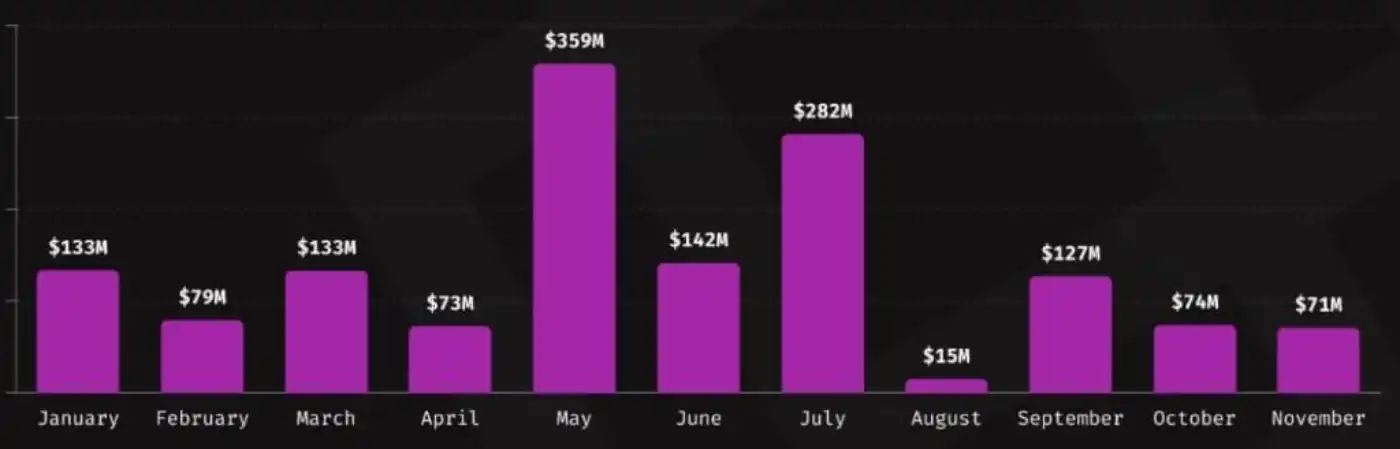

The crypto industry lost nearly USD 71,021,500 million in November and USD 1.48 billion to hackers in the whole of 2024, according to a report by Immunefi, a leading bug bounty platform founded by Mitchell Amador in 2020.

DEFI Projects Account For Most Of November’s Stolen Funds

According to the report, projects in decentralized finance constituted the primary targets of the November hacks, which amounted to USD 70,996,200 million. This figure indicates a decline of 79% when compared to the previous November’s figure of USD 343,038,810.

Notably, the November figure ranks as the second least for all the months of this year thus far.

The USD 1,489,921,677 total for 2024 came from 209 incidents, a 15% decline from last year when USD 1,757,680,745 was stolen.

In November, centralized finance (CeFi) exchanges managed to avoid any major hack incidents, unlike their DeFi counterparts.

Topping November’s list of DeFi exchanges that saw the most significant hacks was Thala Labs, which lost.

All of November’s losses came from the DeFi sector, with no hacks impacting centralized exchanges (CeFi). Notable incidents include Thala Labs losing USD25,500,000 million DEXX, whose losses stand at $21,000,000 million.

Thala Labs can well be taken off the list because the company has since managed to recover all of the assets it lost to the November 15 hack.

The Immunefi report further revealed that direct hacks accounted for 99.96% (USD70,996,200) of 24 incidents.

At the same time, rug pulls were responsible for the remaining tiny percentage, which amounted to USD 25,300 lost to “rug pulls” from a couple of incidents.

This confirms the significant threats that hack incidents pose to the crypto industry.

