks down what makes Bitcoin secure, what can go wrong, and how to protect your coins from common threats. By the end, you’ll know the simple steps to stay safe while using Bitcoin anywhere in the world.

Key Takeaways

| Insight | Summary |

| Bitcoin itself is secure | The blockchain technology behind Bitcoin is extremely hard to hack or alter. |

| User mistakes cause most losses | Lost passwords, fake websites, and phishing scams are the main risks, not Bitcoin’s code. |

| Safety depends on storage | Keeping coins in trusted wallets and backing up keys offline keeps your funds protected. |

| Scams are still common | Always verify sources, avoid “free Bitcoin” offers, and double-check wallet addresses. |

| Learning is your best defense | Understanding how Bitcoin works is the easiest way to use it safely and confidently. |

- Key Takeaways

- Facts & Original Research (Safety and Security Data)

- How Bitcoin Security Works

- The Safe Side (Why Bitcoin Can Be Trusted)

- Bitcoin’s blockchain is nearly impossible to fake

- Transactions are verified by thousands of users

- It gives you full control over your funds

- Public records make it transparent and traceable

- Cryptographic protection

- The Risky Side (What to Watch Out For)

- Human mistakes cause most losses

- Scams and fake websites target beginners

- Price volatility

- Hacks happen on unsafe exchanges

- Some wallets aren’t as secure as others

- How to Use Bitcoin Safely

- Importance of Private Keys

- Common Bitcoin Safety Myths

- Conclusion

Facts & Original Research (Safety and Security Data)

Bitcoin’s code has never been hacked. Most losses happen when people trust the wrong platform or skip basic safety steps.

Verified Facts About Bitcoin Security

| Topic | Fact | Why It Matters |

| Network Uptime | Bitcoin has maintained 99.98% uptime since 2009. | Shows unmatched reliability compared to traditional financial systems. |

| Blockchain Integrity | Over 20,000 nodes worldwide verify transactions daily. | Makes altering data nearly impossible without global consensus. |

| Supply Security | Only 21 million BTC can ever exist. | Prevents inflation or unauthorized creation of new coins. |

| Transaction Proof | Every payment is stored on a public ledger. | Ensures transparency and prevents double spending. |

| Ownership Control | Users hold private keys, not banks. | Security depends on individual responsibility, not institutions. |

Real-World Case Studies and Trends

Exchange Hacks vs. Self-Custody

| Year | Incident Type | Funds Lost (USD) | Lesson Learned |

| 2014 | Mt. Gox Exchange Hack | $450 million | Centralized exchanges can be major risk points. |

| 2020 | KuCoin Hack | $280 million | Secure storage and insurance reduce impact. |

| 2022 | Bridge & DeFi Hacks | $3 billion+ | Smart contracts require stronger audits. |

How Bitcoin Security Works

Bitcoin’s security comes from the blockchain, a public record that anyone can check but no one can easily change. Each block of data is linked to the one before it, forming a chain that keeps transactions permanent and visible. This design makes Bitcoin nearly impossible to fake or duplicate.

Every time someone sends Bitcoin, thousands of computers, called nodes, verify the transaction. These nodes agree on what’s valid, preventing fraud without needing a bank. The system is open, transparent, and supported by people everywhere.

At BTCRepublic, our goal is to make this technology easy to understand. By learning how Bitcoin’s safety features work, beginners can use it with more confidence and less confusion.

Blockchain technology as a security foundation

Bitcoin is backed by blockchain, which is a superior technology compared to what is used in traditional finance. Blockchain leverages cryptography and secure core concepts. The Bitcoin network operates in a manner wherein transactions are irreversible, and Bitcoin’s data security is robust.

A distributed ledger uses hash functions to create a unique fingerprint for each transaction. After the transactions are signed and verified, they are sent to a “block” containing other transactions. It is impossible to modify a block.

Bitcoin also promotes immutability, where data or transactions stored in the blockchain cannot be manipulated, modified, or falsified by a third party.

The Safe Side (Why Bitcoin Can Be Trusted)

Bitcoin’s blockchain is nearly impossible to fake

Each transaction is recorded in a chain of blocks that everyone can see but no one can secretly change. This makes Bitcoin one of the most secure financial systems ever built. Once a block is confirmed, it becomes part of a permanent record that can’t be edited or erased.

Transactions are verified by thousands of users

Across the world, thousands of computers check every Bitcoin transaction. This process, called decentralised verification, means no single person or company can cheat the system. The more users verify, the harder it is for anyone to fake or reverse a payment.

It gives you full control over your funds

With Bitcoin, your money isn’t stored by a bank. You hold your own private keys, giving you direct access to your coins. This independence helps protect against account freezes or third-party errors your funds stay under your control.

Public records make it transparent and traceable

Every transaction lives on a public ledger called the blockchain. Anyone can check where Bitcoin moves, which adds accountability and discourages fraud. That transparency builds trust, even in a digital world.

