Are you seeking to build long-term wealth for yourself? Here are the best ETFs to buy and hold forever to quickly achieve that.

When you are planning to build long-term wealth for yourself, having a strong core holding for your investment portfolio is very important. This will not only wean out some of the volatility involved in long-term investments but also give you a stable base of investments.

Building a solid core holding for your investment portfolio requires patience and diversification. One of the easiest ways to diversify your portfolio right now is by investing in exchange-traded funds (ETFs).

- What Are ETFs?

- How Does An ETF Work?

- Best ETFs To Buy And Hold In 2024

- iShares Core S&P 500 ETF (IVV)

- Vanguard Growth ETF (VUG)

- iShares Core US Aggregate Bond ETF (AGG)

- Vanguard Information Technology ETF (VGT)

- Vanguard High Dividend Yield Index ETF (VYM)

- iShares Core MSCI Total International Stock ETF (IXUS)

- Vanguard Total International Stock ETF (VXUS)

- Invesco QQQ Trust (QQQ)

- Schwab US Small-Cap ETF (SCHA)

- Conclusion

- Frequently Asked Questions FAQs

Yes! Investing in exchange-traded funds (ETFs) helps you diversify your portfolio easily and gain exposure to wide opportunities across various sectors. More so, while ETFs are stock-like funds, they are less volatile than individual stocks.

But what exactly are ETFs, how do they work, and what is the best ETF to buy and hold to generate wealth?

This article will explain what an ETF is, how it works, and the best ETFs to buy and hold in 2024. Read on!

What Are ETFs?

Exchange-traded funds (ETFs) is an investment tool that allows you to buy a basket of hundreds or even thousands of stocks (or other assets, including digital assets) in just one fund with low expenses.

Let us further break it down further. When you invest in an ETF, you are investing in an asset that trades like a stock, but this asset gives you ownership over hundreds of other assets or stocks.

ETFs allow you to invest in many assets or stocks simultaneously, offering you an appealing alternative to investing in individual stocks or assets.

How Does An ETF Work?

We have dividend-focused ETFs, growth-focused ETFs, sector-focused ETFs, and so on.

Some ETFs track major indexes like the Nasdaq Composite, some focus on a specific asset like Bitcoin and Ethereum ETFs, some focus on a specific sector like the bank or technology sector, and some concentrate on certain parts of the world, such as emerging markets.

The performance of each ETF is largely based on how the assets, stocks, or bonds it consists of are performing. If these stocks, assets, or bonds increase in value, the ETF automatically increases in value. However, if these stocks, assets, or bonds fall in value, the ETF falls too.

ETFs have lower volatility than individual stock, are easier to buy/ trade and have lower costs, offer exposure to more sectors, and are traded on an exchange.

With lots of ETFs to choose from, it can be challenging to get started. But if you are looking for the best ETFs to invest in, here are nine best ETFs to buy and hold forever in 2024:

Best ETFs To Buy And Hold In 2024

Now that you understand what ETFs are and how they work, here are 7 best ETFs to buy and hold if you are serious about building wealth:

iShares Core S&P 500 ETF (IVV)

The first ETF on our list is BlackRock’s iShares Core S&P 500 ETF (IVV). IVV has Assets Under Management (AUM) of $504B and holds the largest 500 domestic stocks.

IVV offers a cheap 0.03% expense ratio annually. That means you will be charged just $3 on every $10,000 you invest annually. For context, the expense ratio is the maintenance fee exchanges charge to finance their expenses.

Although this is a lower expense ratio when compared to ratios from other ETFs, it can add up materially if you hold your investment for many years rather than just a few months.

IVV offers affordable fees, which makes it one of the most low-cost index funds you will ever find.

Vanguard Growth ETF (VUG)

The next ETF on our list is the Vanguard Growth ETF (VUG). This ETF focuses on over 180 companies with a strong financial growth potential and has an AUM of $132B.

VUG offers more stability because it concentrates mainly on viable firms that are already running impressive business operations and still have the potential to expand their sales and profit margins. For example, VUG has a majority of its holdings in firms in the technology sector.

VUG charges a slightly higher expense ratio of 0.04%, meaning you will be charged $4 on every $10,000 you invest in the ETF annually.

You can’t go wrong with VUG if you seek an ETF with long-term potential.

iShares Core US Aggregate Bond ETF (AGG)

BlackRock’s AGG is one of the best ETFs to consider if you want to add exposure to your investment beyond just common stock.