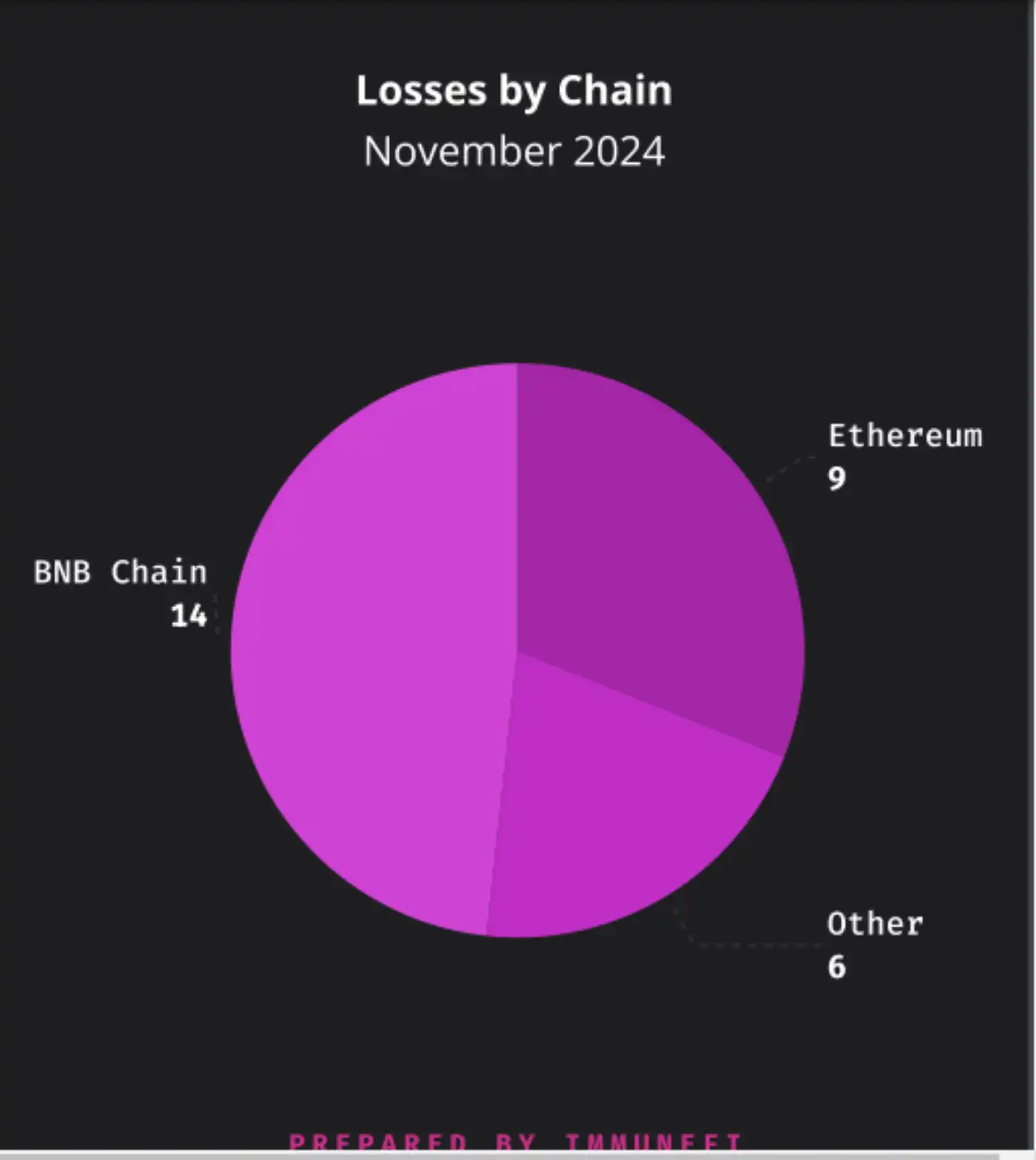

BNB Chain Emerges The Prime Target

Furthermore, Immunefi notes that BNB Chain emerged as the major target, accounting for 46.7% of all incidents across 14 attacks.

Coming a distant second is the Ethereum network, with 30% of attacks recorded from 9 incidents.

With one incident each, Polygon, Solana, Avalanche, Fantom, Aptos, and Arbitrum accounted for 3.3% of the November steals, respectively.

Another Immunefi report assessing the volume of losses in the BNB Chain indicates that the platform has lost USD1.64 billion since it launched in September 2020.

Hacks from 168 attacks accounted for USD1,279,930,833 billion of the losses, while fraud/rug pull activity from 228 incidents brought about a loss of USD368,176,135 million.

Apart from the BNB Chain itself, the leading losses in its ecosystem also occurred in the Venus Protocol, Uranium Finance, and Qubit Finance.

In summary, the loss of USD 1.48 billion this year alone highlights the importance of improving the state of cybersecurity in the crypto and blockchain environments.

Indeed, the rate of hacks and fraud in the industry should be a concern for all stakeholders.

For Mitchell Amador, Immuefi CEO and founder:

The industry is always one attack away from massive damage. While losses due to crypto hacks have decreased compared to previous years, threats persist, and hackers continue to evolve. This is evident in how they infiltrate projects, compromise hot wallets, and exploit vulnerabilities in the darkest corners of the ecosystem.

Earlier in the year, we reported over USD 266 mIllion lost to crypto hacks in July 2024