Cryptographic protection

Bitcoin uses public-key cryptography to create a key pair that offers Bitcoin access. This key pair has a private key and a public key. The public key receives funds, while the private key signs transactions for spending these funds.

The technology capability of the Bitcoin blockchain ensures secure transactions and guarantees that user assets are kept safe.

The Risky Side (What to Watch Out For)

Human mistakes cause most losses

Bitcoin’s system is secure, but people can still make errors. Sending coins to the wrong address or losing a recovery phrase means permanent loss. Unlike banks, there’s no support team to fix a mistake; once it’s sent, it’s gone. Care and double-checking are your best protection.

Scams and fake websites target beginners

Scammers often copy popular crypto platforms or create fake giveaways to steal your coins. They use emails, social media posts, and ads to trick users into sharing private keys. Always verify web addresses and never trust anyone offering “free Bitcoin.”

Price volatility

Bitcoin often witnesses bouts of price volatility. In 2021, Bitcoin tanked from an all-time high of above $60K to below $30K within a month after China announced a ban on cryptocurrency mining and trading.

Bitcoin also started in 2024 with volatility as traders anxiously anticipated the approval of the first Bitcoin exchange-traded fund (ETF) in the US. After spot Bitcoin ETFs began trading on January 10, 2024, Bitcoin rallied to an all-time high of around $73,000 after several weeks.

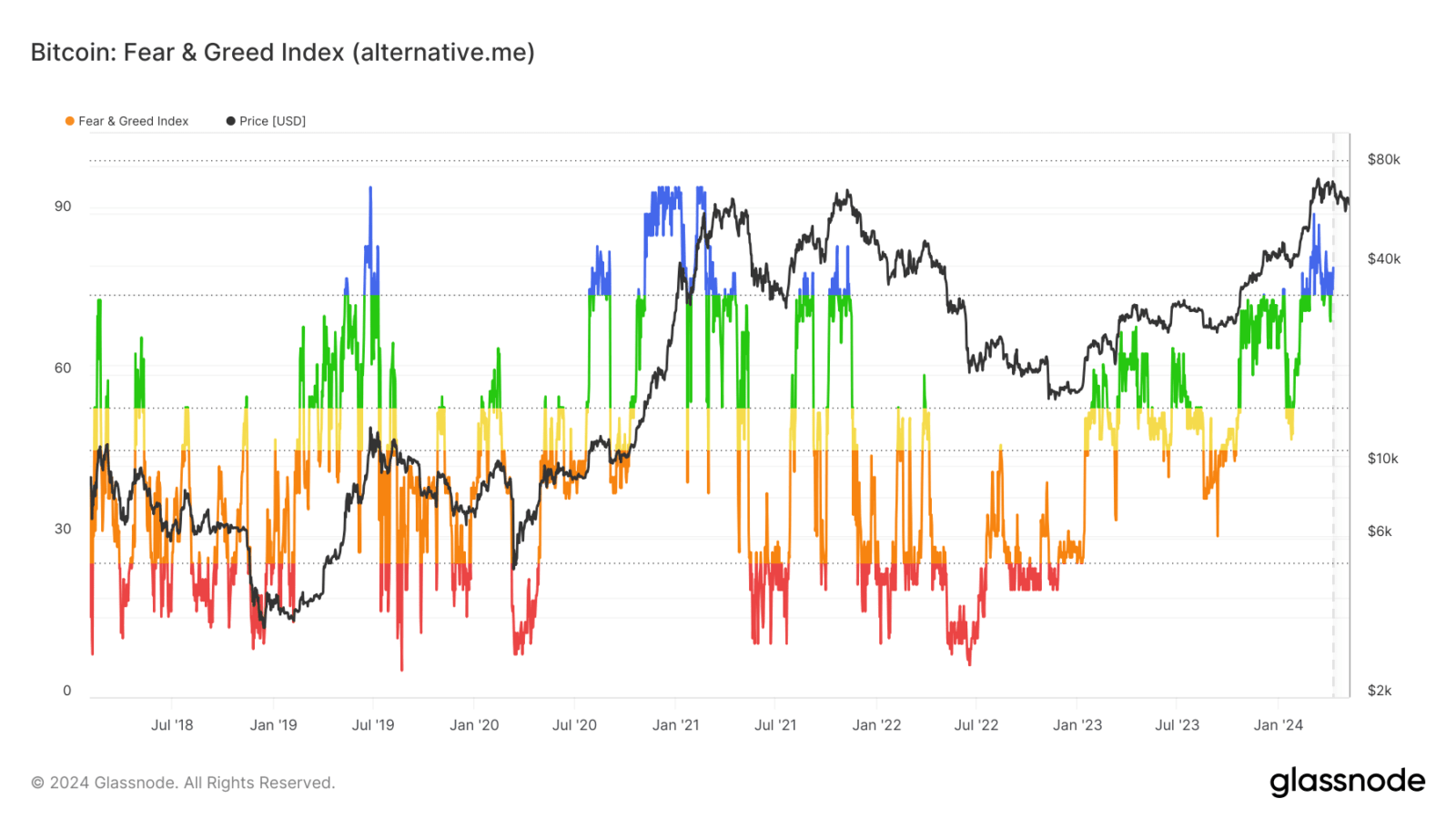

Traders can protect themselves from Bitcoin’s volatile price action by making informed trading decisions. This involves not trading out of fear or greed. Indicators like the Bitcoin Fear and Greed Index can help you analyse market sentiments. Technical indicators will also help you to open and close trading positions at the right time.