It is currently the largest bond-based ETF with an AUM of $116B and one of the ten largest ETFs on Wall Street.

This long-term ETF is an “aggregate” bond fund that offers exposure to thousands of investment-grade bond markets, including corporate and government bonds.

Like IVV, AGG has a cheap expense ratio of 0.03%, but this fund will offer you a 3.2% interest rate. However, this may be affected when the Fed cuts rates in September. Nevertheless, AGG remains a viable option if you want to diversify across assets.

Vanguard Information Technology ETF (VGT)

Here is another tech-based fund with a long history of excellent performance. It is a collection of tech stocks, which include some that you are seemingly familiar with: Apple Inc. (AAPL), Microsoft Corp. (MSFT), and Nvidia Corp. (NVDA). These three stocks are well-known to have delivered significant ROI for investors over the years.

VGT has an AUM of $74.2B and a higher expense ratio of 0.09%. Nevertheless, VGT has a track record of delivering excellent ROI for investors.

While there are little or no guarantees for tech stocks, you can be rest assured that the Silicon Valley leaders who made up this fund will not be leaving anytime soon.

Vanguard High Dividend Yield Index ETF (VYM)

While most ETFs on this list are focused on growth, VYM is focused on dividends for investors, offering a collective yield of 2.7%. If you are focused on higher ROI, try an investment in Vanguard High Dividend Yield Index ETF (VYM) ETF.

VYM has an AUM of $57B, is focused on firms offering financial services, which constitute more than 20% of all assets, and has over 500 holdings with excellent income-generating potential.

With stocks from big financial brands like JPMorgan Chase & Co. (JPM), you can be assured that you are tapping into an ETF that offers stocks from top firms with reliable operations that yield consistent dividends.

You can invest in the long-term ETF with just a 0.06% expense ratio.

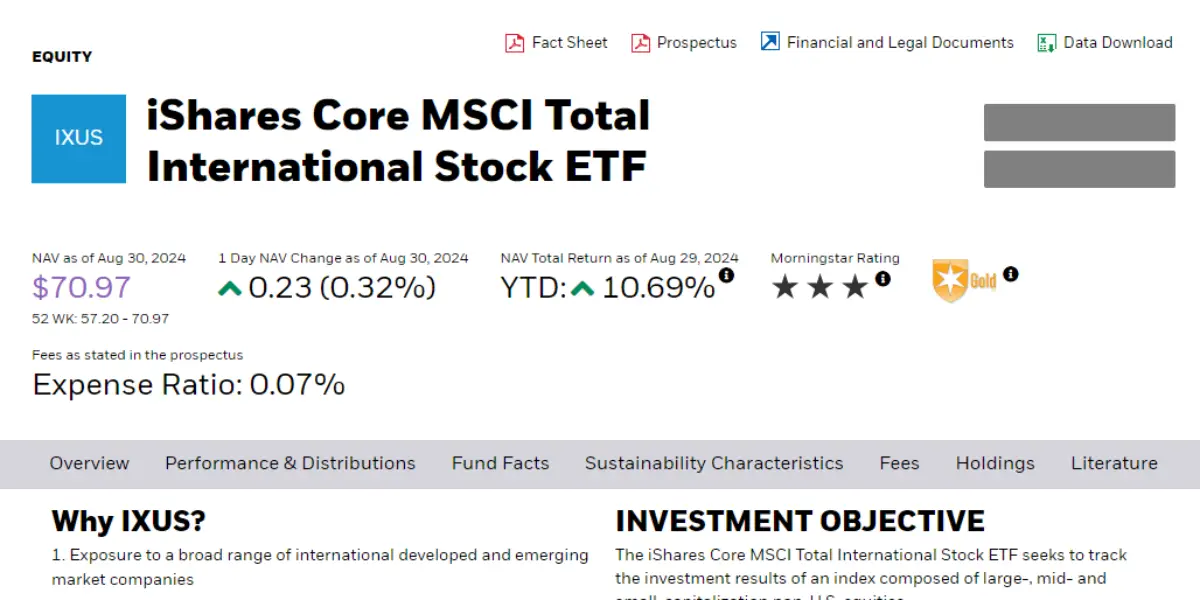

iShares Core MSCI Total International Stock ETF (IXUS)

This ETF allows you to expand your portfolio to cover global investments in over 4,000 stocks. Just like VXUS, IXUS is ex-US and excluded all US-based listings from its portfolio.

IXUS diversifies investments to cover about five geographical areas, which include France, China, Canada, the UK, and Japan.

IXUS has an AUM of $38.4B and charges $7 on every $10,000 you invest. What more? IXUS offers an impressive 3.1% annual dividend yield. This makes it a favorite choice for investors who seek dividend stocks.

Vanguard Total International Stock ETF (VXUS)

VXUS gives you another opportunity to invest in the technology sector. But here is what differentiates VXUS from other tech-based ETFs: VXUS allows you to diversify your portfolio beyond the US. In fact, it is an “ex-US” fund that excludes any domestic stocks in its portfolio.

Yes, this fund gives you access to over 8,000 stocks in several foreign markets across the globe. VXUS constitutes familiar domestic indexes like ASML Holdings NV (ASML) and Novo Nordisk (NVO).

With these constituents and more, VXUS offers you wide exposure to a variety of stocks across developing and developed markets. VXUS has 16% of its stake in Japan, 9% in the UK, and 6% in Canada.

With an AUM of $74B and 0.08% expense ratio, you can never go wrong by considering an investment in this ETF.

Invesco QQQ Trust (QQQ)

Here is another ETF for those seeking to invest in tech-based stocks. This ETF focuses mainly on innovative tech firms with growth potentials to deliver strong ROI. Stocks under this ETF include Amazon (AMZN) and Microsoft (MSFT).

Invesco QQQ Trust, with an AUM of $301.0B, is good for beginners because of its low expense ratio. Imagine being charged a mere $2 annually on your $10,000 investment.

Despite its low cost, QQQ remains one of the best ETFs to consider.

Schwab US Small-Cap ETF (SCHA)

The last ETF on our list is the Schwab US Small-Cap ETF (SCHA). It has an AUM of $18M and charges $4 on every $10,000 invested.

Not everybody wants an investment in the big cap stocks, and that’s where SCHA comes in for investors looking for a smaller long-term ETF investment. SCHA comprises stocks that average below $4B in market value.

Despite being a small-cap ETF, SCHA has over 1500 stocks of diversified firms across various sectors. Industry is the top sector, at 16%, followed by the financial services sector and tech at about 15% each.

SCHA also consists of top individual stocks, such as Carvana Co. (CVNA) and Bitcoin investor MicroStrategy Inc. (MSTR).

Though SCHA may not be as stable as other ETFs listed above, its list of incredibly diversified firms can protect you from volatility in case of any problem.

Conclusion

This article has exposed you to the 9 best ETFs to buy and hold if you want to build wealth through passive ETFs.

These ETFs allow you to invest in a pool of assets (bonds or stocks) in just one fund. They are traded on exchanges at low expenses and can be quickly and easily converted to cash due to their liquid nature.

As a reminder, an ETF is a collection of multiple assets. Therefore, its performance entirely depends on the collective performance of its assets. An ETF can only perform well if it consists of well-performing assets.

Therefore, not all ETFs perform the same way. Before you invest in an ETF, try as much as possible to carry out independent research to know the performances of its holdings.

Frequently Asked Questions FAQs

-

Is it still good to invest in ETFs?

This depends on your choice, but investing in ETFs is still very good. Investing in an ETF is a passive investment in the broader stock market index at a low cost but with a good ROI. You can earn passive income from dividend bonds or stocks through ETF investment.

-

What benefits do ETFs have?

ETFs offer many benefits to investors. Some of these benefits include being able to buy many stocks in one investment, investment diversification, and low management costs.

-

Are ETFs good investments for beginners?

Investing in ETFs is good for beginners because they eliminate the risk and guesswork associated with individual stocks. As a beginner, it is important to choose an ETF with a broader market, which helps to reduce the risks involved in investing.

-

When can you sell ETFs?

ETFs are very liquid. That means they can be easily and quickly converted to cash. You can sell (or buy) your ETFs whenever the market is open. But note that when you sell your ETFs, there is no assurance that you will get the exact amount you paid for the investment; it may be lower or higher.

-

What differentiates ETFs from mutual funds?

These are both investment tools and are similar in benefits and structures, such as diversification, attractive ROI, low fees, reduced risk, and multiple investments. However, ETFs differ from mutual funds because they are cheaper, offer passive investments, charge lower commissions, and lack sales charge.

-

Are there any disadvantages with ETFs?

There are some disadvantages with ETFs, but these disadvantages are just too insignificant.