Below is the Bitcoin Fear & Greed Index movement relative to Bitcoin’s price over the years.

Hacks happen on unsafe exchanges

While Bitcoin itself has never been hacked, some trading sites have. Hackers often target weak platforms or users who skip two-factor authentication. Choose trusted exchanges with strong security records and withdraw coins to your own wallet when possible.

Some wallets aren’t as secure as others

Free or unverified wallets may contain hidden risks. Always download from official sources and test with small amounts first. Hardware and cold wallets remain the safest options for long-term storage.

How to Use Bitcoin Safely

Using Bitcoin safely starts with simple, smart habits. Here’s a quick checklist to help you stay protected while enjoying the benefits of digital money:

- Use trusted wallets. Choose verified mobile or hardware wallets with strong security reputations.

- Verify URLs before logging in. Always check for HTTPS and the correct domain; fake sites can steal your coins.

- Turn on two-factor authentication (2FA). Adds an extra step that blocks most hacks and phishing attempts.

- Start small and test. Send a small amount first to make sure everything works before moving larger sums.

- Keep backups offline. Write down your recovery phrase and store it safely, never online or in cloud storage.

These small steps build strong protection for your Bitcoin and your peace of mind.

Importance of Private Keys

Private keys play a vital role in the cryptocurrency industry. They authorise transactions while ensuring they cannot be altered once they go live. If the transaction details are changed, the signature becomes incorrect, as the algorithm will generate a key using identical information.

Users cannot access the wallet to spend, withdraw, or transfer Bitcoin without a private key. A private key ensures you control your Bitcoin holdings so you can pay whenever you want.

One of the main dangers with private keys is losing access to them. If you lose your private key, you cannot access the wallet to spend your coins. Therefore, private keys should be stored in a safe location.

Using Bitcoin safely starts with simple, smart habits. Here’s a quick checklist to help you stay protected while enjoying the benefits of digital money:

- Use trusted wallets. Choose verified mobile or hardware wallets with strong security reputations.

- Verify URLs before logging in. Always check for HTTPS and the correct domain; fake sites can steal your coins.

- Turn on two-factor authentication (2FA). Adds an extra step that blocks most hacks and phishing attempts.

- Start small and test. Send a small amount first to make sure everything works before moving larger sums.

- Keep backups offline. Write down your recovery phrase and store it safely, never online or in cloud storage.

These small steps build strong protection for your Bitcoin and your peace of mind.

Common Bitcoin Safety Myths

“You can recover lost keys.” Once private keys or recovery phrases are gone, access to your coins is lost forever. There’s no reset option — backups are essential.

“Bitcoin is anonymous.” It’s not. Every transaction is public on the blockchain. While names aren’t shown, wallet activity can still be traced.

“Bitcoin can be hacked easily.” The blockchain itself has never been hacked. Most breaches happen on weak exchanges or through user mistakes.

Conclusion

Bitcoin’s safety depends on the person using it, not the system itself. The blockchain remains secure, but careless habits or scams can lead to losses. By learning basic protection steps, like using trusted wallets, double-checking addresses, and avoiding fake sites, anyone can use Bitcoin safely.

Stay informed, move carefully, and build confidence through knowledge. For step-by-step guides, news, and real-world crypto lessons, BTCRepublic is here to help you grow wisely in the world of digital money.

Frequently Asked Questions (FAQs)

Is Bitcoin hackable?

The Bitcoin network itself has never been hacked. It’s protected by thousands of computers working together to verify transactions. Most hacks happen on exchanges or through phishing scams, not the blockchain.

Can I lose money using Bitcoin?

Yes, if you make mistakes like sending to the wrong address, falling for scams, or storing coins on unsafe platforms. Always verify wallet addresses and use trusted exchanges to reduce risks.

How do I know if an exchange is safe?

Check if it uses 2FA, has cold storage, and is well-reviewed by users. Avoid exchanges that promise unreal returns or ask for private keys.

Is Bitcoin safer than banks?

In some ways, yes, you control your money directly. But it also means you’re responsible for your own security. There’s no recovery system if you lose access.

What’s the best way to store Bitcoin securely?

Use a hardware or cold wallet for long-term storage. Keep your recovery phrase offline and private. For daily use, keep only small amounts in a mobile wallet.